Morning News | Circle obtains financial services license in Abu Dhabi Global Market; Bitget Wallet is raising funds at a $2 billion valuation; HASHKEY discloses IPO details

Overview of major market events on December 9.

Compiled by: ChainCatcher

Key News:

- Trump announces permission for Nvidia to sell H200 chips to China, with a 25% export fee

- HASHKEY discloses IPO details: plans to raise up to 1.67 billion yuan, expected to be listed for trading on December 17

- Bitget Wallet founder reveals Bitget Wallet is raising funds at a $2 billion valuation

- Circle obtains financial services license in Abu Dhabi Global Market

- CZ: The four-year bitcoin cycle may have failed, a "super cycle" may be coming

- YZi Labs announces the list of selected projects for EASY Residency Season 2

- Hassett: The Fed has room to cut rates by more than 25 basis points

What important events happened in the past 24 hours?

Trump announces permission for Nvidia to sell H200 chips to China, with a 25% export fee

ChainCatcher reports, on December 8 local time, US President Trump stated that the US government will allow Nvidia to sell its H200 artificial intelligence chips to China, but will impose a 25% fee on each chip. The H200 is considered Nvidia's "second most powerful" AI chip. Trump said the US Department of Commerce is finalizing relevant details, and AI chip exports from companies such as AMD and Intel will also be subject to the same arrangement.

After the announcement, Nvidia's stock price rose 1.2% after hours. Reuters pointed out that this decision marks a shift in the Trump administration's AI chip policy towards China. Nvidia CEO Jensen Huang has been lobbying the US government for months to ease export restrictions.

The report quoted Jensen Huang as saying that the Chinese market is crucial to the competitiveness of the US AI industry, and stable US-China trade helps avoid double damage to both supply chains. The Chinese Ministry of Foreign Affairs previously stated that the US should take practical actions to maintain the stability of the global supply chain.

BMW adopts JPMorgan blockchain settlement system Kinexys to automate foreign exchange transfers

ChainCatcher reports, German automaker BMW AG has begun using a blockchain-based system to automate some foreign exchange transactions, as companies increasingly seek to leverage the technology behind cryptocurrencies to accelerate and simplify billions of dollars in cross-border payments.

The company uses JPMorgan Chase & Co.'s Kinexys platform, which automatically allocates euros from a Frankfurt account when BMW's US dollar account in New York falls below a set threshold.

Hassett: The Fed has room to cut rates by more than 25 basis points

ChainCatcher reports, according to Golden Ten Data, Kevin Hassett, director of the US White House National Economic Council, said that when asked whether the Fed has room to cut rates by more than 25 basis points, his answer is affirmative.

YZi Labs announces the list of selected projects for EASY Residency Season 2

ChainCatcher reports, YZi Labs today announced the full list of companies and founders selected for EASY Residency Season 2, who will showcase their achievements for the first time at Demo Day during Binance Blockchain Week. This season's selected projects cover the fields of Web3, AI, and Biotech.

YZi Labs believes that the next decade will be shaped by the convergence of three forces: blockchain unlocking ownership, scalability, and global liquidity; AI accelerating creativity, labor, and intelligence; and Biotech extending healthy, long lives. EASY Residency aims to support founders creating breakthrough technologies and unlocking global mass distribution, with project directions ranging from AI-driven drug discovery and robotic automation to financial primitives and infrastructure empowering a tokenized future.

White House Press Secretary: Trump to deliver an economy-boosting speech in Pennsylvania today

ChainCatcher reports, according to Golden Ten Data, White House Press Secretary Levitt said that US President Trump will deliver an economy-boosting speech in Pennsylvania today.

CZ: The four-year bitcoin cycle may have failed, a "super cycle" may be coming

ChainCatcher reports, according to Bitcoin Magazine, Binance founder CZ stated that the four-year bitcoin cycle may have failed, and we may be entering a "super cycle".

HASHKEY discloses IPO details: plans to raise up to 1.67 billion yuan, expected to be listed for trading on December 17

ChainCatcher reports, HASHKEY HLDGS (new listing code: 03887) plans to open for subscription from today to the 12th. The parent company of Hong Kong licensed virtual asset exchange Hashkey Exchange, HASHKEY, plans to issue 240 million shares, with 10% offered publicly in Hong Kong. The offer price ranges from 5.95 yuan to 6.95 yuan, raising up to 1.67 billion yuan. Each lot is 400 shares, with a minimum subscription fee of 2,808 yuan.

HASHKEY is expected to be listed for trading on December 17. JPMorgan, Cathay Haitong, and Guotai Junan International are joint sponsors.

As of October 31, HASHKEY held 1.48 billion yuan in cash and cash equivalents and digital assets worth 570 million yuan. Of the digital assets, mainstream tokens accounted for 89%, including ETH, BTC, USDC, USDT, and SOL.

As of the end of September, platform assets exceeded 19.9 billion yuan, with 3.1% stored in hot wallets and 96.9% in cold wallets. The exchange's cumulative spot trading volume reached 1.3 trillion yuan. The main business is transaction facilitation services, accounting for nearly 70% of revenue.

In the past three years, HASHKEY lost 590 million yuan, 580 million yuan, and 1.19 billion yuan, respectively.

In the first six months of this year, HASHKEY's loss attributable to equity shareholders was 510 million yuan, narrowing by 34.8% year-on-year, while revenue fell 26.1% to 280 million yuan.

As for the use of net proceeds: 40% for technology and infrastructure iteration, 40% for market expansion and ecosystem partnerships, 10% for operations and risk management, and 10% for working capital and general corporate purposes.

Bitget Wallet founder reveals Bitget Wallet is raising funds at a $2 billion valuation

ChainCatcher reports, UXUY founder and Bitget Wallet (formerly BitKeep) founder 0xKevin revealed on X that Bitget Wallet is raising funds at a $2 billion valuation. 0xKevin sent his blessings and commented: "On-chain is no longer a paradise for geeks, but the main battlefield for stablecoins. The on-chain trading entry is becoming the gateway to new finance. The competition for the next generation of on-chain trading entry has just begun."

ChainCatcher reports, according to market news, Grayscale stated that the halving-driven bitcoin pricing model, which shaped bitcoin's early history, is losing its influence. As more bitcoin enters circulation, the relative impact of each halving is diminishing. Grayscale points out that today's bitcoin market is more dominated by institutional capital, rather than the retail speculation that dominated past cycles.

Unlike the explosive rallies of 2013 and 2017, bitcoin's recent rally is more controlled. Grayscale believes that the subsequent 30% pullback is also more like a typical bull market correction. Interest rate expectations, progress in crypto regulation driven by both US parties, and the trend of bitcoin being integrated into institutional portfolios are increasingly shaping market trends.

Bankr co-founder: Polymarket data is accurate, Paradigm is smearing competitors due to investment in Kalshi

ChainCatcher reports, Bankr co-founder deployer posted on X that the recently discussed "double counting" issue in trading volume stems from the way third-party data panels collect data, not from any flaw in Polymarket's own data. He emphasized that there is no fundamental error in Polymarket's trading volume records.

deployer pointed out that Paradigm amplified the controversy and interpreted Polymarket negatively because Paradigm itself is an investor in Kalshi, thus having a clear competitive stance. He bluntly stated that such behavior is "purposeful and low-level," believing Paradigm's motive to smear its competitor is obvious.

ChainCatcher previously reported that Paradigm's founder claimed Polymarket had a data bug, with trading volume double-counted in most public data.

Vitalik: Ethereum Foundation has made breakthroughs at the network layer, PeerDAS is a "heroic" achievement

ChainCatcher reports, Ethereum co-founder Vitalik Buterin wrote that he used to complain that the Ethereum Foundation lacked experience at the P2P network layer, focusing more on cryptoeconomics, BFT consensus, and the block layer, often taking the network layer for granted. But now things have changed, as PeerDAS's performance proves.

He said that @raulvk and other Foundation members have made "heroic contributions" in promoting the smooth operation of PeerDAS and formulating a roadmap for faster propagation, stronger resistance, and parallel improvements in network privacy, and he looks forward to further progress.

Hassett: It would be "irresponsible" to set the Fed's rate target plan for the next six months in advance

ChainCatcher reports, White House National Economic Council Director Kevin Hassett said it would be "irresponsible" for the Fed to set a rate target plan for the next six months in advance, emphasizing the importance of following economic data.

Hassett said in a CNBC interview on Monday, "The Fed chair's job is to watch the data, adjust policy, and explain the reasons behind their actions, so if someone says 'I will do this in the next six months,' that is indeed irresponsible."

Coinbase CEO: The golden age of crypto has arrived, the US is back on the offensive

ChainCatcher reports, Coinbase CEO Brian Armstrong said at the New York Times DealBook Summit that the crypto era is no longer a battle for survival, but a race to accelerate. The US is back on the offensive, leveraging policy tailwinds, market forecasting, and financial reset advantages.

"I'm an optimist, right? I think we're entering a golden age of freedom, with the popularization of all kinds of financial products driving this transformation. In crypto, we're witnessing the booming rise of prediction markets. The regulatory framework for stablecoins is now clear. Market structure is likely to be reshaped, and the US seems to be back on the offensive. We have the opportunity to upgrade the financial system with crypto and eliminate many frictions in the economy. With the midterm elections approaching, the government might stimulate the market and further cut rates. So overall, I'm optimistic, and we try not to be led by short-term trends."

Tether participates in €70 million financing of Italian humanoid robotics company Generative Bionics

ChainCatcher reports, according to The Block, stablecoin issuer Tether, along with AMD Ventures, an Italian state-backed AI fund, and other investors, participated in a €70 million (about $81.48 million) financing round for Generative Bionics, a new spin-off from the Italian Institute of Technology.

This one-year-old company is developing new industrial humanoid robots with "embodied AI" designed to operate in environments built for humans, capable of handling, hauling, and performing repetitive tasks that traditional robotic arms find difficult. CEO Paolo Ardoino said the investment is part of what he describes as a shift to support "digital and physical infrastructure," expanding the company's business beyond stablecoins and reducing reliance on increasingly centralized systems under big tech regulation. Generative Bionics said its first industrial deployments are planned for early 2026, targeting industries including manufacturing, logistics, healthcare, and retail.

Circle obtains financial services license in Abu Dhabi Global Market

ChainCatcher reports, according to the official blog, stablecoin issuer Circle announced that it has obtained a Financial Services Permission (FSP) from the Financial Services Regulatory Authority of Abu Dhabi Global Market, allowing it to operate as a money services provider in the Abu Dhabi International Financial Centre (IFC).

Additionally, Circle appointed Dr. Saeeda Jaffar as Managing Director for Circle Middle East and Africa. Jaffar will leave Visa to join Circle, where she served as Senior Vice President and Group Country Manager for the Gulf Cooperation Council. She will lead Circle's regional strategy, deepen cooperation with financial institutions and enterprises, and drive the adoption of the company's digital dollar and on-chain payment solutions in the UAE and the broader Middle East and Africa markets.

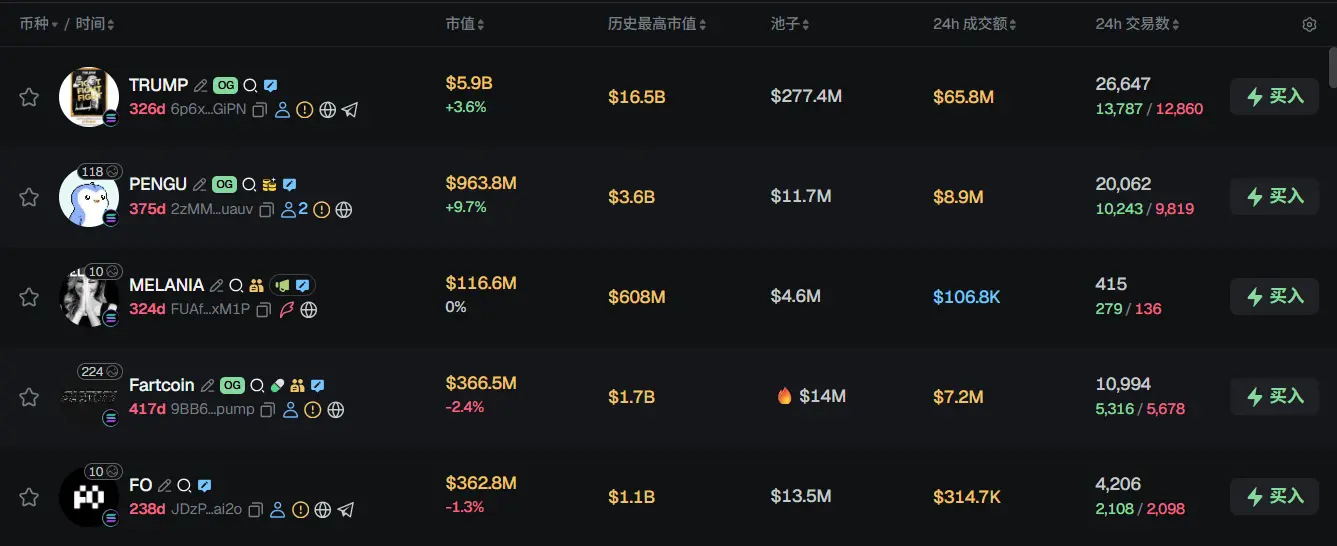

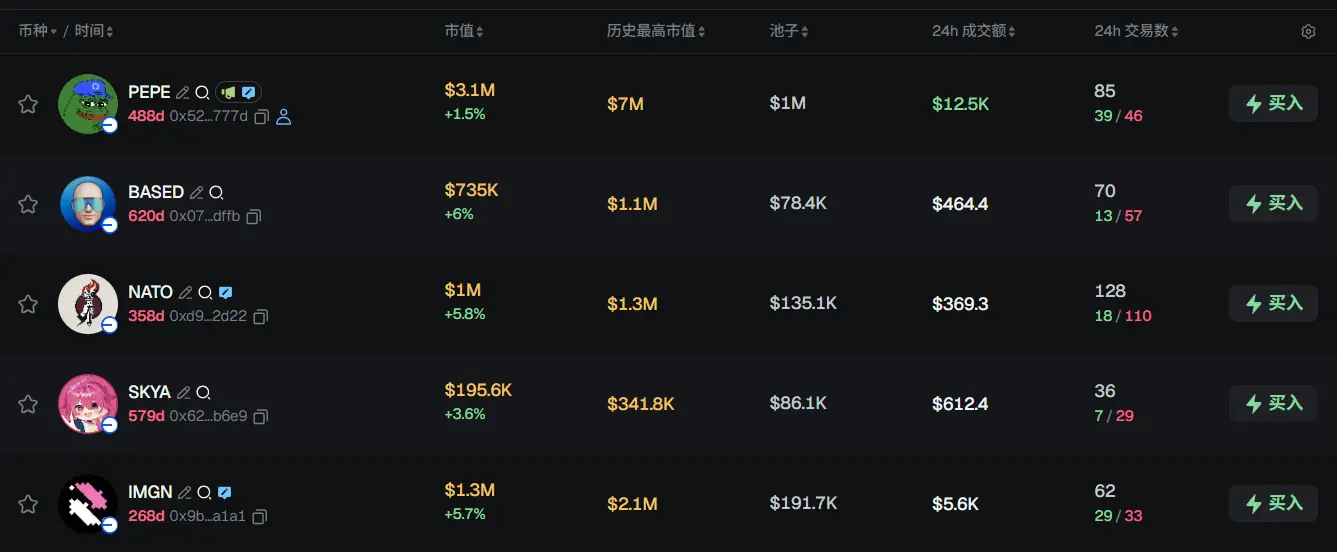

Meme Hot List

According to data from the meme token tracking and analysis platform GMGN, as of December 10, 09:00 (UTC+8),

The top five ETH trending tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five Solana trending tokens in the past 24h are: TRUMP, PENGU, MELANIA, Fartcoin, FO

The top five Base trending tokens in the past 24h are: PEPE, BASED, NATO, SKYA, IMGN

What are some great articles worth reading from the past 24 hours?

Underground Argentina: Jewish money houses, Chinese supermarkets, disillusioned youth, and the impoverished middle class

In Argentina, even the US dollar has lost its power.

Pablo has a unique background. Ten years ago, he was a Huawei employee stationed in Argentina, living in this South American country for two years; ten years later, he returned as a Web3 developer to attend the Devconnect conference.

This decade-spanning perspective made him a witness to a brutal economic experiment.

When he left, 1 US dollar could only be exchanged for a dozen pesos; now, the black market rate in Argentina has soared to 1:1400. According to the simplest business logic, this means if you have US dollars in your pocket, you should have king-like purchasing power in this country.

From "crime cycle" to value return, four major opportunities for the crypto market in 2026

Ansem declared the market top, and CT called this cycle the "crime" cycle.

High FDV (fully diluted valuation) projects with no real applications have squeezed the last penny out of crypto. The bundling and selling of memecoins has made the crypto industry notorious in the public eye.

Worse, almost no funds are being reinvested into the ecosystem.

Web3 unicorn Farcaster, heavily backed by a16z, forced to pivot—Is Web3 social a false proposition?

Farcaster co-founder Dan Romero (dwr) recently announced that the platform will undergo a major strategic adjustment, officially abandoning the "social-first" path it has adhered to for 4.5 years, and instead embracing a "wallet-centric" growth model.

It is reported that Farcaster was initially positioned as a decentralized social network, allowing developers to build novel social networks. It is an open protocol that can support many clients, like email. Users will always be free to move their social identity between apps, and developers will always be free to build apps with new features on the network.

In the early hours of Thursday, the direction of risk assets will not be determined by the rate cut itself

What to watch this week (December 9-12)?The core is the FOMC in the early hours of Thursday. Specifically, look at three things: whether the dot plot changes, especially the median rate expectation for 2026; whether Powell's press conference is dovish or hawkish; and whether there are multiple dissenting votes.

What to watch in mid-to-late December?On December 18, the November CPI will be released. If inflation rebounds, the market may reprice next year's rate cut expectations, and the Fed's "continued easing" narrative will be challenged.

What to watch in Q1 2026?First is the personnel change for the Fed chair. Powell's term ends in May 2026.Second is the continued impact of Trump's policies. If tariff policies are further expanded, inflation expectations may continue to rise, squeezing the Fed's room for easing.Also, keep an eye on whether the labor market deteriorates faster. If layoff data starts to rise, the Fed may be forced to accelerate rate cuts, leading to a different scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Livio from Xinhuo Technology: The value of the Ethereum Fusaka upgrade is underestimated

Weng Xiaoqi: The strategic value brought by Fusaka far exceeds its current market valuation, making it worthwhile for all institutions to reassess the long-term investment value of the Ethereum ecosystem.

Hyperliquid Whale Game: Some Make a Comeback Against the Odds, Others Lose Momentum

The largest IPO in history! SpaceX reportedly seeks to go public next year, aiming to raise over 30 billion and targeting a valuation of 1.5 trillion.

SpaceX is advancing its IPO plan, aiming to raise significantly more than $30 billion, which could make it the largest public offering in history.

DiDi has become a digital banking giant in Latin America

Attempting to directly replicate the "perfect model" used domestically will not work; we can only earn respect by demonstrating our ability to solve real problems.