Money markets point to ECB rate hikes, Polymarket points to unchanged rate policy

Money market traders are pricing in an ECB rate hike in the coming months, ending the period of relatively low rates. On the other hand, Polymarket predictions point to unchanged rates for most of 2026.

The credit landscape in 2026 may include ECB rate hikes and an increased economic outlook for the Euro area, after a period of unchanged interest rates and low inflation.

On the one hand, money market traders are pointing to a potential hike in 2026, as the Euro area economy is showing signs of a faster recovery. On the other hand, traders are pointing to more than a 50% chance that the European Central Bank will increase interest rates after a week of hawkish remarks.

The Euro area inflation remains relatively low, but the period of extremely low rates in Europe may be ending.

Despite the interest rate cuts in 2025 and a dovish Fed, the expectations are that in 2026, quantitative easing may stop, and some central banks may return to rate hikes.

Based on money-market swaps, traders expect 13 basis points of ECB rate hikes by the end of 2026. The market shifted from an expectation for a rate cut last week. At the end of November, ECB Chief Christine Lagarde stated that the current rate level of 2% is correct and reflects the desired effect on Euro Area inflation.

The expectation for rate hikes affected Euro area bond markets, with German 5-year bond yields still rising to 2.49%. The shift reflects ongoing preparation for the end of the rate cut cycles for most major central banks.

Prediction markets see stability for ECB rate

Polymarket traders see no surprises from the ECB, with 99% of the bets on no rate hikes in December, awaiting resolution as the market’s time runs out.

For 2026, Polymarket traders show a different opinion, expecting the ECB to retain its current rates.

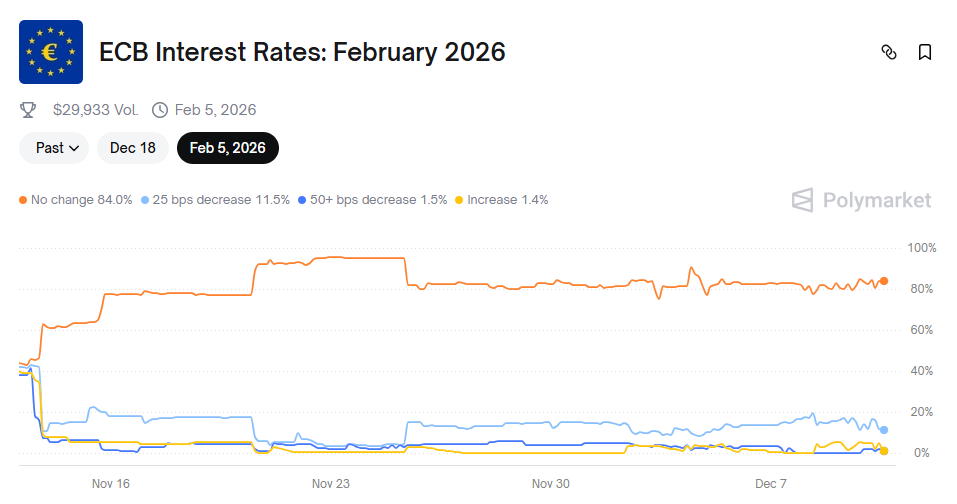

Around 84% of market participants expect no hike from the ECB. The market has a limited volume below $20K, but may become more active as the date of decisions approaches.

The ECB rate market is considered undervalued, but is closely watched for whales positioning and the potential for fast gains in the case of early rate hikes from the ECB. Polymarket is not pricing in rate cuts, and some traders believe this is a likely scenario, though it clashes with the signal from money markets.

ECB rate decision hinges on positive outlook

The European Central Bank may issue a more optimistic outlook for economic growth in the next few days. ECB Chief Lagarde pointed at upgraded predictions from the recently completed projections, and may announce an improved outlook by the end of the year.

The Euro Area has proven more resilient to the US tariffs, said Lagarde during the Financial Times Global Boardroom event. The euro has not depreciated from those measures, leaving little pressure for changing the rates to boost the economy.

A positive outlook may also add another argument for a rate hike before the end of 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo