Will Bitcoin Price Rise or Drop After the Fed’s Third Rate Cut?

Bitcoin price has been hovering around the 90,000 USD mark after the Federal Reserve announced its third consecutive rate cut, lowering the key interest rate to the 3.5–3.75% range. While the move was intended to boost hiring amid a slowing job market, the policy split inside the Fed hints at uncertainty that’s spilling into financial markets—including crypto. Traders are now trying to decide whether this cut sets up a new bullish cycle for Bitcoin or if it signals deeper economic stagnation ahead.

Bitcoin Price Prediction: Is Bitcoin Losing Momentum?

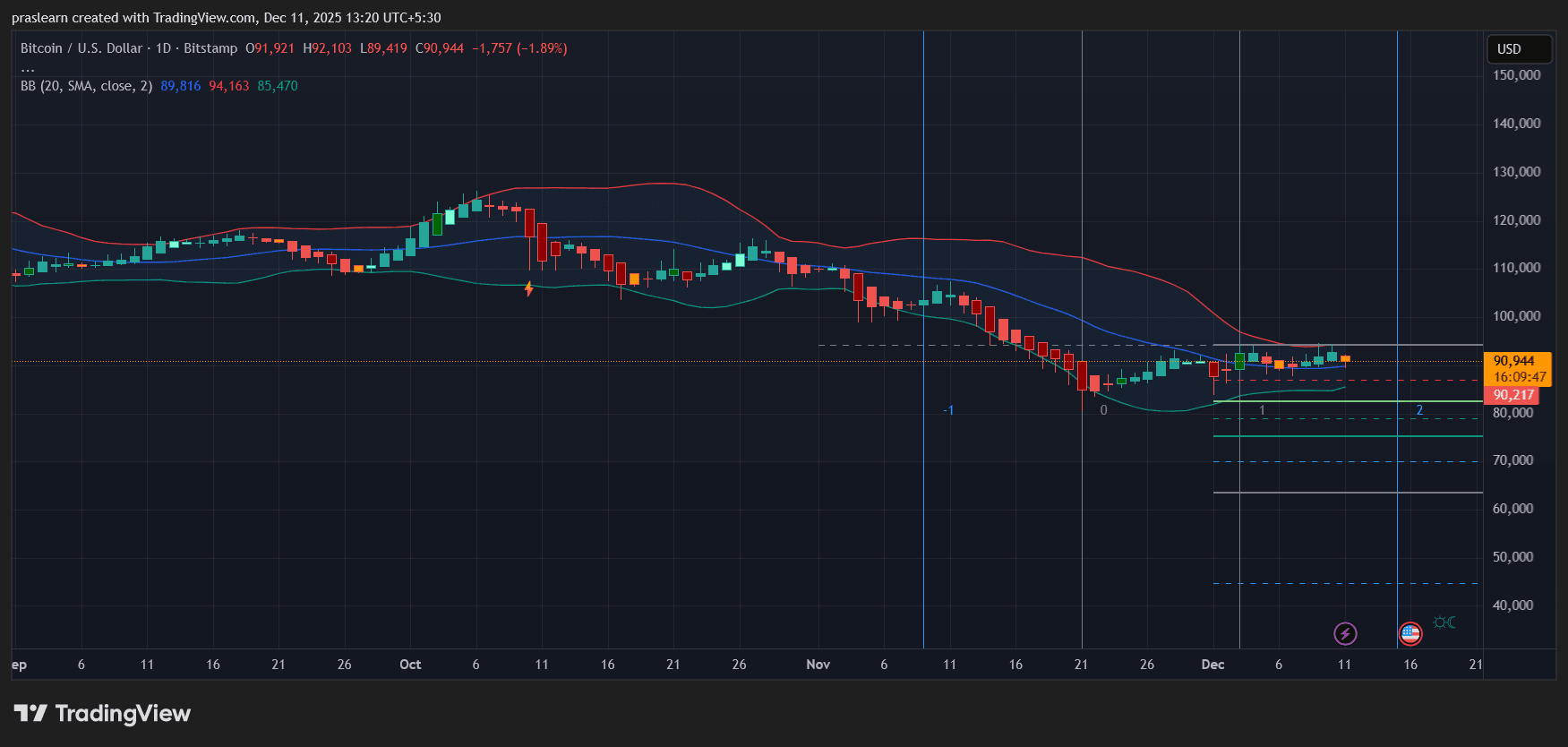

The daily chart shows BTC price trading near 90,944 USD, with the Bollinger Bands starting to tighten—an early sign of a potential volatility breakout. The candles are hovering just below the midline (SMA 20), and price action has repeatedly failed to close above 94,000 USD. This suggests the short-term trend remains mildly bearish unless bulls reclaim the upper band near 94,100 USD.

The 20-day simple moving average is acting as dynamic resistance, and the recent sequence of small-bodied candles shows indecision. Volume has also thinned out, hinting that traders are waiting for macro clarity before committing to new positions.

Fed’s Rate Cut: A Double-Edged Sword for Bitcoin Price Prediction

Typically, lower interest rates weaken the dollar and push investors toward risk assets like Bitcoin price. However, this particular rate cut comes with a warning sign: the Fed is divided, and some policymakers fear “stagflation”—slow growth combined with high inflation. That environment often benefits hard assets in the long term, but in the short run, it can trigger caution in leveraged markets.

If markets interpret this cut as the last one in the cycle, it may dampen speculative appetite and slow down crypto inflows. Bitcoin’s muted reaction so far shows investors are not convinced the easing will translate into sustained liquidity growth.

What the Chart Signals Next

The Bollinger Band base lies around 85,400 USD, forming a critical support zone. A break below that could open the door to 82,000 USD and potentially 78,000 USD if bearish momentum intensifies. On the upside, a daily close above 94,200 USD would mark a bullish breakout from the current compression range, setting up targets near 98,000–100,000 USD.

Momentum indicators suggest mild recovery potential but no strong reversal yet. The structure resembles an accumulation zone—BTC price is building a floor, but the conviction is missing. Historically, similar setups have preceded both sharp rallies and sudden breakdowns, depending on how macro catalysts play out.

Short-Term vs Long-Term Outlook

In the near term, Bitcoin price may remain range-bound between 85,000 and 95,000 USD. Traders should watch for confirmation candles above or below this range to determine the next directional move. Longer term, the macro backdrop—rate cuts, slower growth, and lingering inflation—still supports Bitcoin’s role as a hedge. But without a clear bullish trigger, it might consolidate before attempting any decisive rally toward new highs.

Bitcoin Price Prediction: Consolidation Before a Potential Breakout

If $BTC price manages to hold above 89,500 USD through the week, it could attempt a move back toward 95,000–97,000 USD. Failure to sustain above that level may invite renewed selling, dragging price toward 83,000 USD support. Overall, the structure points to short-term consolidation with a medium-term bullish bias—especially if inflation stabilizes and the Fed hints at more easing early next year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Momentum ETF (MMT) and the Intersection of Retail Hype and Institutional Backing in November 2025

- Momentum ETF (MMT) surged 1,330% in Nov 2025 due to retail frenzy and institutional validation. - Binance airdrop and Sui-based perpetual futures DEX boosted retail demand through liquidity and yield incentives. - $10M HashKey funding and $600M TVL validated MMT's institutional credibility under CLARITY Act/MiCA 2.0 frameworks. - ve(3,3) governance model and token buybacks created flywheel effects, aligning retail/institutional incentives. - Q1 2026 Token Generation Lab aims to expand Sui ecosystem proje

Fed Cuts Rates, Announces $40B T-Bill Program, Crypto Dips

U.S. Marine Policy and Blue Economy Prospects: Key Infrastructure and Geostrategic Roles in Oceanic Commerce

- U.S. oceans policy balances geopolitical strategy, deep-sea tech investments, and UNCLOS ratification challenges to secure maritime influence. - Executive actions accelerate seabed mineral extraction while facing environmental criticism and legal risks from bypassing international seabed authority rules. - Offshore energy partnerships with Australia, Japan, and Saudi Arabia aim to diversify supply chains but face geopolitical tensions in chokepoints like the Red Sea. - Maritime security contracts expand

Aster DEX's On-Chain Momentum: Signaling the Future of DeFi

- Aster DEX reported $27.7B daily volume and $1.399B TVL in Q3 2025, outpacing DeFi benchmarks with 2M users. - Institutional whale activity, including CZ's $2M ASTER purchase, drove $5.7B inflows and 800% volume spikes. - Hybrid AMM-CEX model and ZKP privacy tech enabled 40.2% TVL growth, 77% private transactions, and 19.3% perpetual DEX market share. - ASTER's margin trading upgrades and Stage 4 airdrops fueled 30% price surges, while Aster Chain's 2026 launch will integrate privacy-preserving ZKPs. - On