XRP Price Awaits Volatility Explosion That Could Save It From Slipping Below $2

XRP is struggling to recover as its price action continues to mirror Bitcoin’s weakness. The altcoin has failed to establish momentum over the last few days, pushing it closer to the critical $2.00 threshold. This correlation-driven decline has kept XRP from reclaiming key levels, raising concern among holders. XRP Investors’ Losses Rise The Net Unrealized

XRP is struggling to recover as its price action continues to mirror Bitcoin’s weakness. The altcoin has failed to establish momentum over the last few days, pushing it closer to the critical $2.00 threshold.

This correlation-driven decline has kept XRP from reclaiming key levels, raising concern among holders.

XRP Investors’ Losses Rise

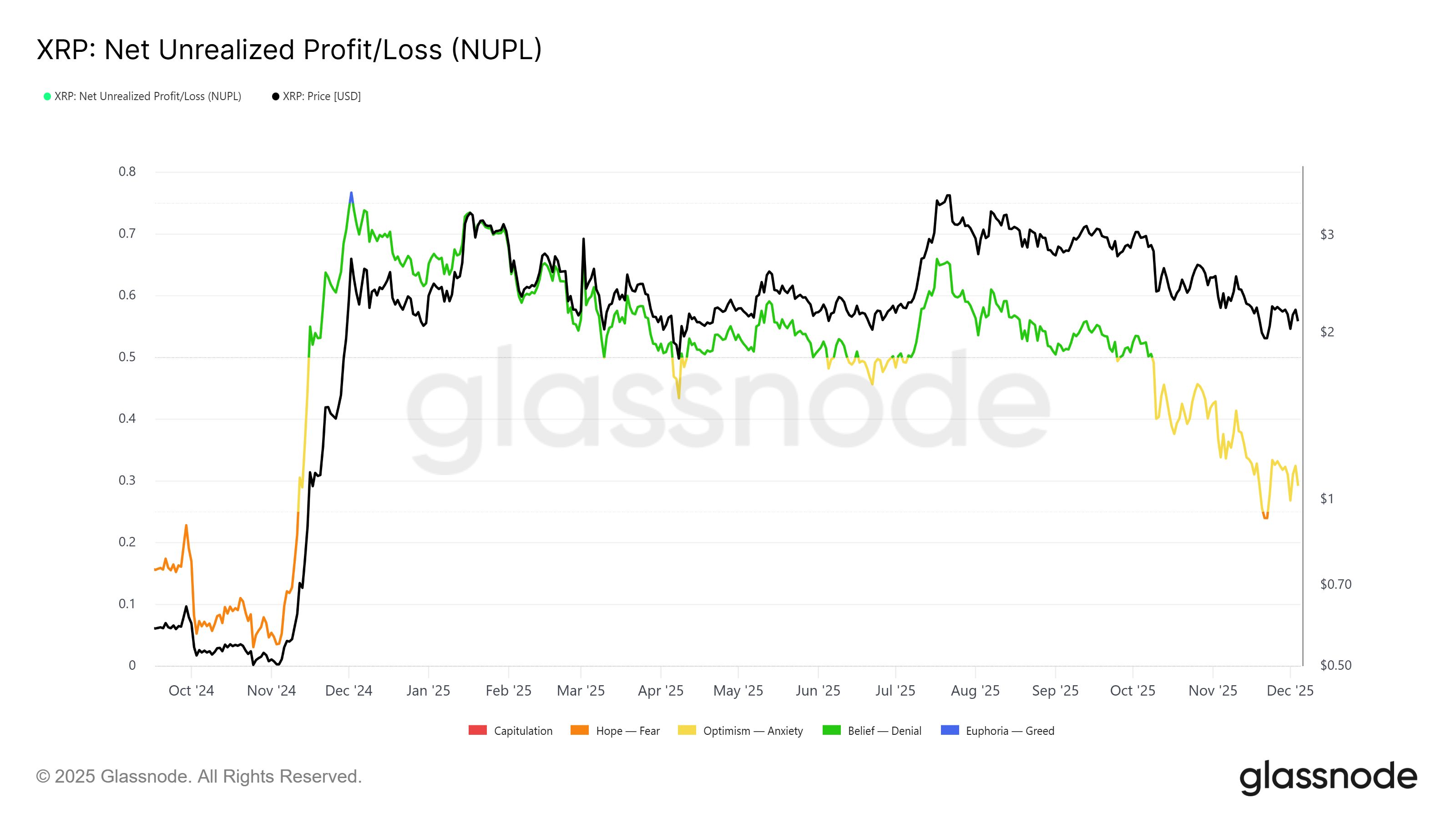

The Net Unrealized Profit/Loss (NUPL) indicator highlights the growing pressure on XRP. NUPL recently slipped from the mildly bearish zone to below 0.25, entering the Fear zone for the first time in over a year. This signals that unrealized profits have significantly eroded, leaving many holders at or near losses.

This dip in sentiment may also act as a reversal trigger. Historically, NUPL falling into Fear has preceded periods of accumulation, as prices reach psychologically appealing levels. If investors interpret current conditions as oversold territory, XRP may benefit from renewed buy-side interest.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP NUPL. Source:

Glassnode

XRP NUPL. Source:

Glassnode

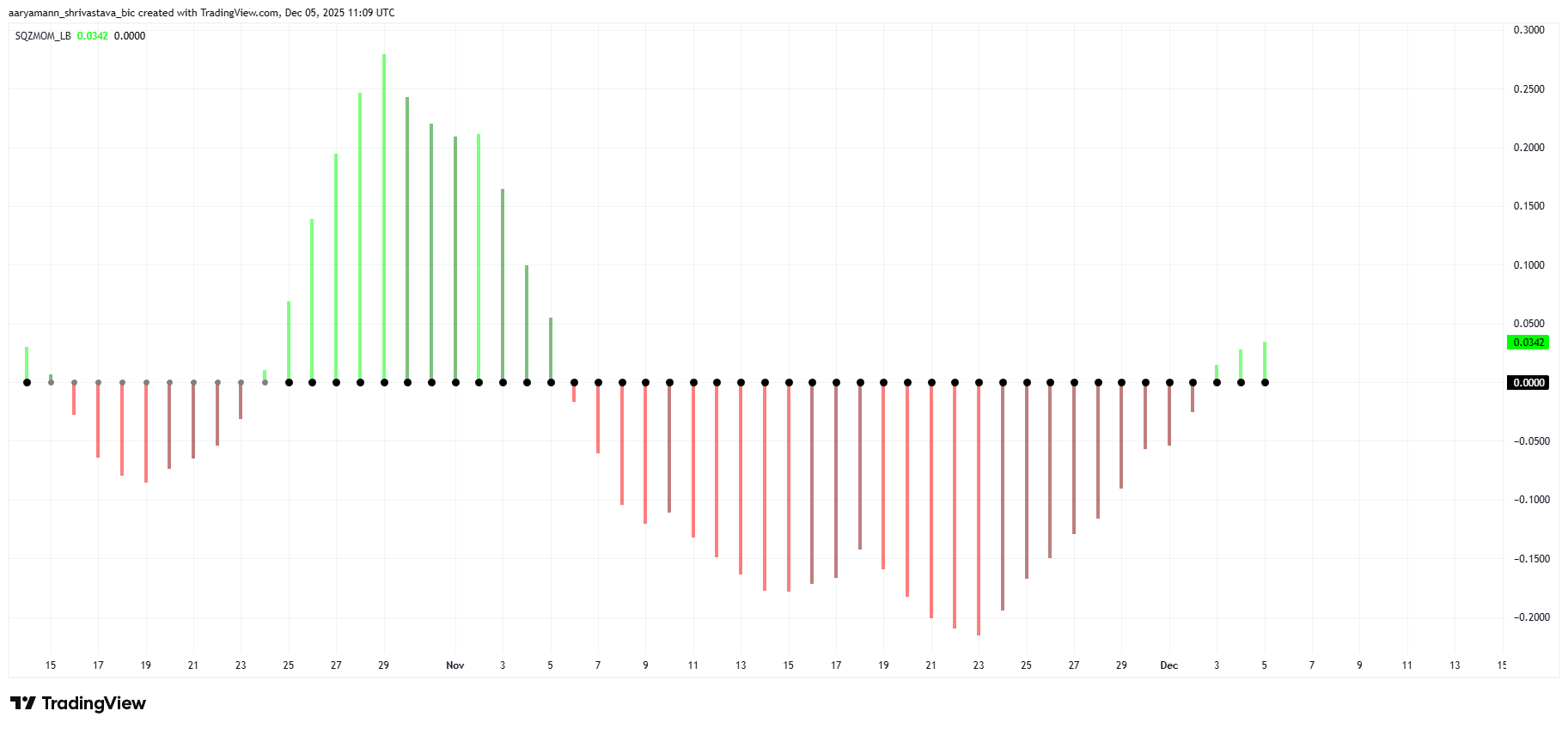

XRP is also witnessing important macro shifts. The Squeeze Momentum Indicator shows a tightening squeeze that has been developing for nearly a month. A squeeze reflects a period of low volatility as pressure builds within the price structure, often leading to a strong directional breakout once it releases.

At present, the indicator suggests a potential tilt toward bullish momentum. If the squeeze resolves upward, XRP could experience a sharp volatility expansion, giving the asset the boost it needs to escape its recent stagnation.

XRP Squeeze Momentum Indicator. Source:

TradingView

XRP Squeeze Momentum Indicator. Source:

TradingView

XRP Price Needs To Escape

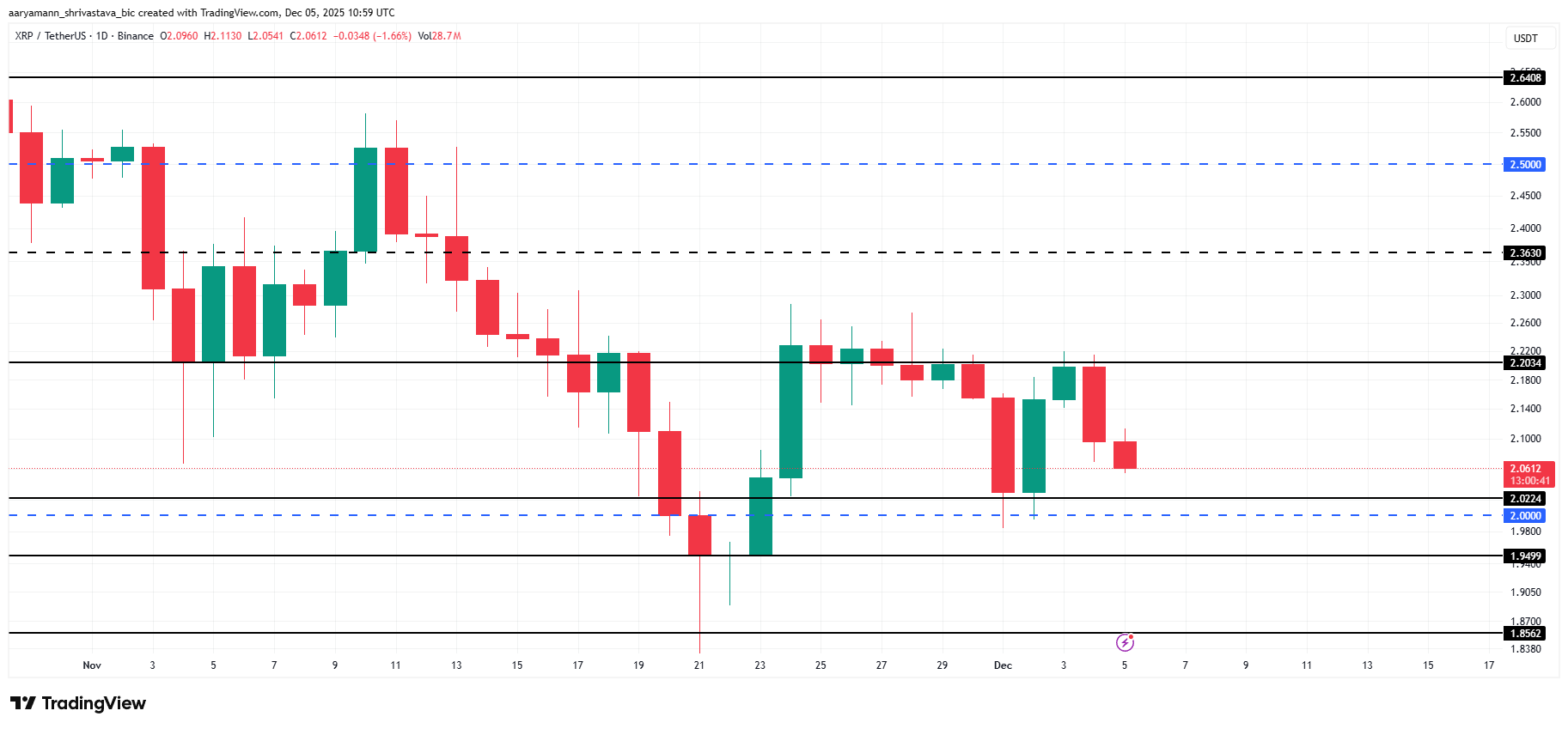

XRP is trading at $2.06 after two failed attempts to break the $2.20 resistance this week. The altcoin is now drifting toward the familiar $2.02 support level, which previously acted as a strong rebound point.

If XRP sees renewed investor confidence and a bounce from $2.02, the price could climb back to $2.20. A successful breakout above this resistance may open the door to $2.26, supported by the potential volatility surge indicated by the squeeze.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, a breakdown remains a risk. Losing the $2.02 support would place $2.00 in immediate danger. A fall below that threshold could push XRP toward $1.94 or even $1.85, invalidating the bullish outlook and signaling deeper correction potential.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MANTRA initiates OM token migration in anticipation of network upgrade

Navigating Workforce Changes Through Investment in Educational Technology

- Global workforce transformation driven by AI/automation demands education-industry alignment to bridge skills gaps. - EdTech investments surge in SaaS/corporate upskilling platforms (18.6x EV/Revenue) as STEM/vocational training gains urgency. - Persistent equity gaps (35% female STEM graduates) and 411K unfilled U.S. teaching roles challenge workforce development. - ETFs like KNCT/RSPT (20.98x-22.74x P/E) offer cost-effective exposure to AI-driven productivity tools versus broader tech ETFs. - Investors

Solana Validator Numbers Slide 68% Since 2023, Community Divided

Quick Take Summary is AI generated, newsroom reviewed. Solana's active validator count has seen a sharp decline, falling from over 2,500 in March 2023 to approximately 800, representing a 68% decrease. One perspective argues the decline is a beneficial "healthy pruning" that removes Sybil nodes and improves the genuine decentralization and quality of the network. An opposing view, supported by infrastructure teams, suggests the exits are genuine operators who were forced out by high hardware and bandwidth

A Strong Wave of Institutional Buying Reshapes the XRP Market

Quick Take Summary is AI generated, newsroom reviewed. US XRP spot ETFs purchased $38.04 million worth of XRP recently. Institutional crypto demand rises sharply as funds increase holdings. Strong inflows boost XRP market momentum and attract new investors. ETF activity strengthens confidence and prepares the market for growth.References BREAKING: 🇺🇸 XRP spot ETFs have just bought 38.04 million worth of $XRP.