Date: Thu, Dec 18, 2025 | 09:55 AM GMT

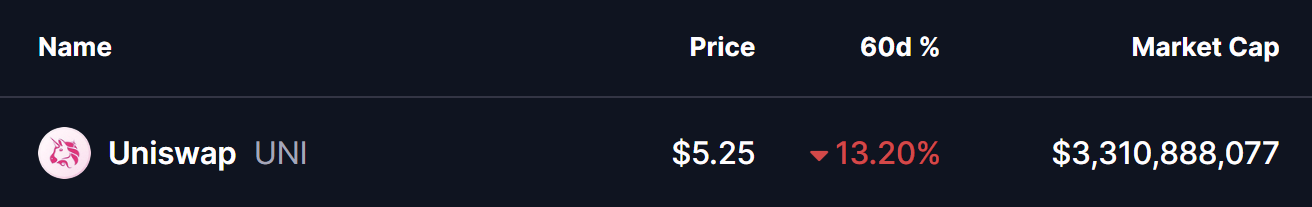

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum (ETH) down by nearly 22% over the last 60 days, keeping sustained pressure on major altcoins, including the DeFi heavyweight Uniswap (UNI).

UNI has slipped more than 13% over the same period. However, despite the ongoing weakness, the chart is starting to show early signs that downside momentum may be fading, with price now sitting at a technically important area that has historically attracted buyers.

Source: Coinmarketcap

Source: Coinmarketcap

Double Bottom Pattern in Focus

On the daily timeframe, UNI appears to be carving out a potential double-bottom formation — a classic reversal pattern that often emerges when sellers begin to lose control. The structure began to take shape after UNI failed to hold above the $12.28 resistance zone in mid-August, a rejection that triggered a steep decline of nearly 61%.

That sell-off dragged UNI back into the $4.55–$5.41 support band, a region that has repeatedly acted as a strong demand zone in the past. The chart now shows price revisiting this same area and stabilizing once again, suggesting that buyers are stepping in to defend it.

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

If this support continues to hold, the current consolidation could mark the second bottom of the pattern — a critical step toward a potential trend reversal.

What’s Next for UNI?

The $4.55–$5.41 zone remains the most important level to watch in the near term. As long as UNI holds above this area, the bullish structure stays intact and allows room for momentum to gradually rebuild.

On the upside, the first major hurdle sits at the 200-day moving average near $7.37. This level has consistently capped recovery attempts during the recent downtrend and now represents the first real test for bulls. A sustained move above it would signal improving market structure and open the door for a broader recovery.

Beyond that, the $12.28 neckline remains the ultimate confirmation level. A decisive breakout above this resistance would complete the double-bottom pattern and significantly strengthen the bullish case, potentially shifting the medium-term trend back in favor of buyers.

Risk Still Remains

Despite the improving structure, risks cannot be ignored. A daily close below the $4.55 support would invalidate the double-bottom setup and expose UNI to further downside, delaying any meaningful recovery attempt.

For now, repeated defenses of the same demand zone suggest that selling pressure is weakening. While confirmation is still needed, UNI appears to be approaching a critical inflection point, with the next few sessions likely to determine whether this setup evolves into a sustained rebound or another leg lower.