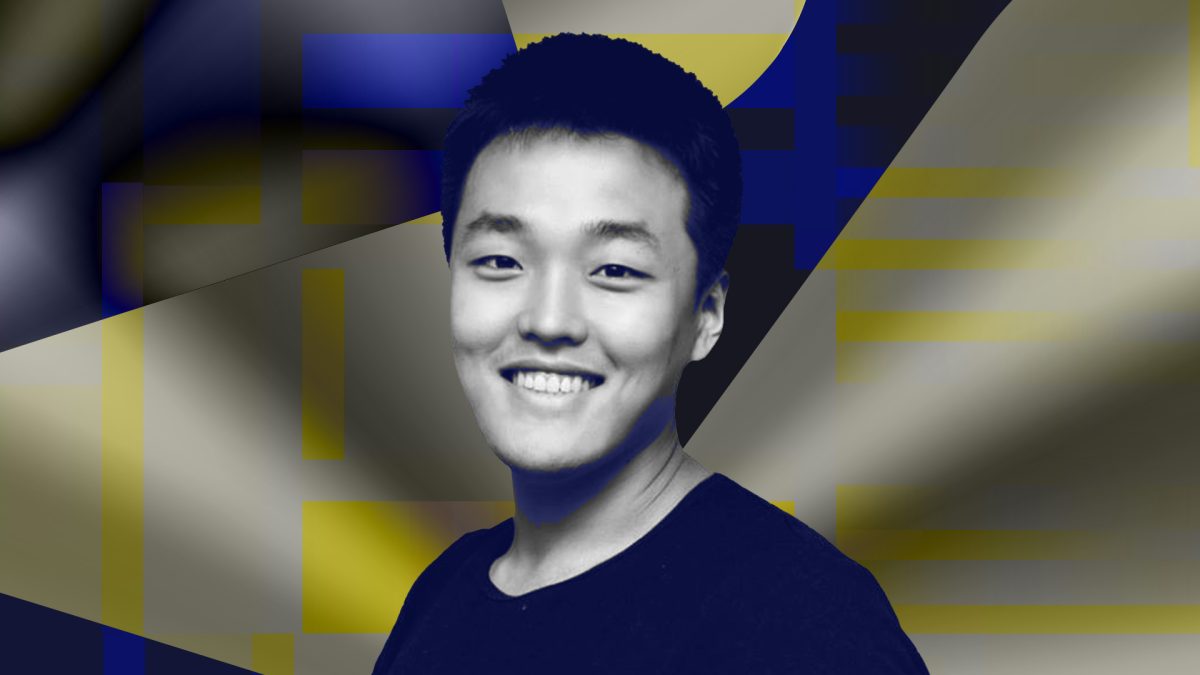

Do Kwon requests 5-year prison term cap in $40 billion Terra fraud case

Quick Take Terraform Labs founder Do Kwon and his attorneys have asked a U.S. court to cap his prison sentence at five years. Kwon’s sentencing is scheduled for Dec. 11.

Terraform Labs founder Do Kwon has requested a U.S. court to cap his prison sentence at five years following his guilty plea in a fraud case tied to the $40 billion collapse of the Terra-Luna cryptocurrencies.

In a 23-page letter filed on Nov. 26 in the U.S. District Court for the Southern District of New York, lawyers for Kwon argued that a prison term of up to five years would be sufficient.

"While the government's offer to seek no more than a 12-year sentence accounts for these factors, it does not consider the totality of circumstances that support a sentence not greater than five years’ incarceration," the letter said.

In August, Kwon pleaded guilty to two counts related to fraud charges stemming from the May 2022 collapse of Terraform Labs' Terra ecosystem, including algorithmic stablecoin TerraUSD and sister cryptocurrency Luna.

The document attributes the crash partly to coordinated trades by third-party firms exploiting vulnerabilities, citing academic papers and reports from Chainalysis. It also notes Kwon's failure to disclose a secret agreement with Jump Trading to support UST's peg in May 2021, which he now regrets as misleading investors about the project's risks.

"Do's criminal conduct was not motivated by personal greed or enrichment, but rather flowed initially from his 'hubris' and later from the desperation of a young founder who made serious mistakes while facing pressures he was ill-equipped to handle," Kwon's attorneys said.

The filing also highlighted Kwon's nearly two-year detention in Montenegro, including solitary confinement, following his March 2023 arrest for using a fake passport and leading up to his extradition to the U.S. in December 2024. It added that Kwon still faces charges in South Korea, where prosecutors are seeking 40 years in prison for the same indictment.

"Do has already suffered enormously from his conduct," the letter said. "Regardless of the sentence … more lies ahead."

The sentencing for Kwon is scheduled to take place on Dec. 11.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."