Visa Launches USDC Settlements in U.S. for Banks and FinTech Companies

Visa officially began conducting settlements with financial institutions in the United States using USDC as part of an upgrade to the settlement infrastructure underlying its global payment network.

Payment system Visa announced the launch of USDC stablecoin settlements in the U.S., giving local banks and payment partners access to 24/7 on-chain settlements without changing the cardholder user experience. The new mechanism marks a key milestone in Visa’s pilot program to integrate stablecoins and modernize its settlement infrastructure.

The first participants in the project are Cross River Bank and Lead Bank. Both institutions are already settling with Visa in USDC via the Solana blockchain. Expansion of access to stablecoin settlements for other U.S. financial institutions is planned for 2026.

The use of stablecoins enables faster fund movement through blockchain infrastructure, ensuring settlement availability seven days a week, including weekends and holidays, while also increasing the resilience of treasury operations.

The new settlement format also supports automated liquidity management and integration of traditional payment rails with blockchain infrastructure. According to Visa and its partner banks, such solutions are becoming critical for FinTech companies and financial institutions that require high speed, transparency, and precise cash flow forecasting.

At the same time, Visa is acting as a design partner for Arc, a new L1 blockchain being developed by Circle and currently in public testnet. The Arc platform is designed for high throughput and scalability needed to support Visa’s global commercial operations in an on-chain environment. After the mainnet launch, Visa plans to use Arc for USDC settlements and to run its own validator node.

According to Visa, as of November 30, monthly stablecoin settlement volumes exceed $3.5 billion on an annualized basis. The company began experimenting with USDC back in 2021 and, in 2023, became one of the first major payment networks to roll out stablecoin settlements on a permanent basis. In July, Visa also expanded support for additional blockchains and digital assets as part of its payment infrastructure modernization program.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tron DAO Integrates with Base: Unlock Seamless DEX Trading Now

XRP Whale Selling Pressure Crushes ETF Optimism: Price Could Plummet to $1.50

Block Sec Arena Partners with Fomo_in To Deliver Comprehensive Security and Growth Solutions for Blockchain Startups

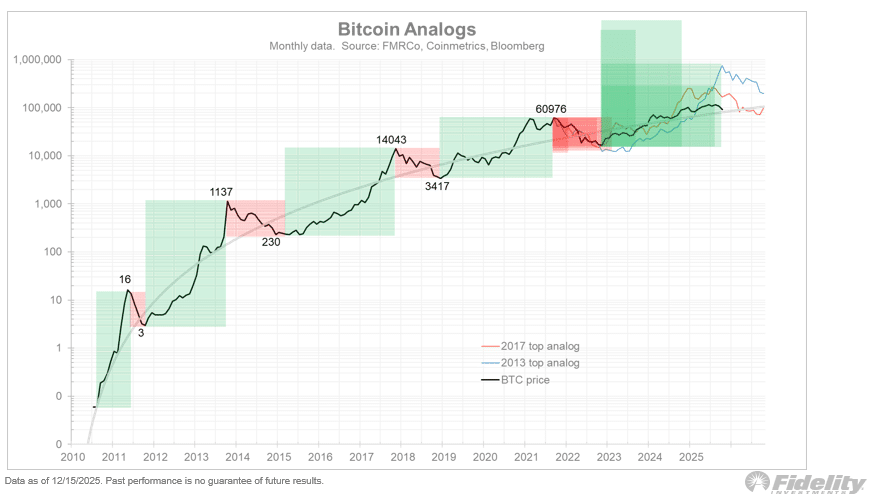

Bitcoin – Could 2026 be an ‘off year’ for BTC’s price?