The US Securities and Exchange Commission sues Island Horse Capital founder Gao Yida, accusing him of investor fraud.

Detailed Explanation of the Island Capital Scandal: SEC Lawsuit, Settlement, and Subsequent Impact

Highlights

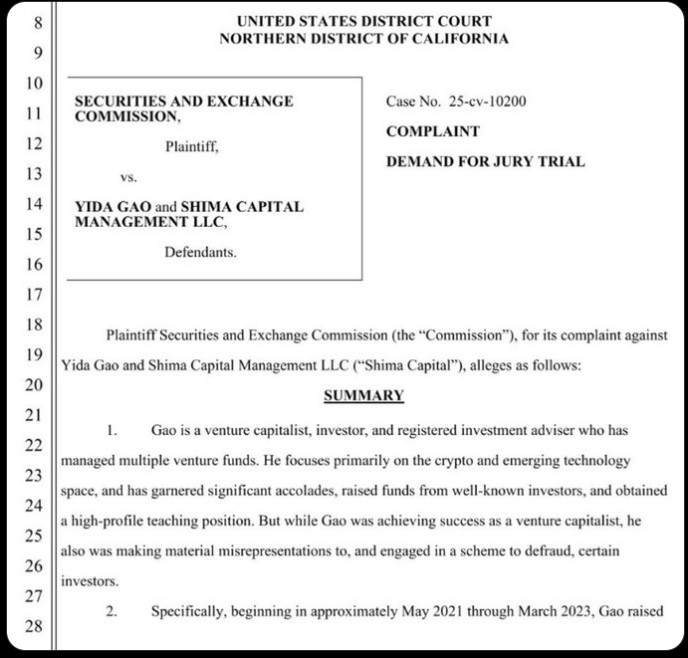

The U.S. Securities and Exchange Commission has filed a lawsuit against Island Capital founder Yida Gao, accusing him of defrauding investors.

Gao has resigned and announced an orderly liquidation of Island Capital's funds.

This case highlights the increasing regulatory pressure faced by crypto venture capital firms.

Key News: SEC Sues Island Capital Founder Yida Gao

The SEC accuses Island Capital founder Yida Gao of deceiving investors by exaggerating investment returns while raising funds for his crypto fund. The complaint states that Gao raised over $158 million by providing false performance reports in investor pitch materials.

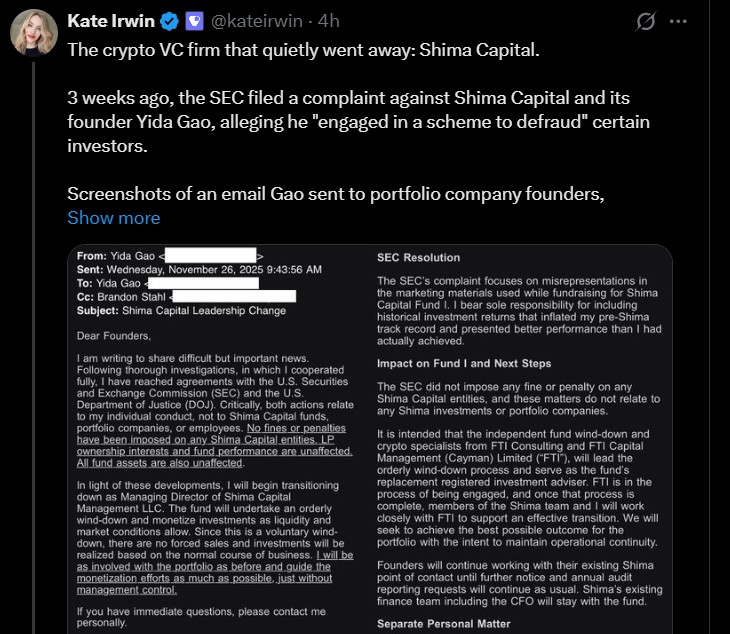

Shortly after the case was filed, the founder admitted to the lawsuit, resigned as fund manager, and announced the closure of the fund. An internal email sent to portfolio companies confirmed his resignation and expressed regret for his actions.

Source: Kate Owen Official X

What is Island Capital?

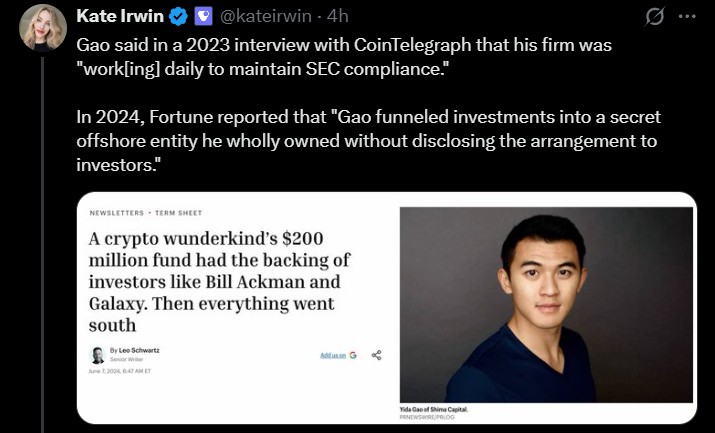

This is a venture capital firm focused on the crypto sector, founded by Yida Gao in 2021. The company manages nearly $200 million in assets and has invested in several high-profile blockchain and Web3 projects, such as Berachain, Monad, Pudgy Penguins, Sleepagotchi, and Gunzilla.

Why did the SEC charge Yida Gao?

The SEC claims that Yida exaggerated the performance of his past investments in marketing materials, thereby deceiving investors.

The regulator also pointed out that one of the early crypto investments was allegedly reported to have a 90x return, while the actual return was about 2.8x. Reportedly, these claims were used to attract investors and raise significant capital for Island Capital's first fund.

Additionally, the SEC stated that Gao failed to disclose personal gains obtained through investments related to BitClout.

The regulator claims that Gao profited about $1.9 million from a privately operated offshore company but did not inform fund investors of this. The SEC stated that these actions violated federal anti-fraud laws and undermined investor confidence.

Source: X

What happened after the lawsuit?

The SEC officially filed the lawsuit on November 25, 2025. The next day, Yida admitted to the case and expressed willingness to pay compensation, but did not contest the charges. As part of the settlement agreement, she agreed to pay about $4 million in ill-gotten gains and interest, and accepted a permanent injunction, including restrictions on serving as an executive or director of a company.

Notably, the SEC did not impose penalties on the Island Capital fund itself. Investors' assets were not frozen, and the company stated that its portfolio companies would not be directly affected. However, the fund is currently undergoing voluntary liquidation under the supervision of a third-party advisor.

What did Yida Gao say to portfolio companies?

In an internal letter sent to the founders of projects funded by Island Capital on November 26, 2025, Yida announced his resignation and the commencement of an orderly liquidation of the fund.

He admitted his mistakes, called them poor decisions, and expressed remorse for letting down founders and investors. He insisted that the liquidation process would be conducted professionally to properly care for portfolio companies and ensure responsible handling of assets.

Source: X

Why is it important to understand this case?

This crypto scam demonstrates that the SEC is increasing its scrutiny of crypto venture capital firms, not just exchanges or token issuers. It strongly indicates that even well-known, reputable investors in the industry will face severe punishment for false performance statements and undisclosed conflicts of interest.

Conclusion

This case warns crypto investors and fund managers that transparency, integrity, and compliance are crucial, as regulation cannot exist without these principles. The crypto market will only become more stringent.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

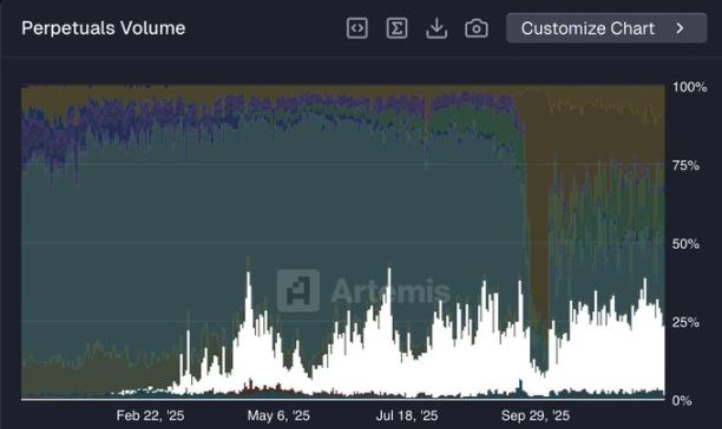

With its market share plummeting by 60%, can Hyperliquid make a comeback?

Russia Rules Out Bitcoin Payments "Under Any Circumstances"