The key US Banking regulatory body revealed that national banks are allowed to intermediate crypto trades without holding the assets on their balance sheets.

The move will allow traditional financial institutions to offer fully-regulated cryptocurrency brokerage services.

Meanwhile, Solana price prediction sparked hopes of recovery as the coin started surging toward $140 on December 9. Other altcoins are logging solid performance, which extends to presales as well. DeepSnitch AI, for instance, reached $730K, moving the AI project closer to the $1M milestone.

The uptick in investment coincides with DeepSnitch AI deploying three AI agents from its analytics suite ahead of the anticipated January launch, which sparked a multitude of 100x predictions for the DSNT token.

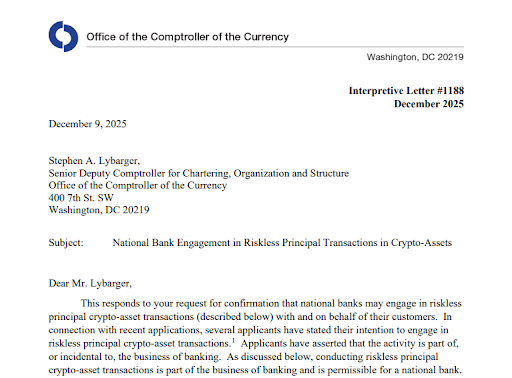

Crypto’s latest regulatory strides

On December 9, the US Office of the Comptroller of the Currency released an interpretive letter that provides banks with the authority to intermediate crypto trades without holding the assets.

Put differently, national banks can act as principals in trade while entering an offsetting trade with another party, similar to how riskless principal activity operates in traditional settings.

As customers will now be able to transact crypto through regulated banks, financial institutions can now fulfill roles as brokerages.

In addition, banks are required to confirm the legal permissibility of crypto transactions, ensuring they are compliant with their chartered powers and must maintain procedures for monitoring market, compliance, and operational risks.

Meanwhile, the crypto market started its long-awaited recovery following weeks of subpar performance. In addition to the Solana price prediction flashing bullish signals, early-stage projects are also bustling with activity, partially due to their upside potential.

Best crypto to buy now

- DeepSnitch AI: Why is December the best time to get DSNT?

DeepSnitch AI uses five AI agents to help users predict FUD storms, sentiment shifts, whale wallet movements, and other actionable analytics.

The team plans to provide early investors with exclusive access to these main functionalities, having recently announced that three agents are fully operational in a central intelligence layer.

DeepSnitch AI is often highlighted as a project with a high upside. Compared to Solana, it’s much more capable of yielding explosive gains in the short term (even if the Solana price prediction goes bullish), especially with smaller investments.

DeepSnitch AI is expected to launch in January. Although not officially confirmed, traders expect the token to list on MEXC ByBit.

- Solana price prediction: Can SOL regain $160?

According to CoinMarketCap , SOL tested the $140 level on December 9.

However, despite SOL investor sentiment improving, the selling pressure is still mounting as analysts point out that SOL needs to reach trading volumes close to $10B to make more confident moves.

To ensure a bullish SOL long-term outlook, Solana will also need to reach $160 , which will reverse the downtrend, followed by a surge toward $200.

Ultimately, the Solana price prediction has its positive sides, but it’s worth pointing out that the Solana ecosystem momentum is slowing down as the meme coin sector continues its decline.

- Ethereum: Is ETH preparing for a historic rally?

Ethereum traded in the $3.3K area on December 9, according to CoinMarketCap .

At face value, ETH was a solid performer in early December. However, Ether supply on CEXs has fallen to the lowest level in a decade, which could boost scarcity and result in a huge rally.

Analysts believe Ethereum could reclaim $5.5K , retracing its all-time high and starting discovery in a massive 60% price move.

Some traders are even more bullish, anticipating a 200% pump toward $10K.

Final words: Ready to surge?

Solana price prediction is leaning bullish, leading many traders to get their wallets ready for a new purchase. While major coins can certainly help double your investment, DeepSnitch AI is gearing up for astronomical growth in 2026.

The popular narrative is 100x, and it’s partially strengthened by the utility, fast development, as well as the favorable position as a mass-appeal AI token.

Prepare for the surge and stay tuned for the latest community news.

FAQs

- Is the Solana price prediction bullish right now?

SOL is showing early strength after testing $140, but it needs a break above $160 to usher in a more substantial trend reversal.

- Why is DeepSnitch AI gaining traction?

The surge in interest followed the activation of three AI agents, boosting confidence and optimism for future performance.

- Will regulated banks supporting crypto trading affect SOL?

Expanded institutional access to crypto could increase liquidity and help boost major assets like Solana.