Dogecoin (DOGE) exits range-bound trading as selling pressure increases at key price levels

After the latest Federal Reserve rate decision was announced, Dogecoin broke below a key technical level, with surging trading volume confirming that bearish forces are dominating in the short term.

News Background

On Tuesday, Dogecoin fell 5% in response to the Federal Reserve’s 25 basis point rate cut and cautious forward guidance. Although the target rate range was lowered to 3.5% to 3.75%, internal disagreements among policymakers regarding the pace of further easing dampened risk appetite for digital assets.

During the overall pullback, meme tokens underperformed, with Dogecoin (DOGE) facing particularly heavy pressure as traders reduced their positions after consolidating near recent resistance levels. This move appears to be driven more by positioning and macro market sentiment rather than the token’s own fundamentals.

Technical Analysis

Dogecoin (DOGE) decisively broke below the $0.1310 consolidation area, a level that had recently served as short-term support during range-bound trading. Once this level was lost, selling quickly intensified, confirming a complete price breakdown rather than a brief liquidity flush.

During the decline, trading volume soared to 769.4 million tokens, far above recent averages, confirming that the drop was due to active selling rather than a drift caused by lack of liquidity. After forming a lower high near $0.1324, the price retreated further, reinforcing the intraday bearish structure.

Structurally, the drop below $0.1310 has put Dogecoin back into a corrective phase. Unless this level is convincingly reclaimed, any rebound may face selling pressure.

Price Action Overview

Dogecoin (DOGE) stabilized after falling from $0.1315 to an intraday low near $0.1266. Buyers entered at lower levels, pushing the price to a modest rebound near $0.1291, where it ultimately closed.

However, the rebound was accompanied by weakening volume, and the price remained below key moving averages. Overnight trading showed continued pressure, with Dogecoin (DOGE) slipping from $0.1320 to $0.1314 in stable but controlled trading, indicating that sellers remained active during the rebound.

What Traders Should Know

Currently, the $0.1310 to $0.1315 area constitutes immediate resistance. As long as Dogecoin’s price remains below this area, any upward movement is merely a retracement rather than a trend confirmation.

On the downside, $0.1290 is the first key level to watch. If this level is breached, the $0.1266 support area may reopen. Conversely, if $0.1290 holds, Dogecoin (DOGE) may consolidate before the next move.

Volume trends remain crucial. Sustained high volume during declines will confirm further distribution, while declining volume near support levels would indicate that selling pressure is beginning to ease.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

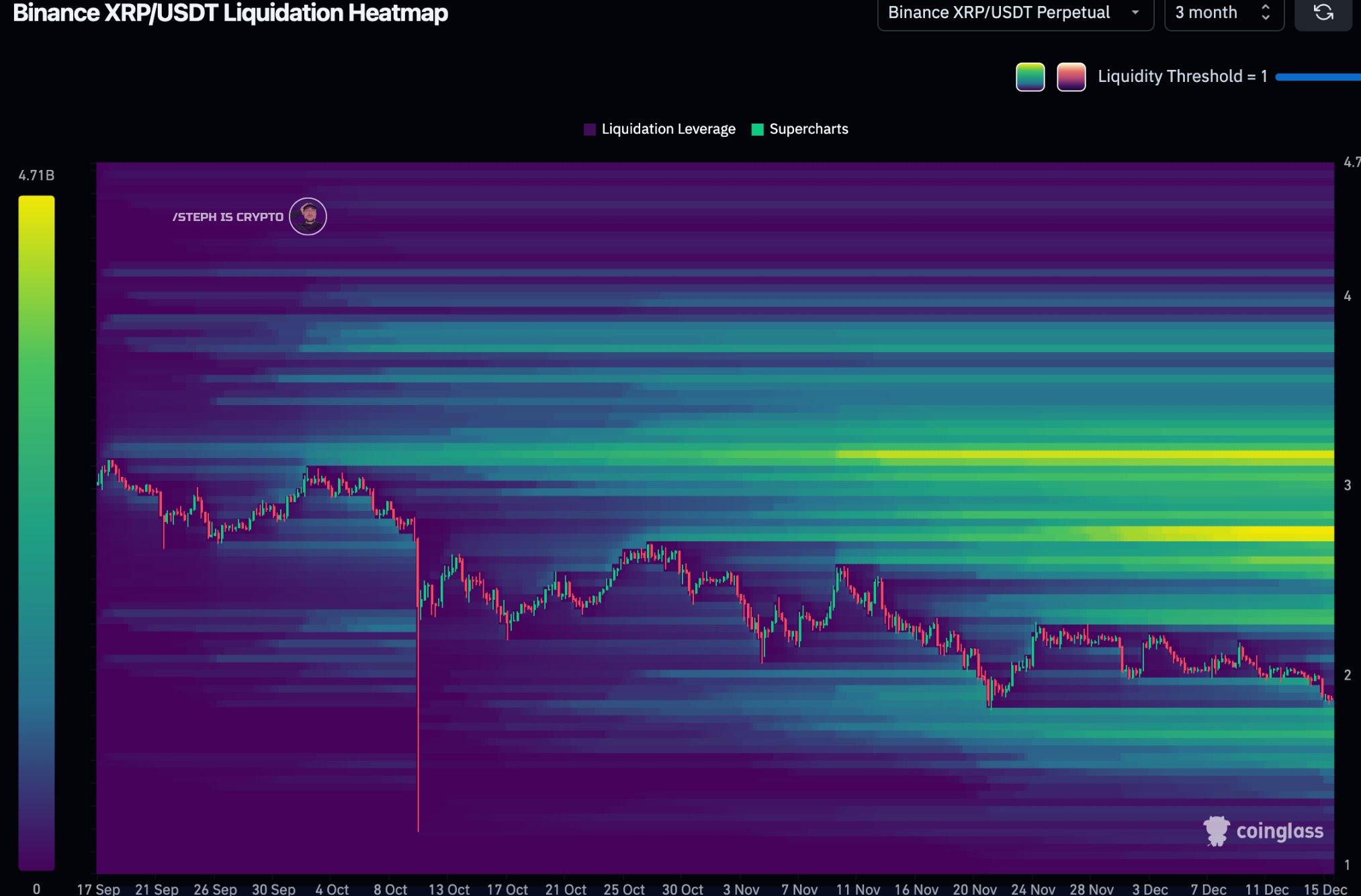

December 17 XRP Price Prediction: Can XRP Find a Bottom and Reach $3?

Strategic Shift: Norway’s $1.6 Trillion Fund Boldly Backs Metaplanet’s Bitcoin Strategy

Opinion Labs Stuns Market: Hits $6.4B Trading Volume in Just 50 Days

Aave founder charts 'master plan' to trillion-dollar scale as DAO tensions mount, SEC ends 4-year probe