Date: Sat, Dec 06, 2025 | 04:40 AM GMT

Bitcoin’s recent rebound is starting to show cracks. After bouncing from the Dec 01 low of $83,822 to a local peak of $94,150 on Dec 04, BTC has slipped back to around $89,646. The pullback has cooled spot volume and nudged futures open interest lower—clear signs that traders are becoming cautious as momentum stalls.

Source: Coinmarketcap

Source: Coinmarketcap

Within this mid-$80k to low-$90k range, on-chain metrics suggest the weakness isn’t driven by panic selling. Instead, it looks like classic profit-taking from miners and whales who saw the brief rally as an ideal window to secure gains.

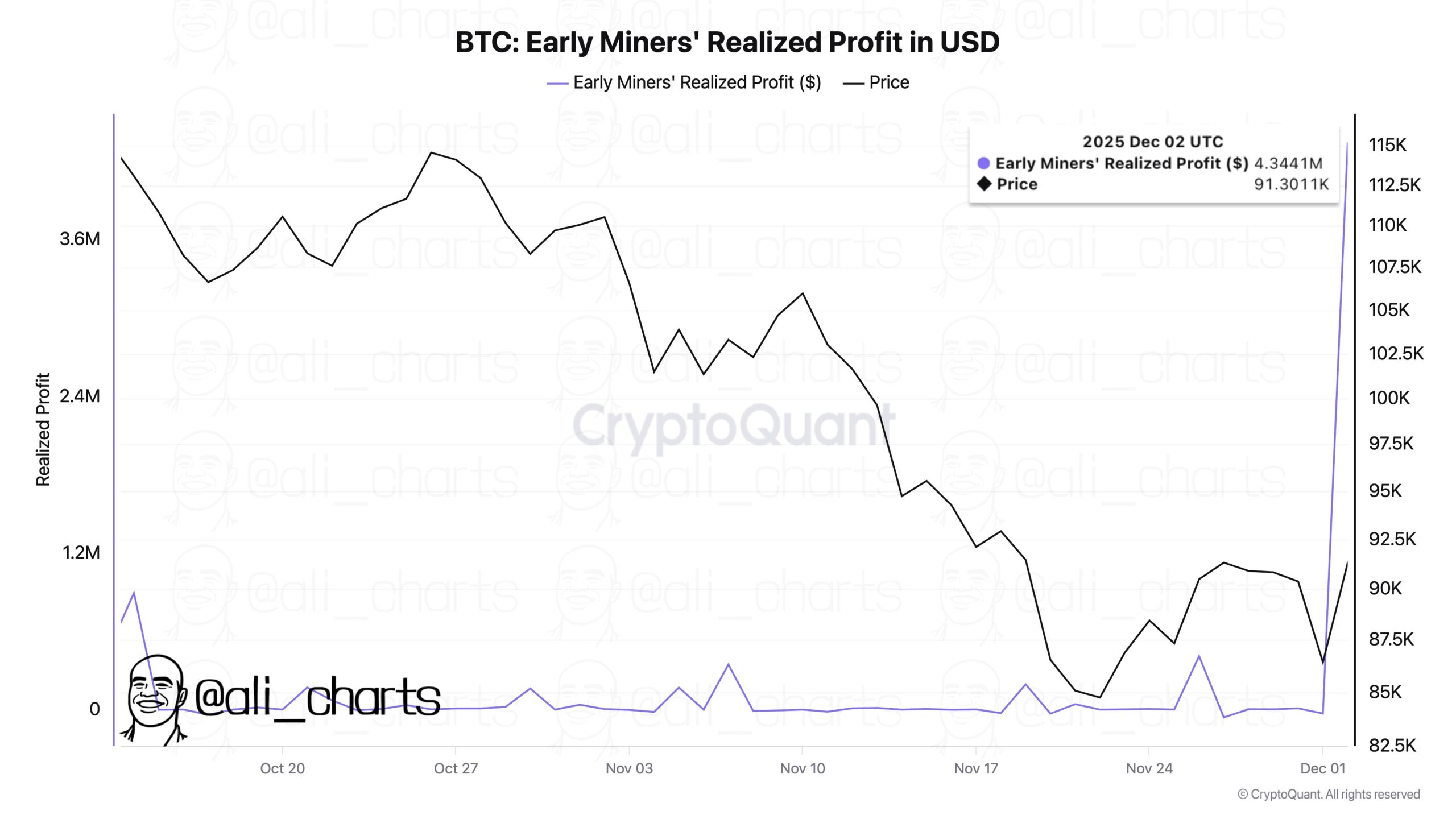

Miners Take Profit as BTC Rises

Crypto analyst ALI highlights that miners—especially early miners with long-held coins—took advantage of the jump toward $94k.

On-chain data from CryptoQuant shows miner realized profits climbing to $4.344 million on Dec 02, a sharp rise from under $1M just a week earlier.

This isn’t aggressive selling; it’s more like scheduled profit-locking after months of inactivity. As BTC drifted lower again, these realized profits eased back toward $3M, suggesting miners may pause unless Bitcoin dips further.

BTC Miners Data/Credits: @ali_charts (X)

BTC Miners Data/Credits: @ali_charts (X)

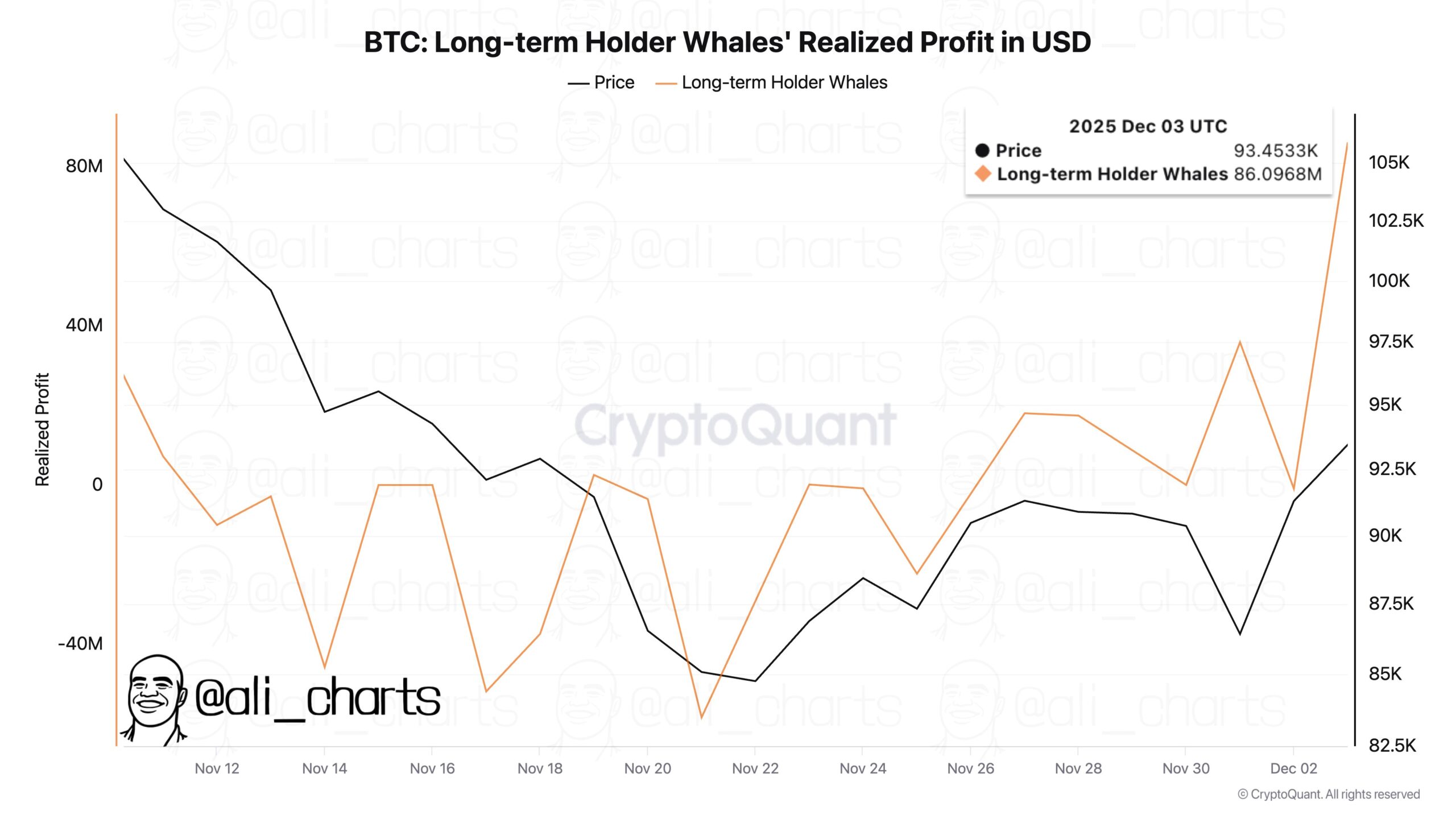

Whales Lock In $86M Amid the Rebound

Whales were equally active. ALI’s data shows long-term holder whales realized a hefty $86.096 million in profits by Dec 03.

Their realized profit line flipped from negative territory in mid-November to strong positive numbers as BTC recovered—classic whale behavior: accumulate low, distribute into strength.

Despite the sell pressure, spot ETF inflows have stayed steady, which may be preventing deeper downside. But continued whale selling could make the $95k region a tough level to break through.

BTC Long Term Holders Data/Credits: @ali_charts (X)

BTC Long Term Holders Data/Credits: @ali_charts (X)

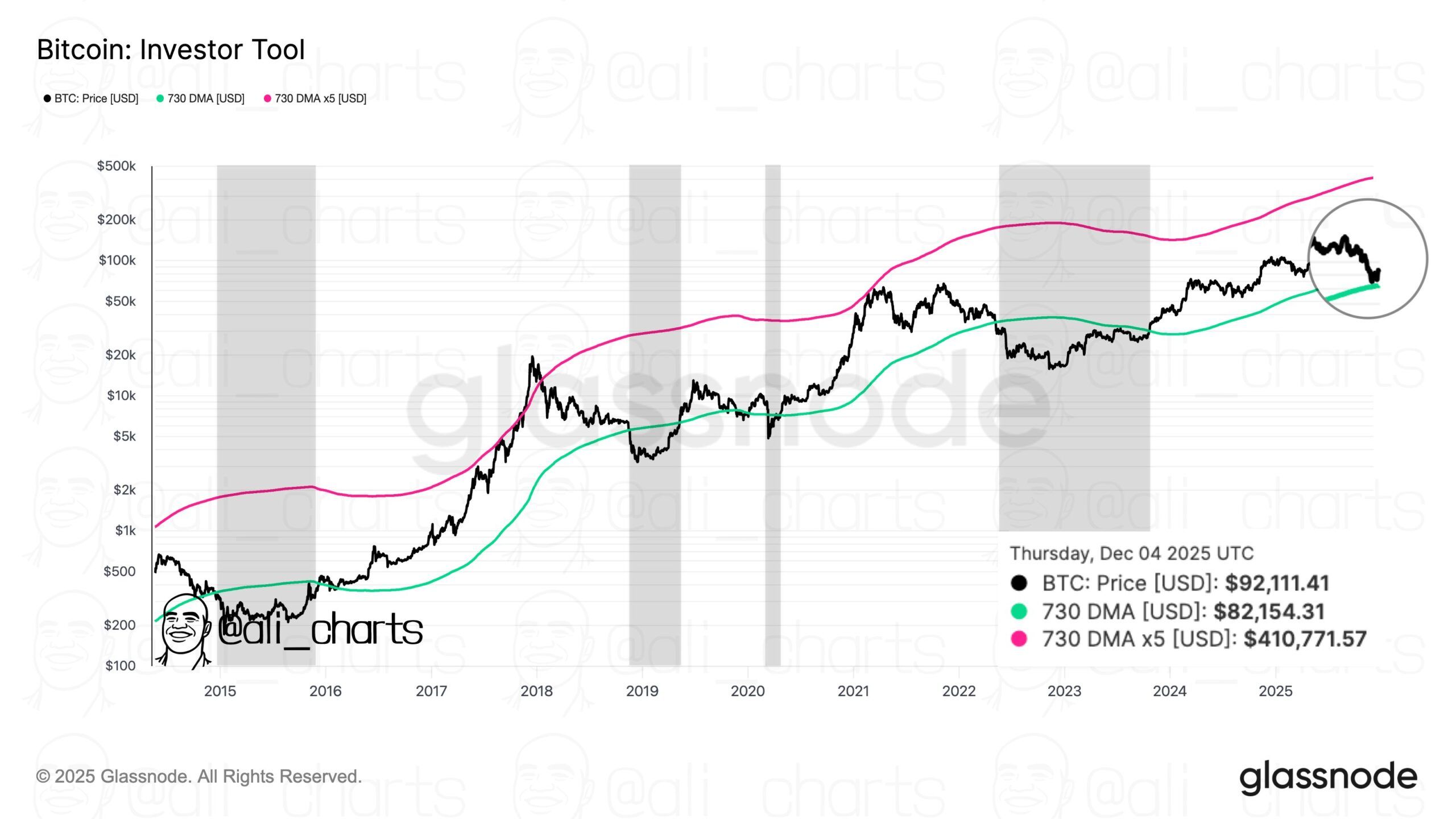

Bitcoin’s 730-Day SMA

ALI also points to an important long-term signal from Glassnode’s Investor Tool.

The 730-day SMA, currently around $82,150, has historically marked the line between extended downtrends and recoveries.

BTC remains above it for now, but the proximity is concerning. A slip beneath $85k could open the door to a retest of that SMA—something that previously triggered deeper corrections (like in 2022).

Conversely, reclaiming $92k could restore momentum and put $100k back in play before year-end.

Bitcoin Chart/Credits: @ali_charts (X)

Bitcoin Chart/Credits: @ali_charts (X)

Where Things Stand

Nothing in ALI’s charts signals an imminent crash, but they do point to a fragile market where profit-taking is slowing upside rather than reversing it outright. Macro uncertainty and Bitcoin’s historically mild December performance add to the cautious mood.

Still, mid-tier holders are accumulating, and long-term halving cycle dynamics remain supportive for bulls.

For now, $82k is the line in the sand. Hold it, and a late-December rally remains possible. Lose it, and BTC could slide toward the high-$70k range.