From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

The next generation of Launchpads may help solve the community bootstrapping problem in the cryptocurrency sector, an issue that airdrops have consistently failed to address.

Written by: Nishil Jain

Translated by: Block unicorn

Preface

With the emergence of various Launchpad platforms, market competition is becoming increasingly fierce.

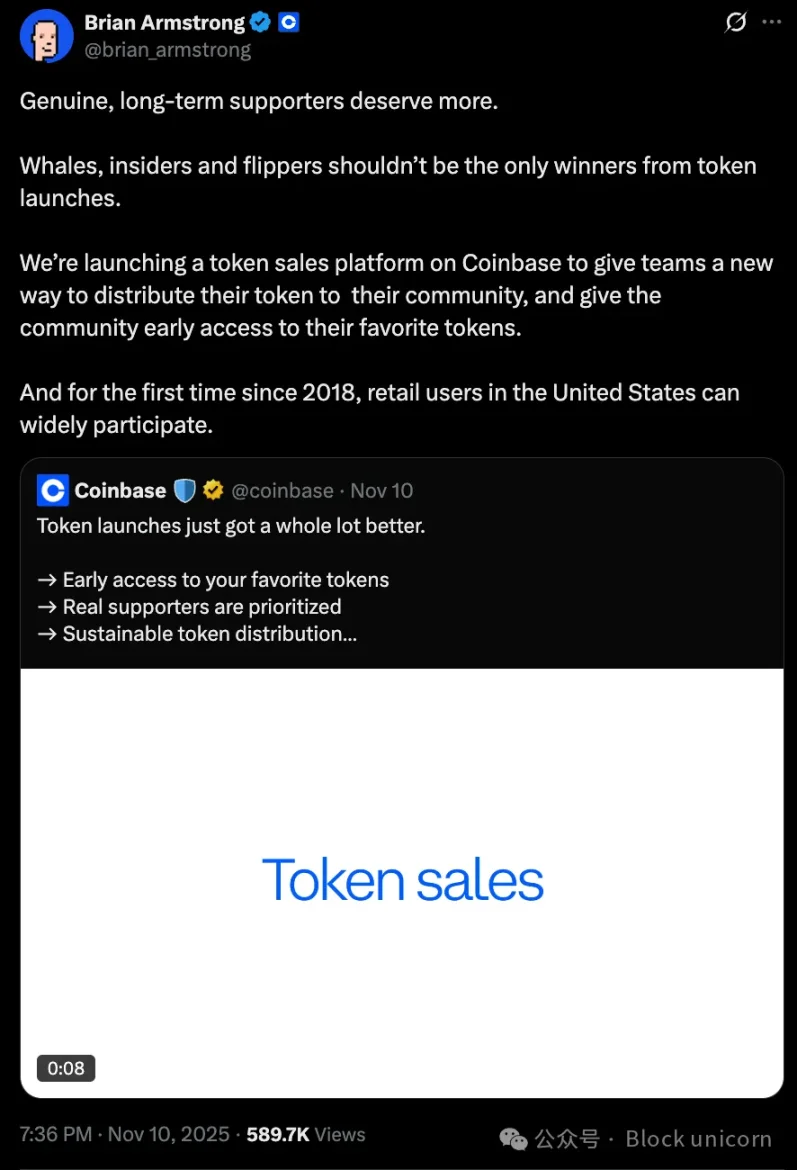

In October, Coinbase acquired Echo and launched its token sale platform earlier this month; in September, Kraken partnered with Legion. Meanwhile, Binance maintains a close relationship with Buildlpad, and PumpFun is attempting to issue utility tokens through Spotlight.

These developments come at a time when investor interest and confidence in the crypto market are rebounding.

Umbra Privacy set a fundraising target of $750,000 on MetaDAO but ultimately raised $156 millions, while Yieldbasis was oversubscribed by 98 times on Legion in less than a day. Aria Protocol was oversubscribed by 20 times on Buildpad, attracting more than 30,000 users to participate.

As token projects begin to raise funds at prices several times higher than their issue price, filtering out the noise becomes especially important.

In our previous article, "Capital Formation in the Crypto Sector," Saurabh explained how capital formation in crypto has evolved. He explored how new financing structures, such as Flying Tulip's investment model and MetaDAO's token issuance, attempt to resolve potential conflicts of interest among teams, investors, and users. Each new model claims to better balance the interests of all parties.

Although the success of these models remains to be seen, we are witnessing various Launchpads attempting to resolve conflicts between investors, users, and teams in different ways. They allow project teams to select their investors during public token sales, thus curating their cap table.

In today’s article, I will walk you through why and how investor selection occurs.

From First-Come-First-Served to Curated Token Holders

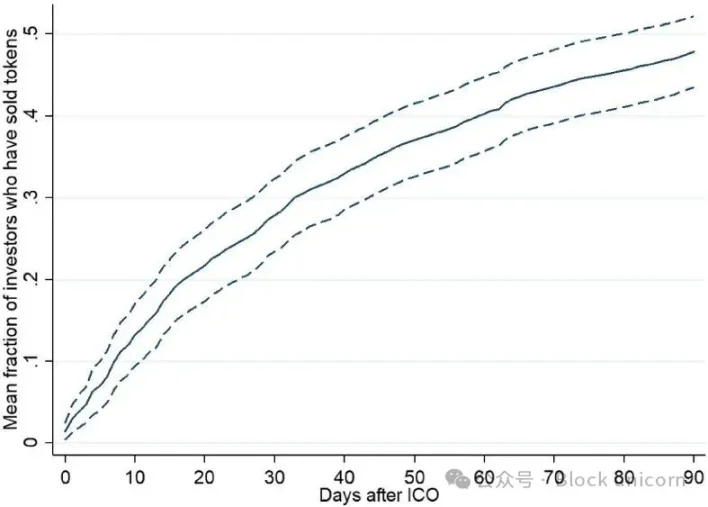

Between 2017 and 2019, early project investments mostly adopted a first-come-first-served (FCFS) model, with investors rushing in to enter at lower valuations, often aiming for quick profits at the project's launch. Research on over 300 token projects shows that 30% of investors exited within the first month after launch.

While quick returns always tempt investors, project teams are not obligated to accept every wallet that reaches out for funding. Truly visionary teams should be able to choose their participants, filtering for those committed to long-term development.

Below is content from Ditto of Eigencloud discussing the shift from FCFS sales to community-centric sales systems.

One issue with recent fundraising waves is that they have fallen into a "lemon market" dilemma. Too many projects have emerged, including scams and traps, making it difficult to distinguish quality projects from poor ones.

Launchpad platforms are unable to strictly vet all listed projects, resulting in low investor confidence. Ultimately, the number of projects surges, but there is insufficient capital willing to support them.

Now, it seems the situation is beginning to shift again.

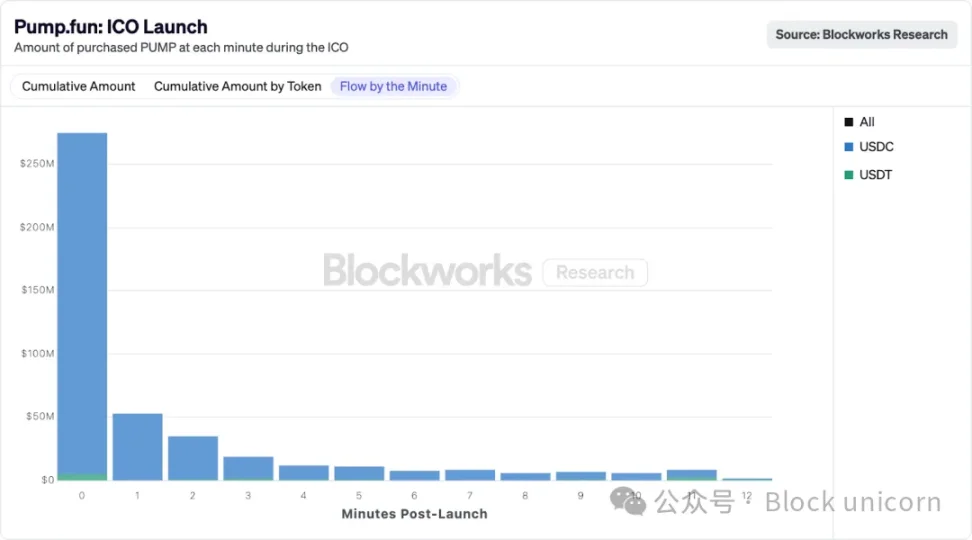

Since its launch, Cobie's fundraising platform Echo has raised $200 millions for over 300 projects. Meanwhile, in some independent fundraising projects, we have seen millions of dollars swept up in just a few minutes. Pump.fun raised $500 millions in less than 12 minutes; Plasma, in its public sale of the XPL project, raised $373 millions against a $50 millions target.

This shift is reflected not only in token issuance but also in Launchpads themselves. Emerging platforms like Legion, Umbra, and Echo promise greater transparency, clearer mechanisms, and more comprehensive structures for founders and investors. They are eliminating information asymmetry, enabling investors to distinguish good projects from bad. Today, investors can clearly understand a project's valuation, fundraising amount, and related details, thus better guarding against being trapped in a project.

This has led to capital flowing back into token investments, with project subscriptions far exceeding expectations.

The new generation of Launchpads is also working to build an investment community aligned with the project's long-term vision.

After acquiring Echo, Coinbase announced the launch of its own token sale platform, emphasizing user selection based on compatibility with the platform. Currently, they track users’ token selling patterns to achieve this. Users who sell tokens within 30 days of the sale receive lower allocation amounts, and more compatibility metrics will be announced soon.

This shift toward community-centric allocation is vividly reflected in Monad’s carefully designed airdrop plan and MegaETH’s allocation plan, both of which center on community members.

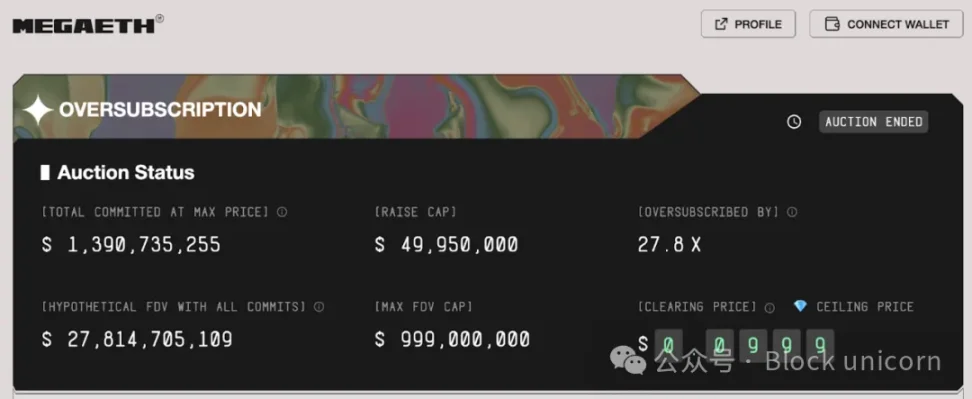

MegaETH was oversubscribed by about 28 times. The project required users to link their social media profiles and wallets with on-chain history to curate a list of token holders deemed most aligned with the project’s philosophy.

This is the transformation we are witnessing: as funds for participating in token projects become abundant again, project teams need to choose whom to allocate capital to. The new generation of Launchpads is designed to address this issue.

The Next Generation of Launchpads

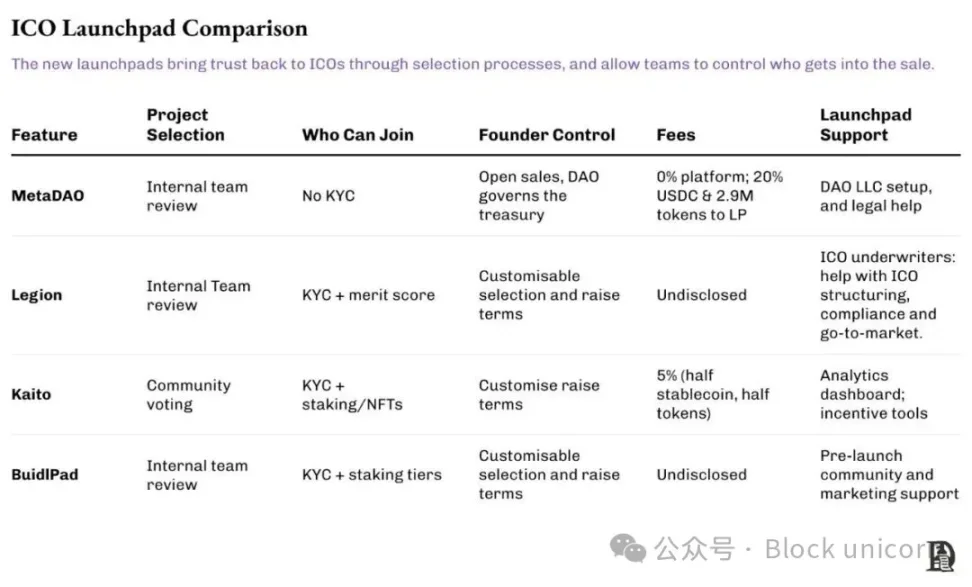

Currently, platforms such as Legion, Buildlpad, MetaDAO, and Kaito are emerging as representatives of the new Launchpad model. The first step is to vet projects to ensure investor trust in the Launchpad platform; the next step is to vet participating investors to ensure capital allocation meets project standards.

Legion adheres to a performance-driven allocation philosophy, offering the most comprehensive community member ranking system. The platform has successfully completed 17 token launches, with the most recent oversubscribed by about 100 times.

To ensure tokens in oversubscribed sales reach the right hands, each participant is assigned a Legion score, which comprehensively considers their cross-protocol on-chain history and activity, developer credentials (such as GitHub contributions), social influence, network reach, and qualitative statements about their intended contributions to the project.

Founders launching products on Legion can choose allocation weighting metrics, such as developer engagement, social influence, KOL (Key Opinion Leader) participation, or community education contributions, and assign weights accordingly.

Kaito takes a more targeted approach, allocating a portion of shares to "speakers" who actively participate in Twitter discussions. Participation is weighted based on users’ voting reputation and speaking influence, the amount of $KAITO staked, and the rarity of genesis NFTs. Project teams can choose from these priority supporter types.

Kaito’s model helps projects attract influential social media participants as early investors. This strategy is especially useful for projects that rely heavily on early exposure.

Buidlpad’s core philosophy is capital-based allocation. The more funds users stake, the more tokens they receive in token sales. However, this also means that only wallets with capital can participate.

To balance this capital-based system, Buidlpad introduced a "team system," awarding leaderboard points and additional rewards for community actions such as content creation, educational promotion, and social promotion.

Among these four Launchpads, MetaDAO is the most unique. Funds raised through MetaDAO are placed in an on-chain treasury and governed by a market-based mechanism called Futarchy. Futarchy is essentially futures trading on the underlying token, but trades are based on governance decisions rather than price.

All raised funds are stored in the on-chain treasury, and each expenditure is validated by conditional markets. Teams must propose spending plans, and token holders bet on whether these actions will create value. Only when the market reaches consensus can transactions be completed.

MetaDAO investors participate permissionlessly and fully openly, with each investor receiving token allocations proportional to their capital contribution. However, community building and alignment of interests among token holders occur after allocation ends. Each proposal in Futarchy is a market; traders can sell tokens if the proposal passes or buy more. Thus, the group of token holders forms based on final decisions.

While this article focuses on curated allocation schemes, from the project team’s perspective, there are many other factors to consider before launch, such as project selection criteria, founder flexibility, platform fees, and post-launch support. The comparison table below can help you quickly understand all these factors at a glance.

Web3 can bring together users, traders, and contributors through incentive mechanisms based on verifiable reputation systems. Without mechanisms to weed out bad actors or attract the right participants, most community token sales will remain immature, filled with a mix of believers and non-believers. Current Launchpads offer teams an opportunity to improve tokenomics and take the right first step.

Projects need tools to identify suitable users in the ecosystem and reward them for real contributions. This includes users with influence and active communities behind them, as well as founders or builders who create practical applications and experiences for others. These user groups play an important role in driving ecosystem development and should be incentivized to stay for the long term.

If the current momentum continues, the next generation of Launchpads may help solve the community bootstrapping problem in the cryptocurrency sector, an issue that airdrops have consistently failed to address.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.