Odaily Editorial Tea Talk (December 17)

This is an "unofficial" column from the Odaily editorial team. Here, the authors share their immediate thoughts and different perspectives on industry news, data, hot events, and their nuances; they elaborate on investment ideas and opportunity hypotheses that are still being tested—they may not be direct wealth codes, and could simply be questions themselves; they share observations gained from exchanges with industry practitioners; as well as materials that have genuinely enhanced our understanding, whether from internal or external sources.

The content of this column is based on the real investment and observation experiences of Odaily editorial team members and does not accept any form of commercial advertising. Its purpose is merely to broaden perspectives and supplement information sources, not to create consensus.

Asher (X: @Asher_0210)

Introduction: Mainly focuses on interaction + financial management, occasionally buys Meme coins (rarely sells after buying), not good at contracts but likes to participate

Content: Yesterday, the crypto fear index dropped to 11. I still believe there will be a rebound, so I have started bottom-fishing SOL, ADA, ENA (also opened small contract positions). For PIPPIN and BEAT, I simply feel they have risen too much, so I opened short positions on both this morning (will share profits next time).

For those who play contracts, I recommend using top on-chain contract platforms to trade and farm for token airdrops. Among them, Lighter is already in Coinbase’s listing plan, and now is the last stage to earn points; StandX has launched mainnet trading and can also be farmed; Aster S4 season is ongoing.

My main recent operations are still interacting with early hot projects. Last week, I wrote a summary and reflection on farming in 2025.

Wenser (X: @wenser2010)

Introduction: Tea-serving junior, crypto bystander, media observer

Sharing:

- Macro: US stocks hit new highs, but crypto concept stocks hit new lows this year. The contrast between hot and cold presents more asymmetric opportunities. Crypto natives should use stock tokenization trading platforms to profit from the stock market in reverse. Altcoins in the circle will continue to bleed, but Meme stocks like Gamestop may see a new wave of speculation.

- Investment reference: Cathie Wood’s Ark Fund is still bottom-fishing, including Coinbase, Circle, and Bitmine. Personally, I think there are still rebound opportunities.

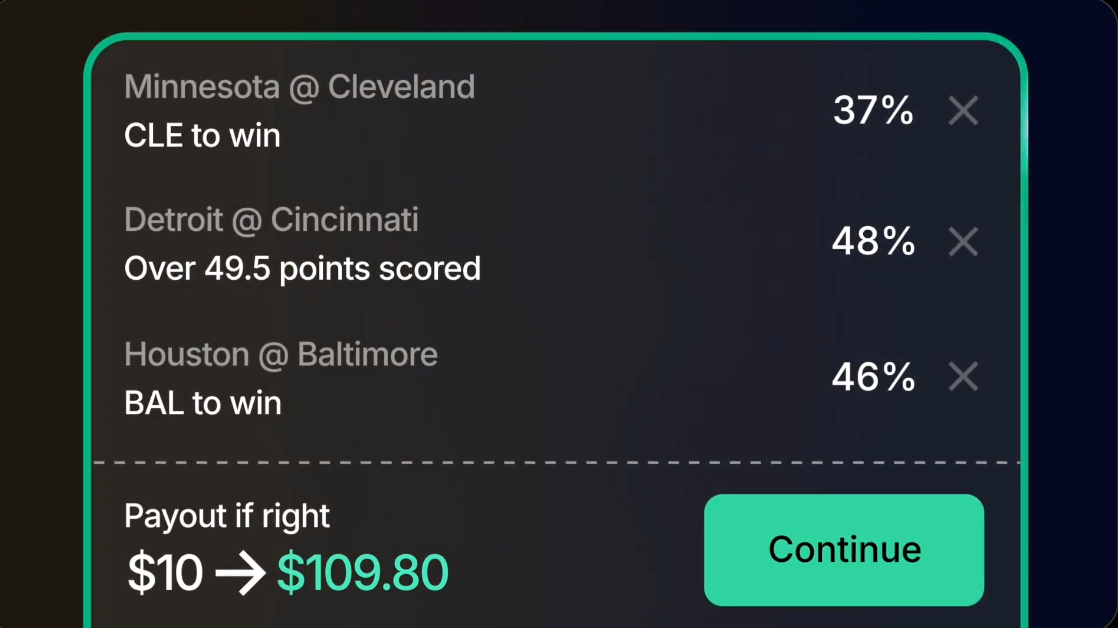

- Prediction market: Kalshi launched the Combo feature. I think this is an important milestone for prediction markets to grow independently as an emerging track outside of the crypto-native field. This also means: (1) Prediction markets support automated combination operations; (2) Prediction markets and traditional financial market derivatives are becoming more closely integrated. In 5 to 8 years (or even sooner), it will quickly grow into a trillion-dollar track. Most importantly, the development of prediction markets and platform updates are themselves events to bet on, so the two have reached a kind of "self-referential state." "Predicting prediction market platforms" may become a separate section. In a way, everything can be predicted and everyone can be a product manager here, which is worth looking forward to. After all, behind every bet is the prize provided by the counterparty.

- New product: "Life K-line" was originally a test product made by @0xsakura666 in the circle. After receiving good feedback, it became a systematic project. Many people reported that the AI fortune-telling results were very close to their reality. I think this is also a big trend, especially after AI is combined with stablecoins, the x402 protocol, and EIP 8004. Stablecoin payments are very promising next year. Circle is still worth betting on, just like Coinbase back then (the two are already closely linked).

Finally, I recommend a biographical article about an asset manager and their past with economic cycles.

Nanzhi (X: @Assassin_Malvo)

Introduction: A Meme diamond hand recovering from a heavy blow, starting over

Content: 1. Fully researching Polymarket copy trading, also farming Opinion part-time. 2. Prediction markets are increasing, already beyond the scope of what I can track. After talking with a major company, I learned that aggregation markets and full data platforms for prediction markets are on the way (Polymarket’s official platform is too poor). 3. Created a Human VS AI project, featuring selected copy traders by Nanzhi vs. the latest AI model, coming soon.

Dingdang (X: @XiaMiPP)

Introduction: Pure "retail investor"

Content: Personally, I have always preferred to go long on BTC, ETH or some quality altcoins. Recently, apart from buying ZEC, I haven’t dared to touch other altcoins. Bitcoin is also extremely volatile—the harder I try, the more I lose.

I always feel that the current trend is a bit like the retracement phase at the top of the 2021 bull market. If it really repeats, then now might be the early stage of a bear market. On the other hand, we are entering an interest rate cut cycle, and there doesn’t seem to be a macro basis for a deep bear. Moreover, major DAT companies have recently been buying up crypto assets aggressively. Do they know some major positive news that we don’t yet know or haven’t seen? In short, this market is too hard to play right now. I’ll just hold onto my chips and stay honest.

Ethan (X: @ethanzhang_web3)

Introduction: Casual talk

Content: The only major event last week was probably Fed Chair Powell announcing a rate cut. I wrote about the market: the core view from institutions is that short-term market activity is declining, and there may be a sustained "slow drop" by the end of the year. The momentum for a bull market restart is limited. Whether rate cuts will continue in the long term depends on weak wage growth or employment data. If the data remains poor, rate cuts may become more aggressive, but for now, it’s best not to blindly bottom-fish.

Recently, I chatted with people in the industry and heard some rumors: due to this year’s tightening policies, many agents in Shenzhen who previously provided operational support for exchanges will most likely all relocate overseas by the end of the year. Take it as a fun tidbit—no way to verify it.

golem (X: @web3_golem):

Introduction: golem’s wild ideas

Content: Last week, the news that sei announced pre-installing its app on overseas Xiaomi phones also attracted significant attention. But after making the statement, sei got cold feet, issued a clarification, and contacted major Chinese media to delete related news. We then discussed internally at Odaily that, in fact, exchanges are the ones who should most cooperate with phone manufacturers to pre-install crypto apps.

So, I asked a few exchange insiders. According to sources, Binance actually cooperated with overseas Xiaomi before sei, but due to Xiaomi’s restrictions, it only exists in certain markets and isn’t really something worth marketing. Also, this kind of pre-installation doesn’t mean the app is automatically downloaded at startup, but rather a guide page pops up, giving users full choice—similar to a push installation. You can imagine how effective that is.

However, everyone’s lively attitude toward pre-installation also shows that growth is still the biggest problem for Web3. If a project can break out of the circle, regardless of whether it’s directly related to them, people will get excited about it.

Moni (X: @mich73692)

Introduction: Doesn’t trade altcoins, only watches Bitcoin

Content: The market trend over the past week has made me even more convinced of one thing: the crypto market is systematically bidding farewell to the "Christmas rally" narrative of collective price surges based on time nodes.

Previously, it was believed that there would be a drop in November, then a rebound in December, especially a sharp rise 1-2 weeks before Christmas, because many US-listed companies have added Bitcoin to their treasuries. Behind these listed companies is Wall Street, and considering human nature, Wall Street would definitely want to gamble for year-end bonuses. But reality quickly "slapped me in the face"—even though Strategy announced buying over 20,000 Bitcoins in the past two weeks, it still couldn’t reverse the price slump. Previous predictions by many Wall Street banks about Bitcoin’s price are basically unreliable and feel like they’re tricking retail investors in, such as JPMorgan predicting Bitcoin at $170,000, Bernstein at $200,000, and Standard Chartered at $100,000.

Another thing to watch is the yen rate hike on Friday. As a carry trade currency, if the yen is raised, investors who previously borrowed yen at zero interest to buy other interest-bearing currencies (like the US dollar) and risk assets (like gold, Bitcoin) may panic. If rates go up, repayment costs increase, and investors may choose to sell risk assets, causing Bitcoin prices to fall further.

Among altcoins, SOL had a lot of positive news in the past week (possibly due to the Breakpoint conference), such as Visa opening USDC settlement services to US banks via Solana, Invesco and Galaxy launching a staking Solana ETP, and Charles Schwab announcing support for Solana and Micro Solana futures products. But due to the overall poor market performance, SOL’s price hasn’t made much of a breakthrough.

Suzz (X: @uu01194636)

Introduction: Adheres to long-termism, shorts air coins

Content: There are too many projects in the crypto market, with mixed quality. My core observation is: a considerable portion of new projects are actually aiming to dump tokens rather than build long-term. This is an inherent risk under irrational market prosperity, and also my opportunity. My idea is to short these overvalued "dump projects" that are destined to retrace, turning risk into profit. The difficulty of shorting lies in the extreme volatility of crypto—one must not get squeezed or liquidated by a temporary rebound.

Currently, I am exploring how to capture downside profits while using strict risk control to avoid being liquidated by short-term noise or extreme rebounds. I am studying a set of entry and stop-loss mechanisms that do not rely on high leverage, can tolerate some volatility, and have a high fault tolerance. I am trying to build an evaluation system to accurately identify those "born to dump" projects from tokenomics, unlock cycles, and capital flows.

Bcxiongdi (X: @bcxiongdi)

Introduction: Mainly plays on-chain PVP

Content: On-chain liquidity is dropping rapidly, and PVP now means fighting for scraps with smarter and more diligent people. At times like this, holding back is the best choice for most people, otherwise it’s easy to become the exit liquidity for the previous tier. The worse the market, the more you struggle, the more unfortunate you become. If you know you’re not a diamond hand, just wait for the market to improve before going back to PVP.

Long-term, I am optimistic about the Meme sector. When liquidity is good, there are still great opportunities to make money, and it won’t die out completely like other sectors. You can observe the operations of top earners who are still making money, copy them first, then gradually form your own style. It’s best to watch more and act less.

Azuma (X: @azuma_eth)

Introduction: Newbie, learning more

Content: Sharing some content I’ve been following recently and think is good:

1. "Go long on the application layer, short the infrastructure"

Major VCs are releasing year-end reports or forecasts for the coming year. Delphi Digital and Moonrock Capital, among others, have put forward the logic of "going long on the application layer, shorting the infrastructure"—"Layer1 valuation premiums are disappearing, and the market’s demand for homogeneous infrastructure is weakening"; "Value will belong to applications that aggregate users on a large scale"; "The ultimate winners will not be those who build the deepest infrastructure, but those who control user identity, user traffic, capital flow, and daily interaction interfaces."

5. Some good general AI content.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.