Zcash price has been one of the most followed tokens after it rebounded from its lows close to $300. The rally was followed by Shielded Labs’ dynamic fee proposal, which has shifted the narrative to a critical post-news phase. Currently, the market participants are looking into whether the ZEC price can hold gains or fade once the reaction cools.

ZEC surged nearly 12% after the proposal, briefly reclaiming levels lost during November’s correction. But with the announcement now widely digested, price action is increasingly being driven by positioning, liquidity, and technical confirmation rather than fresh catalysts.

The market has largely absorbed the initial optimism around the proposed dynamic fee system. This aims to reduce transaction costs and ease congestion. While the proposal is viewed positively, it remains unimplemented, meaning no immediate on-chain changes have occurred.

As a result, traders have begun rotating focus away from the headline itself and toward whether demand can sustain prices above recently reclaimed levels.

- Also Read :

- FOMC Meeting Today [LIVE] Updates

- ,

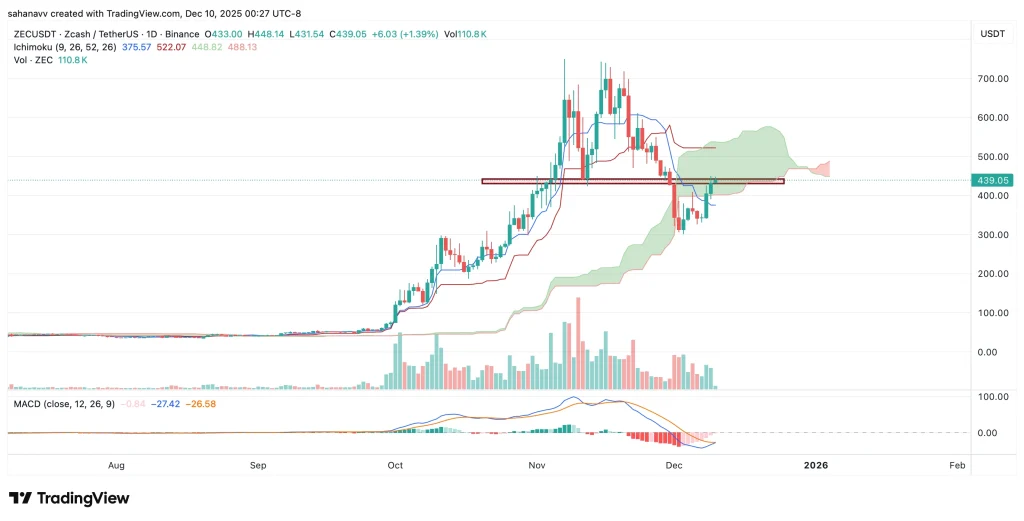

After bouncing from the $330 support zone, the ZEC price has entered a high-risk consolidation range between $435 and $442 — an area associated with prior distribution and short-term liquidation clusters.

- Above $450: Opens upside toward $480, where prior supply remains heavy

- Below $430: Increases risk of long liquidation cascades, with downside toward $400–$380

- Invalidation zone: Sustained loss of $400 would weaken the post-news bullish setup

Until one of these levels breaks decisively, ZEC remains range-bound despite the recent surge. Momentum indicators show stabilization rather than acceleration. Selling pressure has eased, but follow-through remains limited—a common pattern after event-driven moves in low-to-mid liquidity assets like ZEC. Volume has cooled since the post-announcement spike, suggesting traders are waiting for confirmation rather than chasing price. This environment tends to favor mean reversion rather than aggressive trend continuation unless a clear breakout emerges.

A move to $500 is possible for the Zcash (ZEC) price before the end of 2025, largely dependent on post-news follow-through. The recent rally driven by the dynamic fee proposal has already been priced in, shifting the focus to whether buyers can sustain momentum above key resistance levels. A confirmed breakout above $450, followed by strong volume and broader strength in the privacy coin sector, would be required to open a realistic path toward $500.