Bitcoin exchange net inflows have reached a stage high, and the upcoming rate hike by the Bank of Japan, along with the Federal Reserve's wavering policy, is triggering a comprehensive sentiment reversal in the cryptocurrency market.

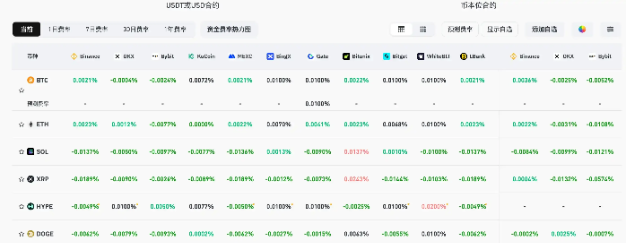

On December 18, the funding rates of mainstream centralized and decentralized exchanges indicate that the market remains broadly bearish.

Behind this phenomenon, Bitcoin's price has fallen back to around $85,600, Ethereum has lost the $3,000 mark, and the driving factors have shifted from mere market sentiment to deeper macro and structural pressures.

I. Market Sentiment Indicators

● According to AiCoin data, the funding rates of mainstream centralized and decentralized exchanges consistently show that market sentiment is leaning towards a comprehensive bearish outlook.

● This indicator is a core sentiment barometer for the crypto market, especially the perpetual contract market. The funding rate is essentially a capital exchange mechanism between long and short traders, with its core function being to anchor the price of perpetual contracts to the spot price of the underlying asset.

● When this rate is significantly below the 0.01% benchmark, or even generally below 0.005%, it indicates that short positions dominate the market, and traders holding long contracts need to pay fees to shorts. This clearly reflects the market's widespread pessimism and cautious expectations.

II. Macro Pressures

● The shift in market sentiment this round is primarily due to profound changes in the global macroeconomic landscape. Among them, the Bank of Japan's monetary policy shift is seen as a key "domino." The probability of the Bank of Japan raising rates for the first time since January 2025 had reached 97% by mid-December, and the market generally believes this is almost a certainty.

● Historical data shows a clear pattern: In the four to six weeks following the last three Bank of Japan rate hikes (March 2024, July 2024, January 2025), Bitcoin experienced significant declines of 20% to 30%.

● The transmission mechanism lies in the reversal of yen carry trades. Due to Japan's long-term zero or negative interest rates, global investors are accustomed to borrowing low-cost yen and investing in high-yield assets such as US stocks, US bonds, or cryptocurrencies. Once the yen enters a rate hike cycle, this leveraged capital quickly unwinds and returns, causing global risk assets, including the crypto market, to face forced liquidations and deleveraging pressure.

● Meanwhile, across the Pacific, although the US has completed its long-awaited first rate cut, the future policy path has become even more uncertain. The market's focus has quickly shifted from "when will rates be cut" to "how many more times can rates be cut in 2026, and will the pace slow down."

● Analysts warn that if employment data shows a "cliff-like cooling" or inflation proves more persistent than expected, the Federal Reserve may even accelerate the reduction of its balance sheet to offset potential easing effects, resulting in a complex situation where nominal policy easing coexists with actual liquidity tightening.

III. On-chain Selling Signals

Macro pressures are quickly translating into specific behaviors by market participants, with on-chain data clearly revealing the source and intensity of selling pressure.

● On the institutional investor side, Bitcoin spot ETFs have recently seen a significant single-day net outflow of about $350 million, mainly from products issued by Fidelity and Grayscale. Bitcoin's performance during US trading hours has been relatively weaker, highlighting the attitude of domestic institutional funds.

● A more direct on-chain signal appeared on December 15. Bitcoin exchange net inflows reached 3,764 BTC, a stage high. Of this, Binance alone saw a net inflow of 2,285 BTC, about eight times the previous stage. This concentrated deposit behavior to exchange addresses is usually interpreted as large holders or institutions preparing to sell.

● In addition, some well-known market makers, such as Wintermute, have also been observed recently transferring assets worth over $1.5 billion to trading platforms, intensifying concerns about liquidity supply in the market.

IV. Miners and Long-term Holders

● Another major source of on-chain selling pressure comes from the core pillars of the cryptocurrency ecosystem—long-term holders and Bitcoin miners. Addresses that have held Bitcoin for more than six months ("old money") have been selling for months, with signs of acceleration recently.

● The miner community is also under pressure. On-chain monitoring platforms have noted significant rotation in Bitcoin's total network hashrate, a phenomenon often coinciding with periods of financial pressure and liquidity tightening for miners. According to F2pool data, as of December 15, Bitcoin's total network hashrate had dropped to about 988.49 EH/s, down 17.25% from a week earlier.

The sharp decline in hashrate corroborates rumors in the market about "Xinjiang Bitcoin mining farms gradually shutting down."

● Industry veterans estimate that, based on an average hashrate of 250T per mining machine, at least 400,000 Bitcoin miners have recently been shut down. This usually means that miners, in order to pay for electricity, maintain operations, or obtain fiat income during periods of low coin prices, are selling their mined Bitcoin, thereby creating sustained selling pressure in the market.

V. Potential Paths and Risk Warnings

Facing a market under multiple converging pressures, the possible future paths and potential risks have become the focus of investors' attention.

● Analysts point out that if the Bank of Japan can pause its rate hikes in the next few meetings after this hike, the current sharp market decline may come to an end, or even usher in a corrective rebound.

● However, the greater risk is that the Bank of Japan's policy may mark the beginning of a long-term tightening cycle. The Bank of Japan has confirmed that it will sell about $550 billion worth of ETF holdings starting from January 2026.

● If rate hikes continue in 2026, accompanied by accelerated bond selling, the ongoing unwinding of yen carry trades could evolve into a prolonged wave of risk asset sell-offs, causing more long-term and far-reaching shocks to the crypto market.

Bitcoin's total network hashrate has dropped by more than 17% in a week, corresponding to about 400,000 mining machines shutting down. Meanwhile, the upcoming rate hike by the Bank of Japan is described by analysts as the last major event in the financial industry this year. Historical data mercilessly shows that after each rate hike, Bitcoin has not escaped a sharp decline.

The future of the market hangs between the policy scissors of the world's major central banks—especially Japan and the United States. As the tide of the liquidity feast begins to recede globally at different paces and intensities, the crypto market, which is extremely sensitive to liquidity, is becoming an ever-sharper "canary in the coal mine."