When the Internet is Repriced: Interpretation of the Significance of x402

Chainfeeds Guide:

The real highlight of x402 lies in agentic workflows. If the past decade was about "turning people into logged-in users," then the next decade will be about "turning AI Agents into paying users."

Source:

Decentralized Thoughts

Opinion:

Decentralised.Co: Why did micropayments fail? The dream of per-unit billing is as old as the internet itself. Digital Equipment’s Millicent protocol promised sub-cent transactions in the 1990s; Chaum’s DigiCash ran banking pilots; Rivest’s PayWord solved the cryptographic issues. Every few years, someone rediscovers this elegant idea: what if you could pay $0.002 per article, $0.01 per song, paying exactly for what you consume? They all died for the same reason: humans hate metering their enjoyment. AOL paid a heavy price for this in 1995. They charged by the hour for internet access, which was cheaper than a subscription for most users, but people hated the psychological burden. Every minute felt like a meter was running, every click felt like spending money, and people instinctively saw every tiny cost as a loss. When AOL introduced unlimited plans in 1996, usage tripled overnight. People would rather pay more to think less. Paying precisely for usage sounds efficient, but for humans, it often feels like anxiety with a price tag. Odlyzko summarized in his 2003 paper "Against Micropayments": people choose subscriptions not out of rationality, but because they crave predictability over efficiency. Later experiments like Blendle and Google One Pass tried charging $0.25–$0.99, but ultimately failed due to low conversion rates and high psychological burden. Once the web starts supporting native payments, the obvious question is: in which scenarios will it explode first? The answer lies in high-frequency usage, where transaction amounts are usually below $1. This is exactly where subscription models overcharge light users. The upfront commitment of a monthly subscription forces light users to pay the minimum just to start using the service. x402, however, can settle every request at machine speed, with granularity down to $0.01, as long as blockchain fees remain feasible. Two forces make this shift seem imminent. On one hand, there’s the explosive growth of work tokenization—LLM tokens, API requests, vector searches, IoT device pings. Every meaningful action on the modern web already has a tiny, machine-readable unit. On the other hand, SaaS pricing models lead to absurd waste—about 40% of licenses are idle, because finance teams prefer seat-based billing for easier monitoring and predictability. We measure work precisely at the technical layer, but bill humans by the seat. You can already see this trend in consumer AI. When you run out of Claude’s message quota, it doesn’t just say you’re out and to come back next week. It offers two paths: upgrade your subscription, or pay per message to finish your current task. The missing piece is a programmable payment rail that allows agents to automatically take the second path for each request, without UI pop-ups, credit cards, or manual upgrades. For most B2B tools, the eventual real-world form will look like "subscription base + x402 peak billing." Teams keep a base plan tied to headcount for collaboration, support, and routine background use; those occasional high-compute tasks (build time, vector search, image generation) are settled via x402, rather than forcing an upgrade to a higher subscription tier. Better networks can also be integrated. For example, Double Zero wants to sell faster, cleaner networks via dedicated fiber. If you route agent traffic to them, you can bill per GB via x402 and set clear SLAs and caps. Agents needing low latency for trading, rendering, or model switching can briefly enter the fast lane, pay for that burst, and then exit. [Original text in English]

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the four-year cycle of Bitcoin coming to an end?

Bitcoin breaks the Thanksgiving curse, returns to the $90,000 mark!

Altcoin ETF Acceleration Race: Six Months to Complete Bitcoin’s Ten-Year Journey

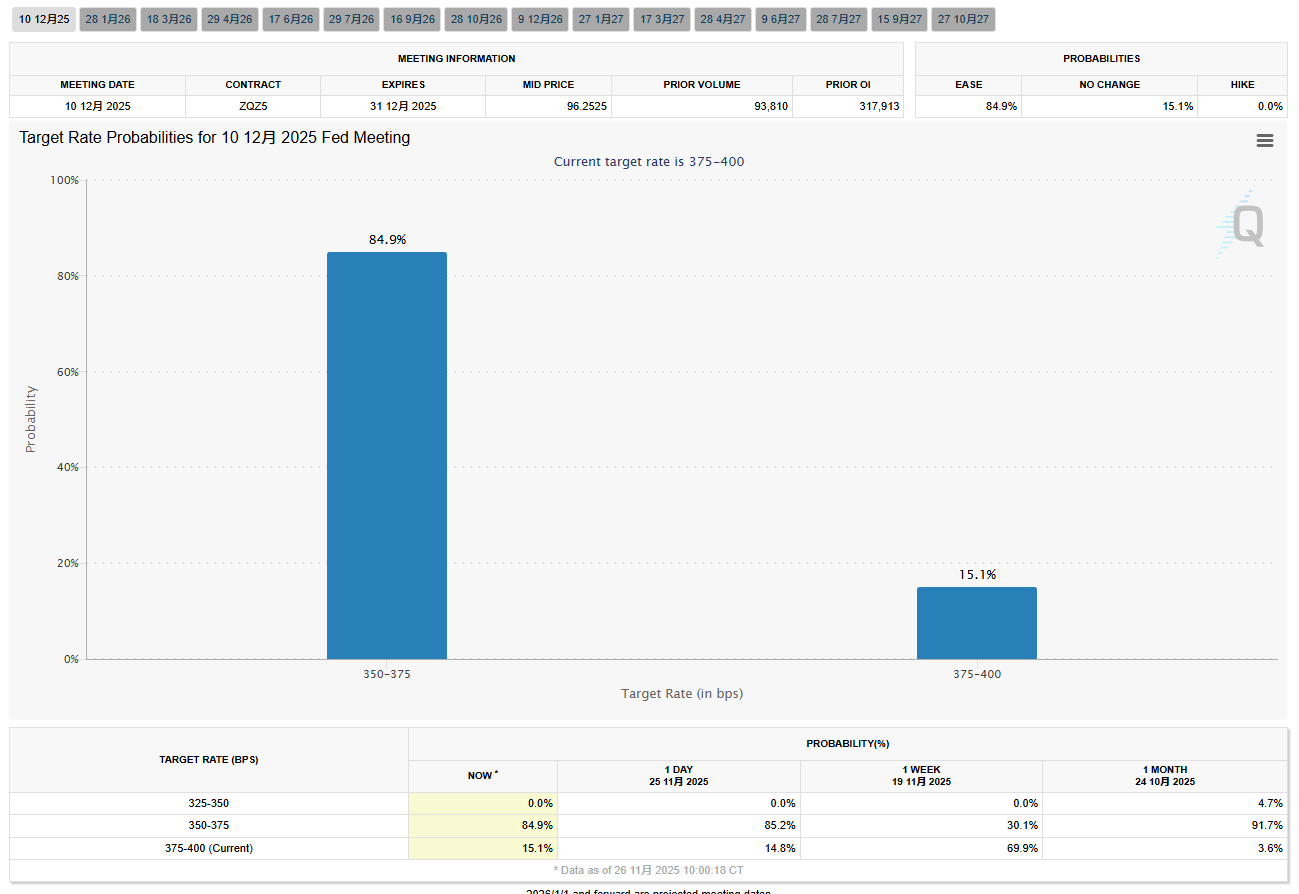

![[Bitpush Daily News Highlights] JPMorgan expects the Federal Reserve to cut rates in December, overturning last week's forecast; Bloomberg analyst: Nasdaq ISE proposes to raise IBIT options position limit to 1 million contracts; the US extends some China tariff exemptions until November 10, 2026; Opinion: Gold price to approach $5,000 in 2026, will break another historic milestone in 2027](https://img.bgstatic.com/multiLang/image/social/36cf6fca0c010535f81683c20d2ea6141764227343223.png)