Bitcoin/Gold Ratio Approaching Extremely Low Levels: Is a Rebound Imminent?

The price of Bitcoin relative to gold has dropped to its lowest point in years, a trend that has often marked market bottoms in the past. Meanwhile, tightening monetary policy and cautious investor sentiment are putting pressure on global markets.

Bitcoin-to-Gold Exchange Rate Declines, Gold Continues to Hold Safe-Haven Demand

The Bitcoin/Gold ratio (showing the value of Bitcoin relative to gold) has been declining since mid-2025. As of December 15, the ratio was around 20 XAU, down from about 35-40 XAU during the 2021 bull market.

This represents a drop of about 40% to 45%. Although the decline is significant, the ratio is still higher than the lows of past bear markets, such as 2 in 2015, 5 in 2018, and 10 to 12 in 2022.

Analyst Michaël van de Poppe noted that the relative strength index (RSI) of Bitcoin against gold has fallen below 30.

He stated that the current signal does not guarantee a price reversal. However, he explained that such extreme conditions usually indicate that one asset is priced higher than another.

In this case, the data shows that gold may be overvalued relative to Bitcoin. Therefore, he believes that funds may soon shift towards Bitcoin.

He also highlighted the significant gap between the BTC/GOLD ratio and its 20-week moving average, a situation that has often signaled mean reversion in past cycles.

Z-Score Shows Extreme Levels

Another chart shows that Bitcoin against gold is testing a long-term trendline that has held since 2019. Meanwhile, the Z-score, which measures the distance between the price and its long-term average, has dropped to about -1.7.

Similar levels were also seen in 2019, 2020, and 2022, periods during which Bitcoin strengthened against gold.

Analyst Mister Crypto said the BTC/gold trading pair looks oversold and may rebound based on previous trends.

Many analysts agree that the current weakness appears to be a normal cyclical correction rather than a long-term collapse. Overall, the current situation is similar to adjustments at the end of previous cycles, when Bitcoin also temporarily lagged behind gold before outperforming again.

Macro Catalysts Keep Cryptocurrency Volatility Elevated

Notably, Bitcoin's oversold signals are appearing during a period of active global market trading. Cryptocurrency prices have been influenced by U.S. inflation data, employment reports, and central bank decisions.

Van de Poppe pointed to the Bank of Japan, which is expected to raise interest rates. In the past, such moves have put short-term pressure on risk assets like Bitcoin while boosting gold prices.

In U.S. dollar terms, Bitcoin is currently trading at around $86,172, down 3.7% over the past day and about 10% over the past month. This decline occurred after Bitcoin was blocked near the $90,000 level.

Van de Poppe stated that a return of Bitcoin's price above $88,000 would be a positive signal. If Bitcoin fails to recover to that level, the price may fall to support levels near $83,800 and $80,500.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

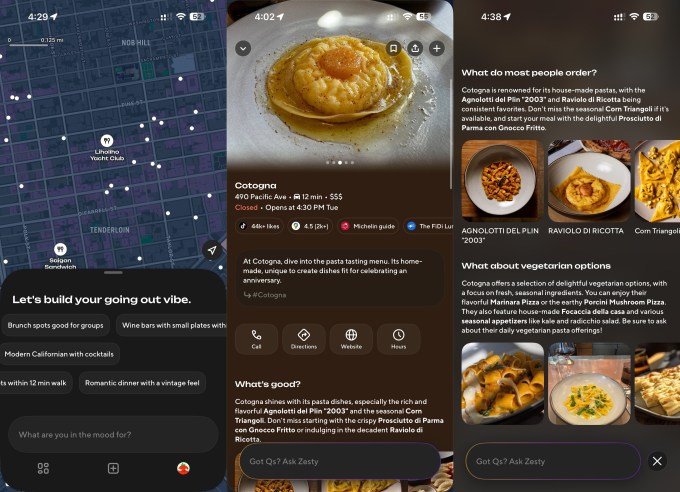

DoorDash rolls out Zesty, an AI social app for discovering new restaurants

Ethereum price plunges below $3,000, liquidations surge, volatility intensifies