Interest Rate Cut Expectations Shift Dramatically! Has Bitcoin Already Bottomed Out?

After several weeks of sluggish performance, Bitcoin staged a strong rebound on November 26, with its price breaking through the $90,000 mark and swiftly recovering losses from Tuesday. This surge not only broke the usual pre-Thanksgiving market pattern, but was also the result of a combination of three positive factors: macroeconomic expectations, capital inflows, and improved market structure.

Macroeconomic Data Drives Market Confidence

The latest U.S. employment data shows that initial jobless claims fell to 216,000, the lowest level since mid-April, significantly boosting investor confidence. Although the PPI report indicated a slight rise in wholesale prices due to higher energy and food costs, the core PPI increase (2.6%) was the smallest since July 2024. Analysts believe this report may prompt the Federal Reserve to consider another rate cut in December.

Following the report, JPMorgan economists urgently revised their forecasts, now expecting the Federal Reserve to start cutting rates in December, overturning their previous judgment from a week ago that policymakers would delay rate cuts until January next year. The research team noted that several key Fed officials (especially New York Fed President Williams) have expressed support for a near-term rate cut, prompting a reassessment of the situation.

JPMorgan now expects the Federal Reserve to cut rates by 25 basis points each in December and January next year.

With the boost from macroeconomic tailwinds, Bitcoin's price climbed nearly 4% on the day to above $90,000; Ethereum (ETH) rose 2% to $3,025. Major altcoins including XRP, Solana (SOL), and BNB also saw gains. The total market capitalization of the crypto market reached $3.08 trillion, rebounding nearly 3% within 24 hours, with trading volume hitting $139 billion. Bitcoin's market cap dominance rebounded to 56.5%, while Ethereum's stood at 11.5%.

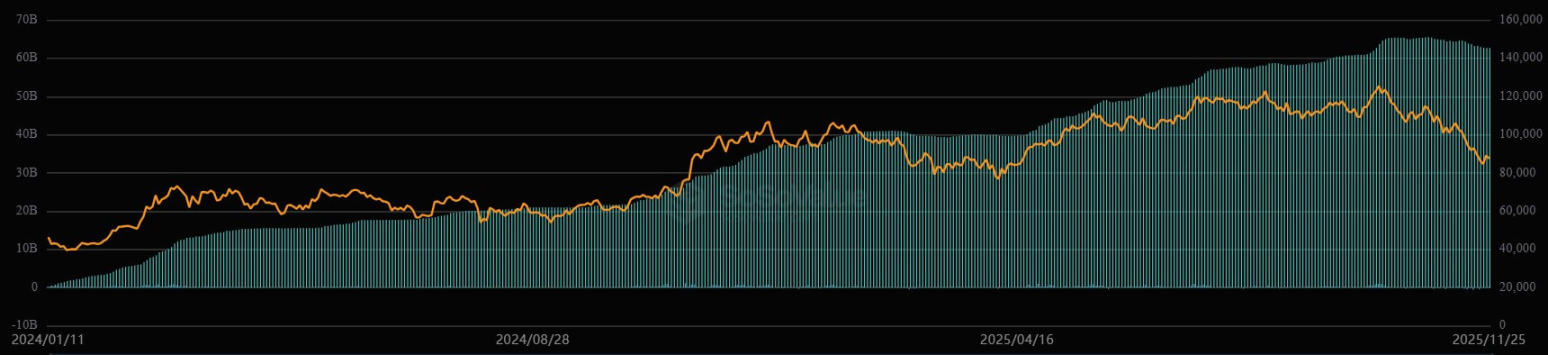

Capital Flows Reverse, ETF Shows Siphon Effect Again

ETF capital flows have shown significant improvement.

Previously, the market faced severe capital outflow pressure, even breaking historical records. However, Wednesday's data showed that Bitcoin ETFs attracted nearly $129 million, Ethereum ETFs saw inflows of over $78 million, Solana (SOL) ETFs increased by $53 million, and XRP ETFs attracted $35 million. Driven by renewed macro confidence, institutional funds are reallocating into the crypto market.

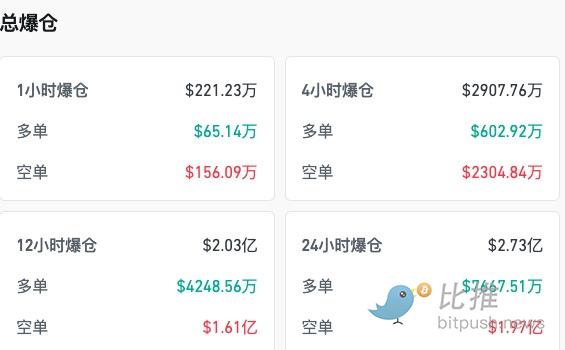

According to Coinglass data, in the past 24 hours, the crypto market saw total liquidations exceeding $273 million, with short positions dominating ($197 million). Bitcoin led with $86 million in liquidations, followed by Ethereum and HYPE.

Are Bottoming Signals Emerging?

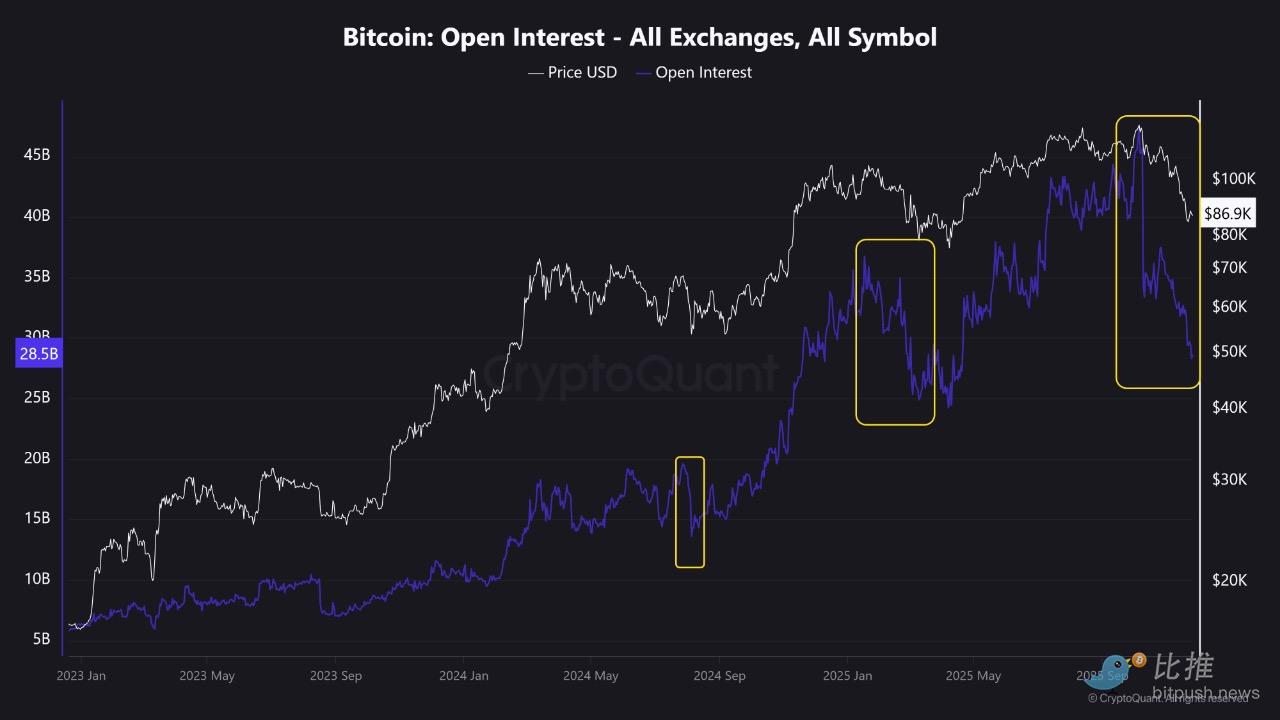

CryptoQuant analyst Abramchart pointed out that the market has just completed a deep "leverage flush," with total open interest plummeting from $45 billion to $28 billion, marking the largest drop of this cycle. This is not a bear market signal, but rather a major market reshuffle, clearing out excessively inflated speculative positions and building healthier momentum for subsequent rallies.

In addition, after intense volatility, BTC remains stable above the ETF average cost price of $79,000, indicating that large institutional funds have not engaged in more aggressive selling. This provides important psychological and capital support for the market.

Combining several indicators that have recently attracted market attention, deeper structural changes can be observed:

Puell Multiple Approaching Cycle Bottom

On-chain analyst Ali observed that the Puell Multiple indicator is currently at 0.67, which, although not yet below the key historical cycle bottom threshold of 0.50, is already very close.

The Puell Multiple is an on-chain analysis indicator created by David Puell, used to assess Bitcoin miners' profitability and its impact on the market. Calculation: Puell Multiple = (USD value of daily new Bitcoin issuance) / (365-day moving average of the USD value of daily new Bitcoin issuance).

Simply put, it measures the current selling pressure from miners (or the value of Bitcoin they earn daily) compared to the average level over the past year.

Historical data shows that since 2015, when this indicator falls below 0.50, it often signals the bottom of the Bitcoin cycle. This suggests that miners' selling pressure may be easing and the market is entering an important observation window, potentially indicating the arrival of a mid-term bottom.

Technical Indicators Turn Positive

Technical analyst Skew Δ pointed out that on the 4-hour chart, Bitcoin currently presents a bull-friendly technical structure, with multiple momentum and trend indicators (50EMA, RSI, Stoch RSI) all pointing positive.

$88,000 is the lifeline for bulls, while the $90,000 to $92,000 range will be the key resistance/contested area to confirm whether the market can start a stronger structural uptrend. Traders should closely monitor price action near these key levels.

Risks and Expectations

Despite the short-term improvement in sentiment, the lack of liquidity during Thanksgiving may amplify volatility. Wintermute trading strategist Jasper De Maere pointed out that the options market shows traders generally expect Bitcoin to fluctuate in the $85,000-$90,000 range, betting that the market will maintain the status quo rather than see a breakout move.

In the mid-to-long term, $74,000 is a key level to watch. If Bitcoin's weekly closing price falls below this threshold, the market may face a broader correction. Currently, Bitcoin is still down nearly 30% from its historical high of $126,000. Whether this rebound can truly turn into a sustainable rally ultimately depends on whether macro policies and capital flows can provide sustained and strong support.

Author: Seed.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Infinex will launch a Sonar token sale, aiming to raise $15 million.

Texas establishes Bitcoin reserves—why choose BlackRock BTC ETF as the first option?

Texas has officially taken the first step and is likely to become the first state in the United States to designate bitcoin as a strategic reserve asset.

The four-year cycle of bitcoin has ended, replaced by a more predictable two-year cycle.

Exploring alternative frameworks for assessing cycles of prosperity and depression in the future era.