The crypto markets rejuvenated a bit as significant liquidations pushed the Bitcoin price close to $92,000. As the token surged above the consolidated zone around $87,500, the altcoins like Solana gained strength. Solana is believed to follow the trend set by the star crypto, and hence, after rebounding from $127, a rise to $150 appeared to be on the horizon. Meanwhile, the latest hack on a popular exchange may serve as a catalyst, increasing the SOL price volatility in the short term. With the price trying hard to clear the $145 resistance, can Solana maintain its bullish structure and reach $150?

The confirmation of a $36 million Solana exploit on Upbit has injected fresh caution into the market, disrupting what had been a steadily recovering sentiment for SOL. According to early reports, the incident stemmed from unauthorized access to user accounts rather than a flaw in Solana’s core protocol, but the distinction has done little to calm traders.

Source: X

Source: X

However, the exchange has suspended all deposits and withdrawals and issued a notice to conduct a comprehensive inspection. The exact nature of the breach is yet to be disclosed, which has drained 24 different cryptos, including SOL, USDC, BONK, LAYER, JUP, etc., and others.

- Also Read :

- Bitcoin Price Today: Thanksgiving Rally Lifts BTC Back Above $91,500

- ,

Similar to the Bitcoin price rally, the Solana price has also rebounded from the local lows below $130. However, the token appears to be struggling to break above the crucial resistance that has held for several days before the 15% pullback. Currently, the price has recovered almost all the losses incurred during the crash; however, in the broader context, the bearish influence persists.

As seen in the above chart, the SOL price rebounds from the interim support at around $127 but is unable to rise above the resistance zone between $142 and $144. The technicals have turned bearish, which raises concern over the next price action. The CMF and OBV have displayed a bearish divergence, suggesting outflow of liquidity, keeping the bearish influence over the token for a while. Hence, the price is still feared to drop back below $140 and consolidate around $138. However, a rise from $150 to $153 may invalidate the bearish trajectory for some time.

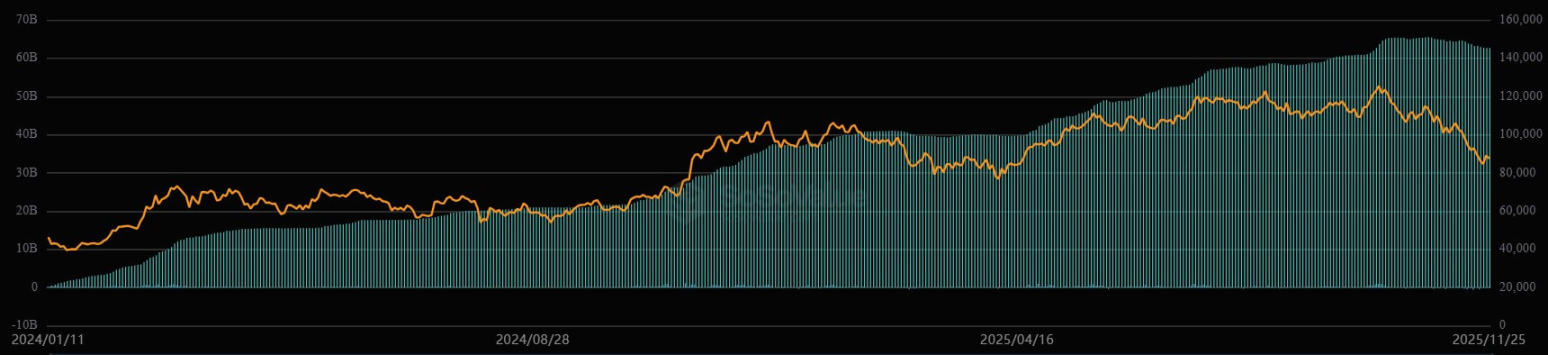

Technically, Solana’s pullback is still contained within a broader bullish structure, with the $180 zone acting as the immediate line of defense. On-chain metrics support this view—network activity, validator strength, and DEX volumes remain healthy, indicating no fundamental breakdown. Derivatives positioning also leans neutral rather than bearish: open interest has eased without collapsing, and funding rates remain balanced, showing traders are not aggressively shorting the move.

If buyers continue defending $180, SOL can stabilize and build the base needed for a push back toward $195–$205, where the next major resistance cluster sits. A decisive breakdown below $180, however, would flip momentum and open a pathway toward a deeper corrective leg before any recovery attempt.