In a move that signals growing institutional confidence, asset manager Bitwise has officially filed with the SEC for a spot SUI ETF. This pivotal development could bridge the gap between traditional finance and the innovative Sui blockchain, offering investors a regulated pathway to exposure. Let’s unpack what this filing means and why it matters for the future of digital assets.

What Exactly is Bitwise Proposing with This SUI ETF?

Bitwise submitted an S-1 registration statement to the U.S. Securities and Exchange Commission (SEC). This document is the first formal step in creating a new exchange-traded fund. Therefore, a spot SUI ETF would hold the underlying SUI token directly. Investors could then buy and sell shares of this fund on traditional stock exchanges, much like they would with a stock.

This structure offers a familiar and convenient wrapper for those hesitant to navigate cryptocurrency exchanges and wallets. Moreover, it provides the security and regulatory oversight of the traditional financial system. The filing itself is a declaration of intent, kicking off a review process where the SEC will evaluate the proposal.

Why is a SUI ETF Such a Big Deal for Investors?

The potential approval of a SUI ETF represents a significant maturation for the Sui ecosystem. For everyday investors, the benefits are clear:

- Accessibility: Buy through your existing brokerage account without managing private keys.

- Regulatory Clarity: Investment occurs within a well-defined SEC-regulated framework.

- Institutional Validation: Bitwise’s filing acts as a major vote of confidence in Sui’s long-term viability.

However, challenges remain. The SEC has historically been cautious about approving spot crypto ETFs for assets beyond Bitcoin and Ethereum. The regulator will scrutinize Sui’s market structure, liquidity, and potential susceptibility to manipulation before granting approval.

How Does This Fit into the Larger Crypto ETF Landscape?

Bitwise is not a newcomer to this space. The firm is a seasoned player in crypto index funds and was among the issuers of the landmark spot Bitcoin ETFs. Their move to file for a SUI ETF indicates a strategic expansion into what they perceive as high-potential layer-1 blockchains.

This filing could trigger a domino effect. If successful, it may pave the way for ETFs tied to other smart contract platforms. Consequently, it accelerates the trend of bringing decentralized finance (DeFi) and Web3 assets into the mainstream investment portfolio. The race for the next approved crypto ETF is officially heating up.

What Are the Actionable Insights for Crypto Enthusiasts?

While the filing is exciting, it’s crucial to maintain perspective. The SEC review process can be lengthy and uncertain. Here’s what to watch for next:

- SEC Commentary: Look for public statements or questions from the SEC regarding the filing.

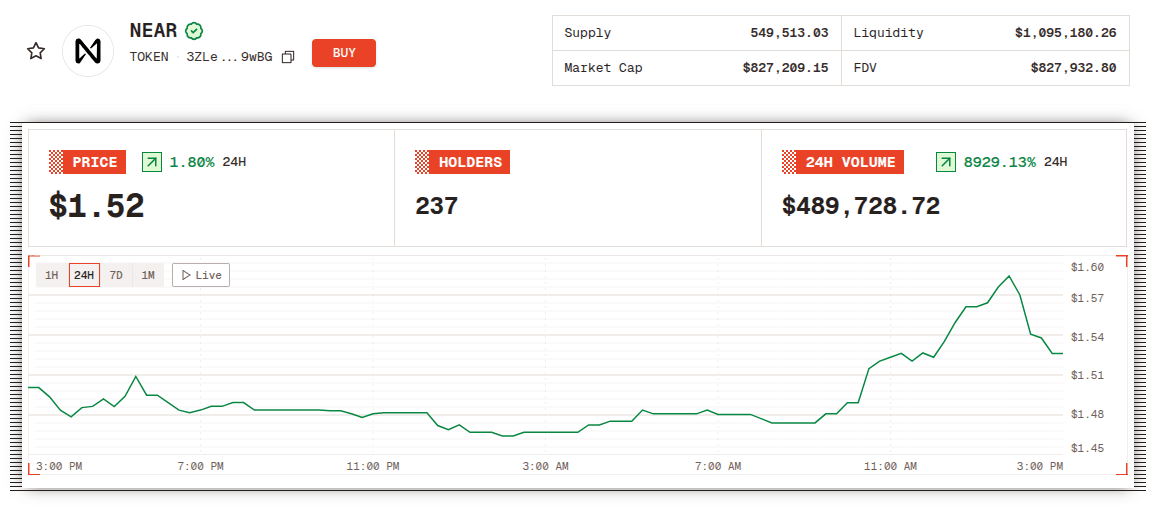

- Market Reaction: Observe how the SUI token and broader ecosystem respond to this news over time.

- Competitor Moves: See if other asset managers like Grayscale or Fidelity follow with similar filings.

This development is a powerful reminder of the accelerating convergence between crypto and traditional finance. For the Sui network, it represents an unprecedented opportunity for increased visibility, liquidity, and legitimacy.

Conclusion: A Stepping Stone to a New Financial Era

Bitwise’s filing for a SUI ETF is more than just paperwork; it’s a bold bet on a blockchain future. It underscores a growing institutional narrative that extends beyond Bitcoin, recognizing the value and utility of advanced smart contract platforms. Although the path to approval is not guaranteed, this move undeniably pushes the entire industry forward, offering a glimpse into a future where digital assets are seamlessly integrated into every investment portfolio.

Frequently Asked Questions (FAQs)

Q: Has the SUI ETF been approved?

A: No. Bitwise has only filed the initial registration statement (S-1). The SEC must review and approve it before the ETF can launch, a process that could take months or longer.

Q: How is a spot SUI ETF different from a futures ETF?

A: A spot ETF holds the actual SUI tokens. A futures ETF holds contracts that bet on the future price of SUI. Spot ETFs are generally considered a more direct form of exposure.

Q: Why would I buy a SUI ETF instead of SUI directly?

A: An ETF offers convenience (trading in a brokerage account), potential tax advantages in certain accounts (like IRAs), and eliminates the need for self-custody of crypto assets.

Q: What does this mean for the price of SUI?

A: While filings can generate positive sentiment, the direct price impact is uncertain. Long-term, an approved ETF could increase demand and stability by opening the asset to a vast pool of new investors.

Q: Who is Bitwise?

A: Bitwise Asset Management is a leading specialist in crypto index funds and ETFs. They are known for their research and were a key participant in the launch of the first spot Bitcoin ETFs in the U.S.

Found this analysis insightful? The journey of crypto into mainstream finance is a story we all share. Help others understand this pivotal moment by sharing this article on X (Twitter), LinkedIn, or with your crypto community!