A major shake-up in U.S. crypto regulation has just arrived. The CFTC has officially withdrawn its 2020 guidance on “actual delivery” of digital assets, a move hailed by insiders as a green light for greater exchange innovation and flexibility.

This decision could reshape how margin trading and custody work in the crypto space, right as the market enters a period of renewed volatility.

Meanwhile, XRP price prediction chatter is heating up as regulatory tailwinds combine with technical resistance. But while XRP inches forward, traders looking for asymmetric upside are eyeing DeepSnitch AI, a token combining real utility with current-stage pricing.

CFTC withdrawal adds fuel to XRP market forecast as regulatory clarity shifts

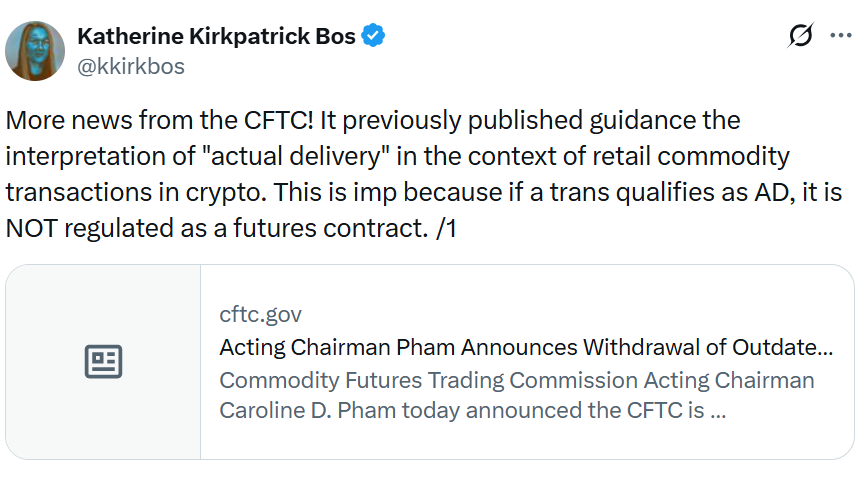

In a move shaking up the regulatory landscape, the U.S. Commodity Futures Trading Commission (CFTC) has withdrawn its 2020 guidance on “actual delivery” of crypto. The rollback, announced by Acting Chairman Caroline Pham, aims to eliminate “outdated and overly complex guidance” that has limited innovation and flexibility in the digital asset space.

Legal experts like Katherine Kirkpatrick Bos from StarkWare welcomed the change, calling it a step forward for exchanges offering leverage or margin products. However, critics such as Todd Phillips from the Roosevelt Institute warned that the lack of replacement guidance leaves regulatory gaps and questions unanswered.

Regardless, it’s a signal that the regulatory doors are being blown wide open. And these are the three coins we think could take the most advantage:

- DeepSnitch AI (DSNT): 80% gains locked in as January 2026 launch approaches

The platform scrapes on-chain data, sentiment, trading signals, and whale movements, then delivers them to users in real time through its AI-powered dashboard. The product is already live, having already released three of its five AI agents, which makes it one of the few early-stage crypto projects offering functional value ahead of launch.

And investors are clearly loving it already. In just stage 3 of funding, DeepSnitch AI has raised over $780,000, with its price of $0.02790 up 80% already from the initial offering.

In the coming sections, we’ll take a look at the XRP price prediction, but first, let’s review Solana:

- Solana: Price holding steady, but upside appears capped

Solana (SOL) is currently trading around $139.63 on December 12th, posting a modest 0.9% gain over the past 7 days and up 6% in 24 hours. Despite these upticks, it remains 52% below its all-time high of $293.31 set in January.

Recent developments include the launch of Wrapped XRP on Solana via Hex Trust and LayerZero, signaling deeper integration into DeFi. In parallel, Solana spot ETFs recorded $11 million in net inflows, bucking the trend of outflows seen in Bitcoin and Ethereum ETFs.

Yet, even with this institutional support, price momentum appears to be stalling. Analysts suggest that until Solana clears the $145 – $150 resistance, it may continue to range sideways.

For traders chasing 10x+ potential, SOL’s $78B market cap makes those kinds of gains far harder to realize compared to smaller, early-stage plays like DeepSnitch AI.

Now let’s take a look at the XRP price prediction:

- XRP price prediction: ETF launch and DeFi push spark mixed outlook

The latest XRP price prediction is caught between bullish catalysts and short-term resistance. XRP is trading at $2.04 as of December 12th, down 2.4% over the past 7 days, despite a 1.3% uptick in 24-hour volume.

Recent catalysts include the launch of the 21Shares XRP ETF and the rollout of wrapp e d XRP (wXRP) on Solana, enabling cross-chain DeFi and RLUSD trading. Together, these events add legitimacy and utility to the XRP price prediction.

That said, XRP technical analysis shows the token struggling to reclaim the $2.17 resistance set earlier in the week. With the price still 44% below its all-time high of $3.65, and with a $123 billion market cap, traders question how much near-term upside in the XRP price prediction remains.

Some forecasts suggest a gradual climb toward $3.00 in 2026, driven by institutional adoption, but others warn that XRP price drivers like SEC-related developments and broader market risk may keep prices volatile.

The XRP market forecast remains cautiously optimistic, but the explosive upside seems more likely to come from smaller-cap projects with early growth potential.

What’s the verdict?

While major tokens like Solana and XRP’s price prediction continue to shape headlines, their upside is increasingly priced in. At a sub-$0.03 entry point, DeepSnitch AI offers something the majors cannot: early-stage asymmetry with real-world product utility already live.

With more than half of its AI agents functional, momentum is building fast.

FAQs

Can XRP reach $100?

While some long-term bulls support the idea, most XRP price predictions agree that reaching $100 would require global-scale XRP adoption and deep institutional integration. With a market cap already over $120 billion, many traders are looking instead at early-stage projects like DeepSnitch AI, which offer stronger upside from a much lower base.

How much will 1 XRP cost in 2030?

Estimates for 2030 range between $5 and $10, depending on factors like XRP market forecast, regulatory clarity, and XRPL expansion. Still, many investors argue that newer tokens with proven utility like DeepSnitch AI could outperform, especially in the short to mid-term.

Is XRP worth buying?

Based on current XRP technical analysis, XRP is showing mixed momentum, down 2% on the week but gaining ETF traction. However, as larger caps slow, traders increasingly favor AI-driven tokens like DeepSnitch AI that combine a low entry price with high-growth narratives.