Expert: XRP Will Drop to $1.75, Then Rise to $16 By End of January 2026

2025/12/16 12:06

2025/12/16 12:06The XRP market is once again at a psychological crossroads. Price volatility has returned, sentiment is divided, and traders are watching key levels with growing intensity. After months of sharp rallies, corrections, and consolidation, the token is approaching a phase where fear and opportunity tend to overlap. Historically, this is where decisive moves are born.

Against this backdrop, a bold forecast circulating across crypto social media has reignited debate. Crypto Bull, a widely followed technical analyst on X, recently shared a forward-looking XRP outlook that is gaining traction among market participants.

His projection outlines a near-term downside phase before a powerful upside expansion unfolds over the coming year.

#XRP will drop to $1.75, then rise to $16 by end of January, 2026. You read it here first.

— CryptoBull (@CryptoBull2020) December 15, 2025

Short-Term Weakness and Market Structure

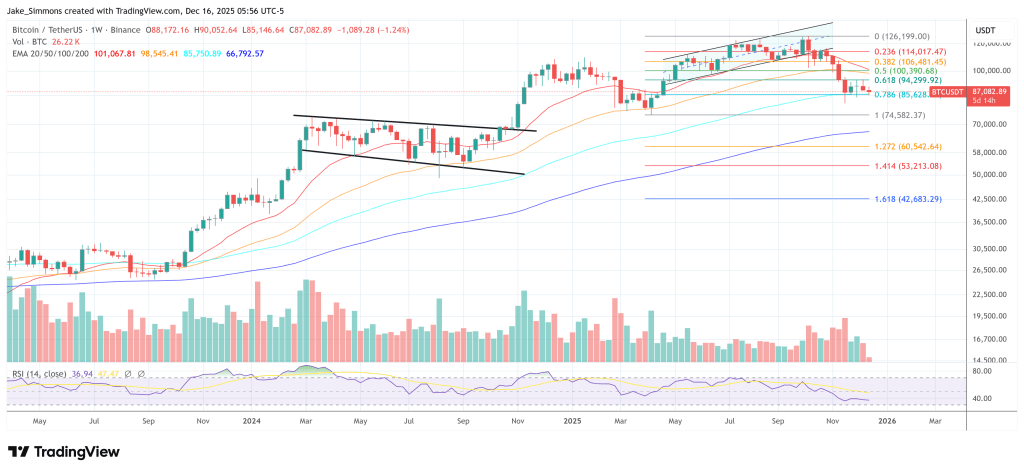

Crypto Bull’s analysis places strong emphasis on market structure rather than emotion. According to his assessment, XRP remains vulnerable to a final corrective move toward the $1.75 region. This level aligns with historically significant liquidity zones and prior consolidation ranges on higher timeframes.

From a technical perspective, such a pullback would not invalidate the broader bullish trend. Instead, it would represent a reset phase designed to remove late leverage and weak hands. Similar corrective moves have occurred in previous XRP cycles before major price expansions followed.

Why a Deep Pullback Could Be Constructive

The projected dip is framed as a structural necessity, not a breakdown. XRP has already experienced rapid appreciation during the current cycle, and sustained rallies rarely occur without deeper retracements. A move to $1.75 would also coincide with key Fibonacci retracement levels monitored by institutional and algorithmic traders.

Market data continues to show strong long-term holding behavior, with large wallets maintaining positions despite volatility. This suggests that downside moves are increasingly viewed as accumulation opportunities rather than exit points.

The Case for a $16 XRP by January 2026

Looking beyond the correction, Crypto Bull’s outlook turns decisively bullish. His longer-term projection targets a potential rise toward $16 by the end of January 2026, contingent on cycle continuation and broader market strength.

We are on X, follow us to connect with us :-

— TimesTabloid (@TimesTabloid1) June 15, 2025

This forecast is supported by historical XRP cycle behavior, where explosive rallies often follow extended consolidation and final shakeouts. It also aligns with expectations of renewed capital inflows into high-liquidity altcoins once Bitcoin dominance peaks.

Fundamental Tailwinds Supporting the Thesis

Beyond technicals, XRP’s fundamentals remain materially stronger than in prior cycles. Ripple’s expanding payment corridors, growing institutional partnerships, and increased clarity following the conclusion of its legal battle with the SEC have reshaped XRP’s market profile.

Additionally, the maturation of on-chain liquidity solutions and stablecoin infrastructure has improved XRP’s utility narrative. These factors provide a stronger foundation for sustained upside if market conditions cooperate.

Final Thoughts

While no price prediction is guaranteed, Crypto Bull’s projection reflects a disciplined, cycle-based approach rather than hype-driven optimism. A temporary drop to $1.75 may test investor conviction, but history shows that XRP’s most aggressive rallies often begin when sentiment is weakest.

As always, market participants are advised to monitor price action closely and separate long-term structure from short-term noise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Yen carry trade unwinding impacts global markets, putting pressure on bitcoin.

Do Kwon’s Sentence: Could a Shorter Prison Term Await in South Korea?