In the past six weeks, the cryptocurrency markets have faced a near one trillion dollar loss in value, leading to new lows for altcoins. Despite this downturn, certain privacy-focused altcoins, notably Zcash (ZEC), have stood out with significant positive performance. ZEC has risen contrary to the overall market negativity, raising questions about the underlying reasons for this trend.

The Rise of Privacy Altcoins

As regulations in the crypto sector widen, scrutiny and compliance demands grow more stringent. Pressures from the Financial Action Task Force (FATF) and the European Union’s new Anti-Money Laundering (AML) rules have fueled an upsurge in privacy altcoins as a form of protest. The increased crackdown and restrictions on fundamental freedoms in cryptocurrency have driven interest in altcoins equipped with privacy features.

Since the end of summer, Zcash has continuously multiplied its value. Its market capitalization, which was under one billion dollars in August, surpassed seven billion dollars by early November. It even managed to unseat Monero as the leading privacy altcoin .

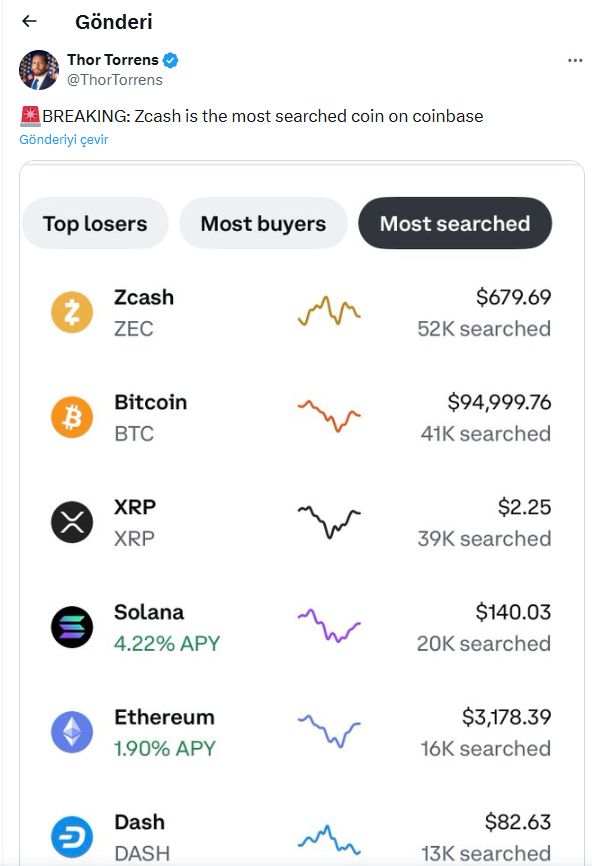

An interesting detail worth noting is the surge in interest on the Coinbase exchange. Zcash became more popular in search volumes within the platform than even Bitcoin $91,333 and Ripple $2 . This clear trend indicates that American retail investors are increasingly attracted to ZEC Coin.

Part of this interest circles around the hype about privacy altcoins like ZEC. Investors revel not only in privacy concerns or motivations but also perceive growth potential within this realm, further fueling their interest in ZEC Coin.

Concerns Arising from the Surge

The NU6.1 update was a primary catalyst for the acceleration of ZEC’s rise. The reduced issuance bolstered faith in the future of ZEC Coin. However, significant risks loom. For instance, European Union’s AML rules mandate licensed exchanges to prohibit privacy altcoins by 2027.

The EU’s extension of its AML policy in this direction could further contract global borders. This outcome could result in widespread delisting of fully anonymous cryptocurrencies from all major centralized exchanges. Such measures would challenge the liquidity access of coins like Monero, Dash, and ZEC Coin.

Kraken has already announced it will discontinue XMR trades for customers in the European Economic Area by the end of 2024. In 2024 alone, we observed delisting decisions affecting 60 different privacy altcoins from centralized exchanges. These insights hint at the possibility that the current rally might be a temporary escape before liquidity is wholly restricted.