Did Jane Street Cause Another 10 a.m. Bitcoin Dump Today?

Claims that Jane Street triggers a daily 10 a.m. Bitcoin dump resurfaced on December 12. Futures data, liquidations, and price action tell a more complex story.

Claims that Wall Street trading firm Jane Street triggers a daily 10 a.m. Bitcoin “dump” resurfaced on December 12, after BTC saw a sharp intraday drop.

Social media speculation once again pointed to institutional traders and ETF market makers. A closer look at the data, however, tells a more nuanced story.

What is the “Jane Street 10 a.m.” Narrative?

The theory suggests Bitcoin often sells off around 9:30–10:00 a.m. ET, when US equity markets open. Jane Street is frequently named because it is a major market maker and an authorized participant for US spot Bitcoin ETFs.

The allegation claims these firms push prices lower to trigger liquidations, then buy back cheaper. However, no regulator, exchange, or data source has ever confirmed such coordinated activity.

BREAKING: The 10am manipulation is back.Bitcoin dropped $2,000 in 35 minutes and wiped out $40 billion from its market cap. $132 million worth of longs have been liquidated in the past 60 minutes. This is getting ridiculous.

— Bull Theory (@BullTheoryio) December 12, 2025

Bitcoin Futures Data Doesn’t Show Aggressive Dumping

Bitcoin traded sideways today through the US market open, holding a tight range near $92,000–$93,000. There was no sudden or abnormal sell-off exactly at 10:00 a.m. ET.

The sharp drop came later in the session, closer to mid-day US hours. BTC briefly fell below $90,000 before stabilizing, suggesting delayed pressure rather than an open-driven move.

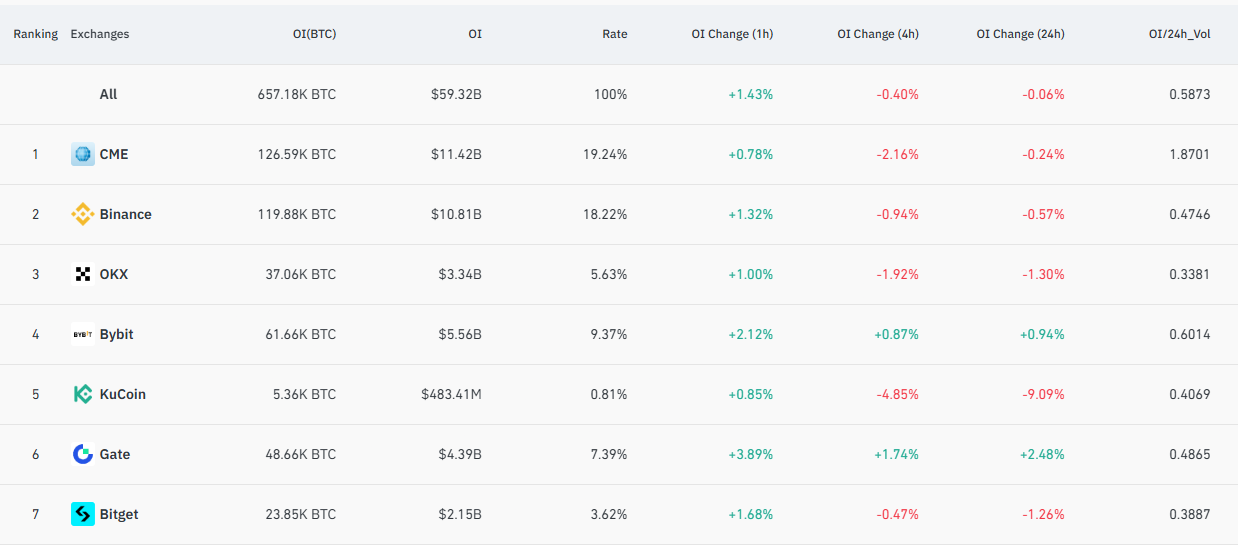

Bitcoin futures open interest across major exchanges remained broadly stable. Total open interest was nearly flat on the day, indicating no large buildup of new short positions.

On CME, the most relevant venue for institutional trading, open interest declined modestly. That pattern typically reflects risk reduction or hedging, not aggressive directional selling.

Total BTC Futures Open Interest. Source:

CoinGlass

Total BTC Futures Open Interest. Source:

CoinGlass

If a major proprietary firm were driving a coordinated dump, a sharp spike or collapse in open interest would normally appear. It did not.

Liquidations Explain the Move

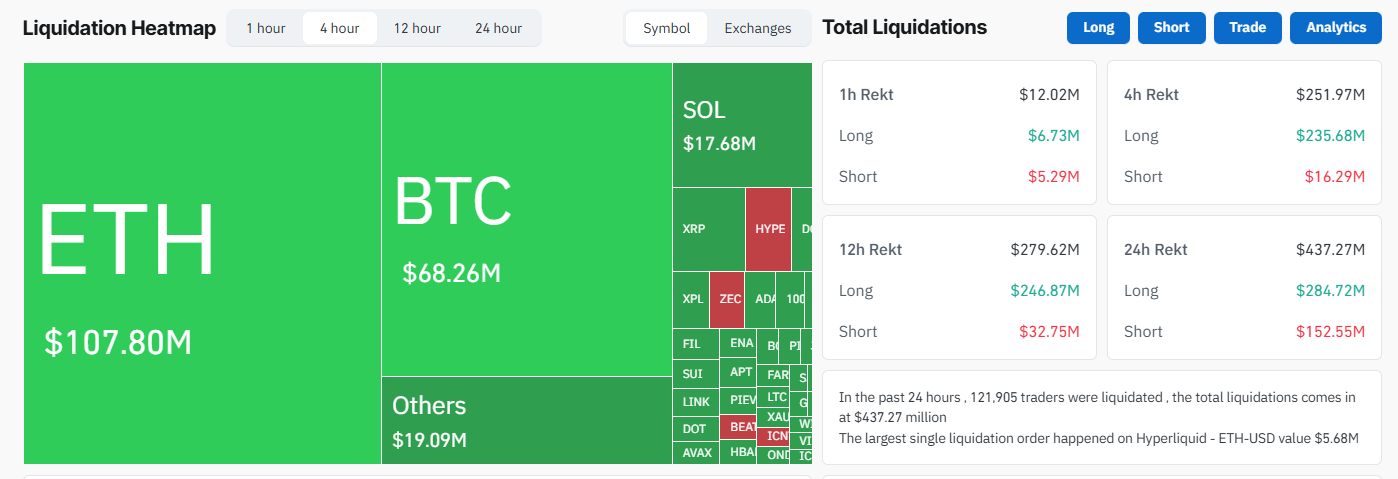

Liquidation data provides a clearer explanation. Over the past 24 hours, total crypto liquidations exceeded $430 million, with long positions accounting for the majority.

Bitcoin alone saw more than $68 million in liquidations, while Ethereum liquidations were even higher. This indicates a leverage flush across the market, not a Bitcoin-specific event.

Crypto Liquidations on December 12. Source:

CoinGlass

Crypto Liquidations on December 12. Source:

CoinGlass

When prices slip below key levels, forced liquidations can accelerate declines. This often creates sharp drops without requiring a single dominant seller.

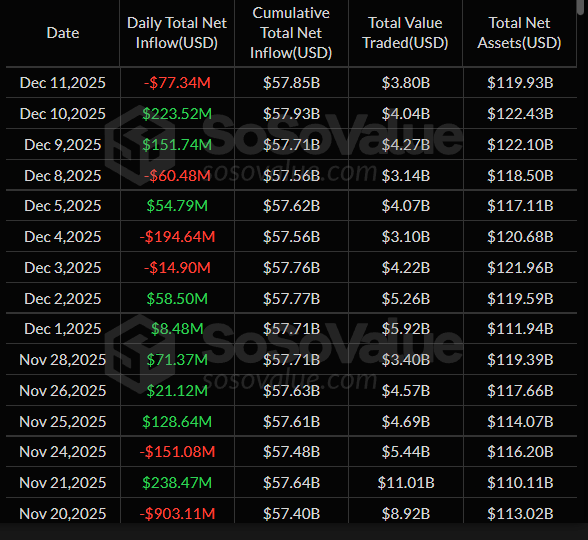

Most notably, US spot Bitcoin ETFs recorded $77 million outflow on December 11, after two days of steady inflow. Today’s brief price shock was largely reflected in this move.

US Bitcoin ETFs Daily Inflow. Source:

SoSoValue

US Bitcoin ETFs Daily Inflow. Source:

SoSoValue

No Single Venue Led the Sell-Off

The move was distributed across exchanges, including Binance, CME, OKX, and Bybit. There was no evidence of selling pressure concentrated on one venue or one instrument.

That matters because coordinated manipulation typically leaves a footprint. This event showed broad, cross-market participation consistent with automated risk unwinds.

Why the Jane Street Narrative Keeps Returning

Bitcoin volatility often clusters around US market hours due to ETF trading, macro data releases, and institutional portfolio adjustments. These structural factors can make price moves appear patterned.

Jane Street Bots already entered Polymarket xDWhile most traders chase narratives, one Polymarket account turned 15-minute crypto prediction windows into a mechanical profit engine.Trader didn't build a sophisticated arbitrage bot.He found something simpler, momentum lag on…

— gemchanger (@gemchange_ltd) December 12, 2025

Jane Street’s visibility in ETF market making makes it an easy target for speculation. But market making involves hedging and inventory management, not directional price attacks.

Today’s move fits a familiar pattern in crypto markets. Leverage builds, price slips, liquidations cascade, and narratives follow.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale exchanged 163 BTC for 4717 ETH via THORChain cross-chain technology.

In the past 24 hours, CEX saw a net outflow of 69,300 ETH.