Solana News Update: Institutional Investments Boost Solana Despite Security Concerns and Negative Market Trends

- Analysts predict Solana (SOL) will likely stay below $150 due to bear flag patterns and weak momentum, with key support at $140 potentially triggering a 30% drop to $99 if breached. - Despite technical headwinds, Solana's ETF inflows ($531M in first week) outpace Bitcoin and Ethereum , driven by 7% staking yields and lower fees compared to Bitcoin's $900M outflows. - Security risks persist after Upbit halted Solana withdrawals following a $37M hack, exposing vulnerabilities in hot wallet storage while CM

Solana Faces Technical and Market Challenges

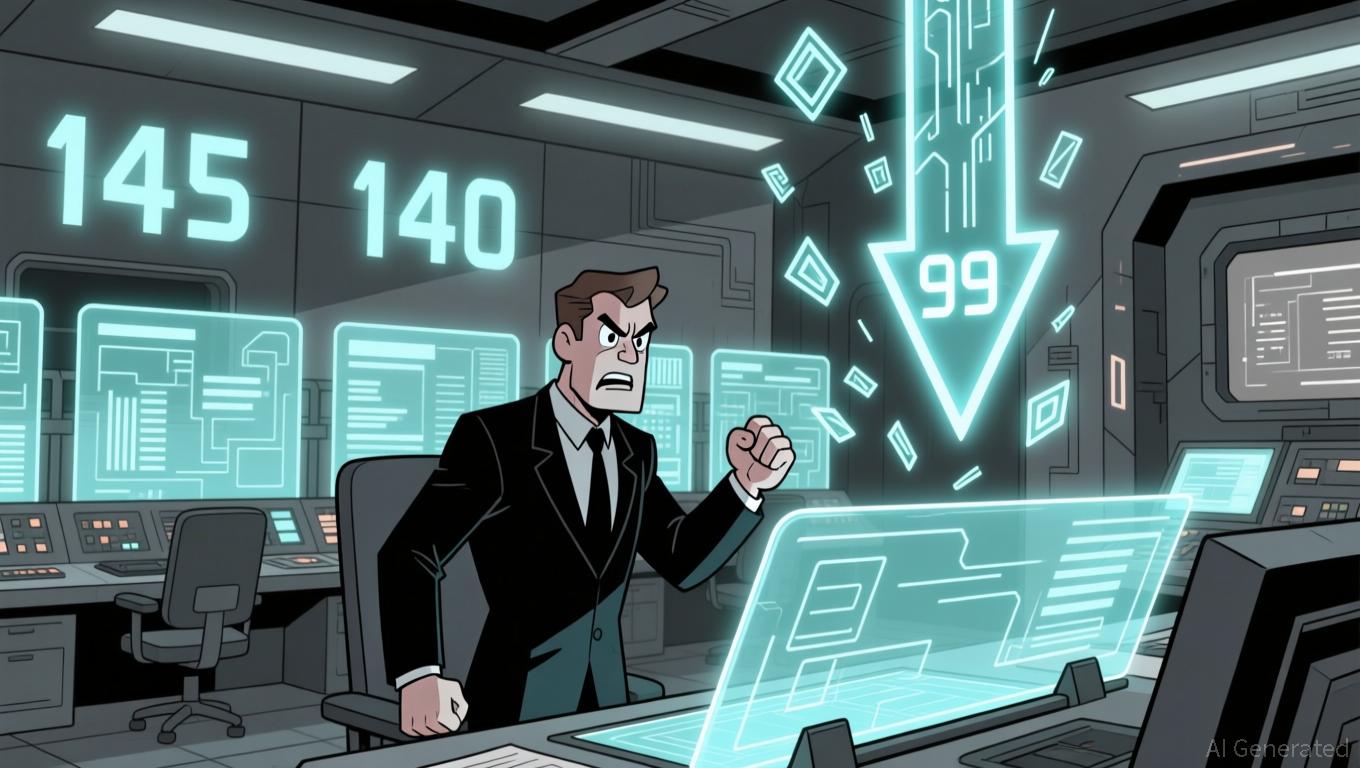

Solana (SOL) is currently struggling to break free from a period of restricted price movement, with experts predicting that it is unlikely to climb above $150 in the short term. The six-hour chart reveals a bear flag pattern, which emerged after SOL fell sharply from $170 in November. This pattern suggests that the downward trend may continue, especially as the price has repeatedly tested crucial support near $140. Should SOL fall below this level, analysts warn that it could trigger a significant decline, potentially dropping as low as $99—a correction of about 30% from recent peaks.

Trader MR Ape has highlighted the importance of the $145 resistance level, pointing out that previous attempts to break above it have failed and that momentum appears to be fading. According to him, SOL is at a pivotal moment, and the market’s next move will be determined soon. This underscores the current fragility of bullish sentiment, particularly as volatility remains high.

Institutional Investment Grows Despite Obstacles

Despite these technical hurdles, institutional interest in Solana has been on the rise. Inflows into Solana-based ETFs have surpassed those of Bitcoin and Ethereum, with net inflows reaching $531 million during the first week of its spot ETF debut and additional weekly increases of over $58 million. This surge is partly due to Solana’s attractive staking rewards of 7% and its lower transaction fees compared to Bitcoin, which, by contrast, experienced $900 million in outflows in a single day in November as its price dipped below $95,000.

Further evidence of institutional demand comes from CME Group’s upcoming launch of spot-quoted futures for both XRP and SOL, scheduled for December 15. These new contracts are designed to track real-time spot prices and offer lower margin requirements, making them more accessible to large investors, according to industry experts.

Security Incidents Raise Concerns

Security remains a significant concern for Solana. South Korea’s leading crypto exchange, Upbit, temporarily halted all Solana-related withdrawals following a $37 million hack on November 27. The attack targeted SOL, USDC, and various DeFi tokens, prompting the exchange to freeze deposits and withdrawals and move assets to cold storage. Upbit has promised to reimburse all affected users from its reserves, which helped calm fears but also highlighted ongoing vulnerabilities in hot wallet security. This incident occurred as Dunamu, Upbit’s parent company, was finalizing a $10.3 billion merger with Naver, drawing further attention to the exchange’s ability to withstand operational shocks.

Outlook: Uncertainty Ahead for Solana

The outlook for Solana remains mixed. While strong ETF inflows and the introduction of new CME products point to increasing institutional adoption, technical signals and security issues continue to weigh on sentiment. If SOL fails to hold above $140, it could trigger renewed selling pressure, potentially aligning with the bear flag’s target of $99. On the other hand, a decisive move above $145 might restore some optimism, though analysts caution that upward momentum is currently lacking. The next few weeks will be crucial in determining whether Solana can balance the excitement of innovation with the realities of a rapidly evolving market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Drops for 27 Consecutive Days as U.S. Institutions Lead Over International Investors

- Coinbase Bitcoin Premium Index hits 27-day negative streak, signaling U.S. institutional selling pressure amid $84,500 price decline. - Bitcoin ETFs lost $3.79B in November, led by BlackRock's $2.47B IBIT outflows, while Solana ETFs gained $531M from staking yields. - Weekend trading pauses briefly reverse negative premiums, but weekday institutional selling dominates Bitcoin's short-term trajectory. - Experts warn sustained bearishness requires premium index normalization, with Ark Invest cutting 2030 B

Bittensor's TAO Surge Stands Out Amid Challenges in Conventional Industries

- Bittensor's TAO token surged after Safello's ETP listing on SIX Swiss Exchange, reaching $10B monthly volume and 7% daily gains. - Clearside Biomedical filed Chapter 11 bankruptcy with $50M-$100M liabilities, while ProMIS executed 1-for-25 reverse split triggering 18.8% drop. - U.S. CMS slashed prices for 15 major drugs up to 70%, and China's Vanke delayed 2B yuan bond repayment amid property crisis concerns. - Market divergence highlights crypto's institutional adoption versus traditional sectors' regul

XRP News Today: While Bitcoin Leads the Market, Altcoin ETFs Face Liquidity Challenges

- NYSE Arca approved multiple altcoin ETFs (XRPZ, GDOG, GXRP, BWOW), expanding crypto access with institutional-grade products. - Grayscale's XRPZ saw $90M inflows amid market declines, while Dogecoin ETFs face liquidity challenges despite cultural appeal. - XRP futures hit record volumes, and Zcash's ETF conversion proposal highlights privacy token demand amid regulatory gaps. - Altcoin ETFs struggle to compete with Bitcoin's dominance, with DOGE's $22B market cap underscoring speculative risks and opport

Bitcoin News Today: Xapo's Enhanced Bitcoin Fund Signals Growing Institutional Confidence in Digital Assets

- Xapo Bank expanded its Byzantine BTC Credit Fund after $100M in institutional allocations, reflecting growing demand for Bitcoin-backed yield products. - The fund uses Hilbert Group's institutional-grade lending process to generate low-risk returns for Bitcoin holders through collateralized loans. - Xapo's expansion follows 2022 lending sector collapse, leveraging regulatory compliance in Gibraltar/Cayman to rebuild institutional trust in Bitcoin collateral. - The product differentiates from ETFs/stablec