Date: Sat, Dec 06, 2025 | 06:10 AM GMT

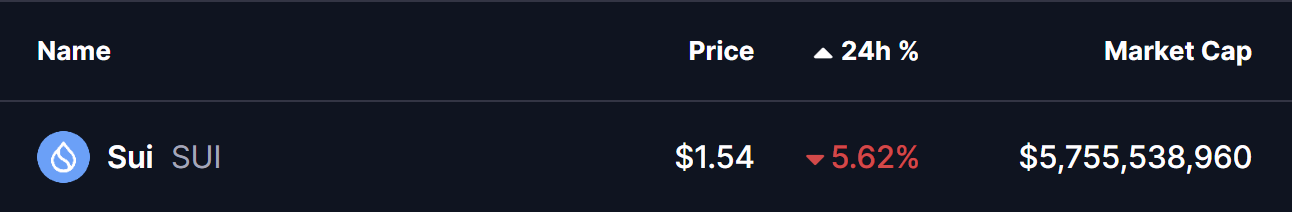

The broader cryptocurrency market is once again facing notable downside pressure after a sharp relief rally earlier this week. Bitcoin (BTC) surged from $83,822 to $94,150 on Dec 04 but has since corrected back to $89,500, while Ethereum (ETH) is down over 4% in the past 24 hours. This selling momentum has weighed on several altcoins, including Layer-1 project Sui (SUI), which is currently retracing more than 5% on the day.

Source: Coinmarketcap

Source: Coinmarketcap

Yet, beneath the current pullback, SUI’s chart now reflects a constructive pattern — one that strikingly mirrors Solana’s (SOL) past bullish breakout structure.

SUI Mirrors SOL’s Fractal Setup

On the 4H timeframe, SUI is mimicking a previous SOL setup with impressive precision.

In October 2024, Solana formed a double-bottom base, broke above its neckline, and then pulled back to retest the same breakout zone. That retest aligned perfectly with the 50 MA support, leading to a strong rebound and a rapid 23% upside expansion.

SOL and SUI Fractal Chart/Coinsprobe (Source: Tradingview)

SOL and SUI Fractal Chart/Coinsprobe (Source: Tradingview)

SUI is now tracking the same technical footprint.

The token has completed its breakout from a double-bottom formation and is currently retesting the neckline zone at $1.54–$1.56, which also aligns with the 50 MA support currently hovering near $1.5432. The structural similarity with SOL’s pre-rally configuration is notable — both assets consolidated at neckline support, absorbed sell pressure, and then launched into strong bullish continuation.

If fractal behavior continues to assert itself, SUI may be setting up for a similar expansion phase.

What’s Next for SUI?

If buyers successfully defend the neckline and 50 MA confluence zone, the probability of another leg higher increases significantly. A breakout from this support region could fuel upside continuation toward $1.90, matching the magnitude and trajectory of SOL’s past breakout rally.

However, it is important to recognize that fractals serve as directional guides rather than guaranteed outcomes. A failure to sustain support at $1.54–$1.56 would weaken the bullish fractal alignment and could push SUI into deeper consolidation before attempting any renewed climb.

For now, all eyes remain on this critical demand zone. If history repeats — as the SUI/SOL fractal suggests — a sharp rebound may be closer than current market sentiment reflects.