Prysm Bug Cost Ethereum Validators Over $1 Million After Fusaka Upgrade

While Ethereum’s client diversity prevented broader failure, the episode has renewed concerns about concentration risks among consensus clients.

Ethereum consensus client Prysm said validators missed out on 382 ETH, equivalent to more than $1 million, after a software bug triggered network disruptions shortly after the recent Fusaka upgrade.

The incident, detailed in a post-mortem titled “Fusaka Mainnet Prysm incident,” stemmed from a resource exhaustion event that affected nearly all Prysm nodes and led to missed blocks and attestations.

What Caused Prysm’s Outage?

According to Offchain Labs, the developer behind Prysm, the problem emerged on December 4 when a previously introduced bug caused delays in validator requests.

Those delays resulted in missed blocks and attestations across the network.

“Prysm beacon nodes received attestations from nodes that were possibly out of sync with the network. These attestations referenced a block root from the previous epoch,” the project explained.

The disruption led to 41 missed epochs, with 248 blocks missing out of 1,344 available slots. That represented an 18.5% missed slot rate and pushed overall network participation down to 75% during the incident.

Offchain Labs said the bug responsible for the behavior was introduced and deployed to testnets about a month earlier, before being triggered on mainnet following the Fusaka upgrade.

While a temporary mitigation reduced the immediate impact, Prysm said it has since implemented permanent changes to its attestation validation logic to prevent a recurrence.

Ethereum’s Client Diversity

Meanwhile, the outage has renewed scrutiny around Ethereum’s client concentration and the risks posed by software monocultures.

Offchain Labs said the outage could have had more severe consequences if Prysm had accounted for a larger share of Ethereum’s validator base. The firm pointed to Ethereum’s client diversity as a key factor in preventing a wider network failure.

“A client with more than 1/3rd of the network would have caused a temporary loss in finality and more missed blocks. A bug client with more than 2/3rd could finalize an invalid chain,” it stated.

Despite that mitigation, the incident has intensified calls for greater client diversity.

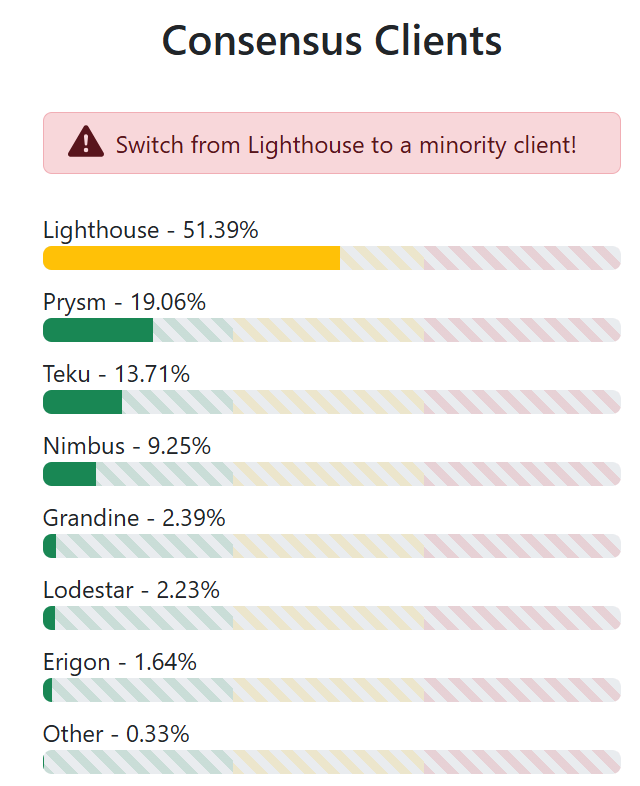

Data from Miga Labs show that Lighthouse remains the dominant Ethereum consensus client, accounting for 51.39% of validators. Prysm represents 19.06%, followed by Teku at 13.71% and Nimbus at 9.25%.

Ethereum’s Consensus Clients. Source:

Clientdiversity

Ethereum’s Consensus Clients. Source:

Clientdiversity

Lighthouse’s share places it roughly 15% points away from a threshold that some researchers view as a systemic risk.

As a result, developers and ecosystem participants have again urged validators to consider switching to alternative clients to reduce the likelihood that a single software flaw could disrupt the blockchain’s core operations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Moonbirds to launch BIRB token in early Q1 2026

Aligning Universities with Emerging Industries: The Critical Need for STEM Investment

- Global industries demand AI, renewable energy, and biotech skills faster than traditional education systems can supply, creating a critical skills gap. - Universities like MIT and Stanford are embedding AI across STEM curricula while industry partnerships accelerate hands-on training in automation and biomanufacturing. - Renewable energy programs with apprenticeships and public-private funding are addressing talent shortages as $386B global investments outpace workforce readiness. - Biotech's fragmented

PENGU Token Value Soars: Blockchain Data and Institutional Interest Indicate Optimal Timing for Investment

- PENGU ranks #81 with $706.5M market cap, showing rising institutional interest and whale accumulation. - The pending Canary PENGU ETF, if approved, could unlock institutional capital by including NFTs in a U.S. ETF. - Mixed on-chain signals (RSI 38.7, OBV growth) and 2B tokens moved from team wallets highlight uncertainty. - Partnerships with Care Bears and Lufthansa, plus Bitso collaboration, expand utility but face regulatory risks. - Recent 8.55% price rebound and 2.6% gain post-BNB listing suggest ca

Evaluating How the COAI Token Scandal Influences Cryptocurrency Regulatory Policies

- COAI Token's 88% price crash and $116.8M loss exposed systemic risks in centralized AI-DeFi projects with opaque governance. - Global regulators responded with stricter frameworks, including EU's MiCA and Singapore's asset freezes, to address jurisdictional gaps. - Institutional investors now prioritize compliance, with 55% of hedge funds allocating to digital assets via tokenized structures in 2025. - Emerging solutions include AI-driven risk platforms and anthropological governance models to enhance tr