Capriole digital asset fund founder Charles Edwards has warned that Bitcoin could slide below $50K if it is not quantum-resistant by 2028. His remarks add to the heated debate on the quantum-computing threat to BTC.

While still theoretical, highly advanced quantum computers have the potential to break Bitcoin’s cryptography, exposing private keys and other sensitive data to bad actors. Such an advancement could trigger a bear market, pushing Bitcoin below $50,000, according to Charles.

With that in mind, some might now be concerned about the XRP price prediction in 2026 and beyond. As traders and degens search for the next crypto to rally, a new AI project has emerged as a potential strong performer for 2026. The protocol uses AI agents to give market intel and trading signals to everyday traders.

BTC to go “sub $50K” if quantum threat is not fixed by 2028

The quantum-computing threat to Bitcoin has been a hot topic across crypto. While previously perceived to take decades, advancements in theoretical quantum computing capabilities have brought the risk closer. The Capriole founder believes that it could be as soon as 2028.

If a solution is not found by then, Charles highlighted on an X post on Wednesday, that Bitcoin could drop below $50K.

“If we haven’t deployed a fix by 2028, I expect Bitcoin will be sub $50K and continue to fall until it’s fixed,” he wrote.

Critics have, however, argued that Quantum would wipe out traditional banks well before they turned to BTC on a distributed network. But Charles suggested that Bitcoin would be “first on the quantum chopping board,” citing its high liquidity and the fact that banks are already shifting to post-quantum (PQ) encryption.

Meanwhile, XRP price drivers have signaled an incoming price slump for the Ripple-backed coin while traders eye strong performance in 2026 on early-stage, low-cap coins utilizing AI technologies.

XRP price prediction outlook for 2026

1. AI projects attract traders’ attention for 2026

As the quantum-computing threat to Bitcoin continues to take centre stage at crypto conversations, investors are exploring AI-powered market intelligence projects.

These platforms may use advanced AI agents to deliver timely market data, such as whale movements and trading signals, directly to investors.

While still in the early stages, some projects already have functional AI agents, granting early participants access to actionable market data in a tiered manner. As a first-time buyer, this provides a chance to spot opportunities such as instant XRP price drivers before other market participants.

Access to these AI agents is possible by participating in the ongoing fundraising rounds associated with certain tokens. These initiatives have gained interest from traders, with significant amounts raised.

Many traders now see such AI-driven projects as potential strong performers in 2026 due to robust AI use cases, low caps, and rising demand.

2. XRP price prediction shows continuation of bearish trend

The price of XRP stands at a crucial position at the moment, as XRP technical analysis shows that the coin could continue to drop further below $2.

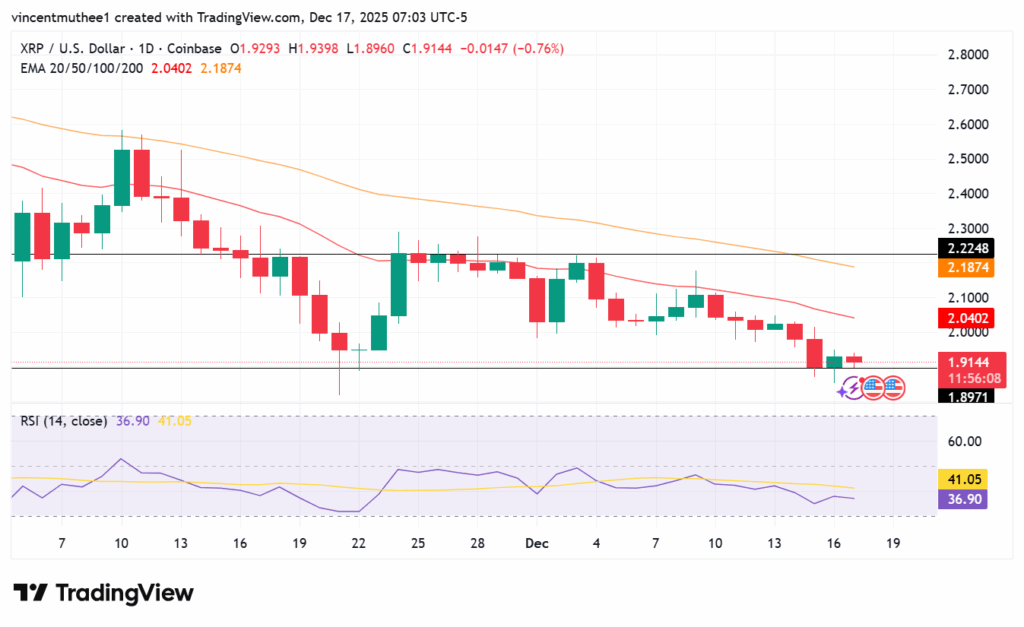

XRP’s daily trading chart on TradingView showed that the coin was trading at $1.9144 on December 17th. The price sat below the 20-day and 50-day EMAs at $2.0402 and $2.1874, respectively, confirming the bearish trend.

On the other hand, the relative strength index (RSI) indicator at 36.90 points to a bearish XRP price prediction. If the support at $1.8971 is broken, XRP could record more losses.

Additionally, XRP’s on-chain data supports the bearish thesis. As per a recent report, XRP futures data shows a collapse in demand, while the Estimated Leverage Ratio shows strong market de-risking.

Overall, the above data shows a slump XRP market forecast. Not unless liquidity conditions improve significantly, the coin might drop further or remain range-bound around $2.

3. Morpho price prediction as it surges 9% over the past 24 hours

Morpho was trading at $1.20 on December 17th, having surged 9.2% over the past 24 hours according to market data.

The fresh momentum has reignited interest in the coin. Additionally, Morpho entered into a partnership with Wirex and Gauntlet to create a simplified, non-custodial stablecoin yield platform last week. This might stir new demand for MORPHO, pushing the price higher moving into 2026.

Final verdict

XRP technical analysis and on-chain data show that the coin could continue to struggle in the short term. Not until XRP price drivers trigger a rebound could the coin drop further below $2. But a surge past short-term EMAs may trigger an upswing in 2026.

Nonetheless, AI-powered projects emerge as top contenders for significant gains in 2026, with XRP price prediction showing caution and Morpho currently in recovery. The early-stage pricing, strong AI use cases, and growing demand fuel these projects’ potential in 2026.

Purchasing certain tokens before specific dates or with promotional codes may provide bonuses, depending on project terms.

FAQs

1. Will XRP ever hit $10?

Reaching $10 is achievable for XRP. However, the coin has to climb over 390% to achieve such a milestone based on the XRP price prediction.

2. Is it too late to invest in XRP now?

XRP market forecast shows that the coin has the potential to rally as its use case in the cross-border payment market grows. Hence, it is not too late to buy XRP now.

3. Why is XRP not going up?

XRP’s price upswing has been limited by several factors, such as negative sentiment across the general crypto market at the moment. Additionally, the XRP technical analysis shows the coin’s structure is limiting price upswing. For example, the RSI reading highlights bearish momentum.