Data: Bitcoin's SOPR ratio has fallen to 1.35, indicating a complete "reset" of market profitability.

according to CryptoOnchain data, the Bitcoin SOPR ratio has dropped to 1.35, reaching its lowest level since the beginning of 2024. As BTC retraces to $89,700, this indicator shows that market profits have undergone a "thorough reset."

The large-scale profit-taking phase by long-term holders is weakening, indicating a decline in selling momentum. Historically, when the SOPR falls to similarly low levels, it usually means a local bottom is forming and market enthusiasm is cooling down. If a reversal starts from the current position, it may lay the foundation for the next healthy upward trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UNIfication Greenlights 100M UNI Burn and Switches On Protocol Fees

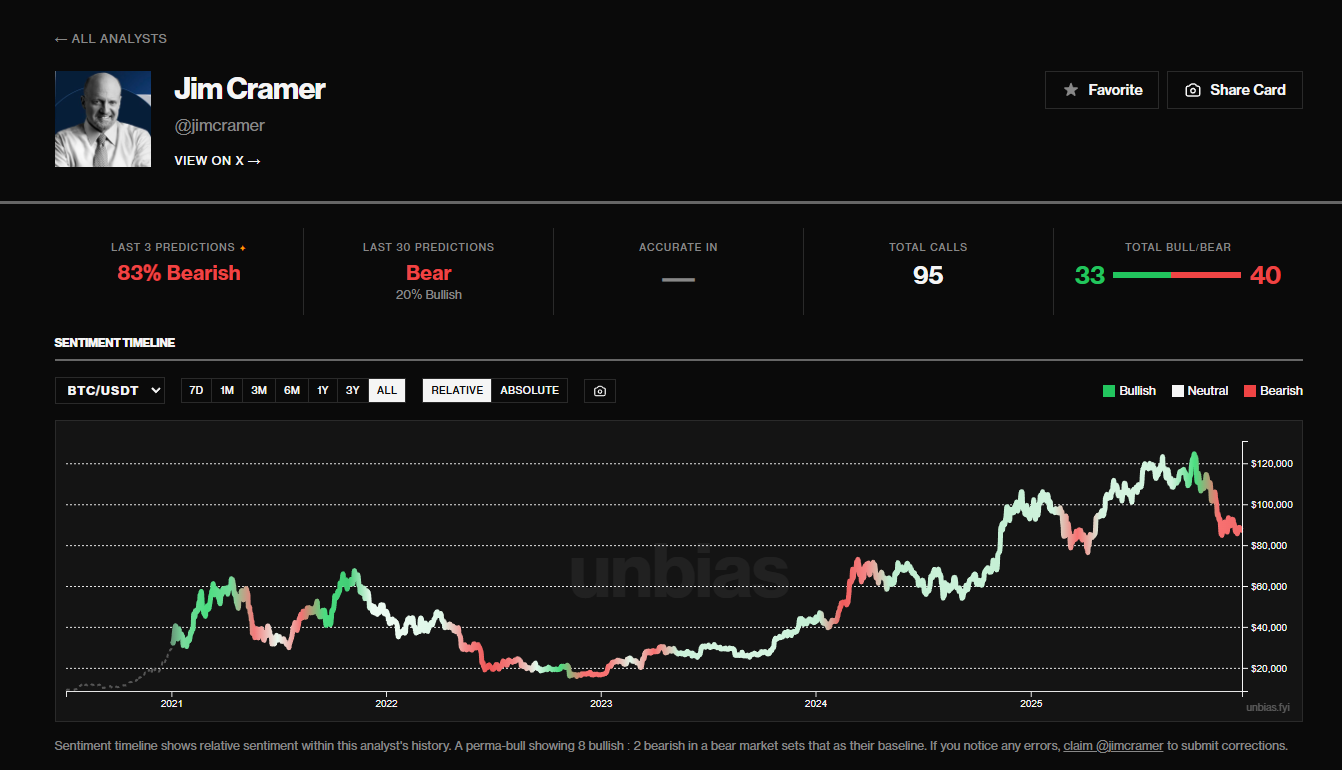

Jim Cramer's Bitcoin Bear Growl: Time to Buy the Dip? – Kriptoworld.com

Dive into Dogecoin’s Dramatic Decline and its Potential Rebound Signals