Bitcoin Faces Dramatic Fluctuations in Response to Global Economic News

2025/12/19 09:50

2025/12/19 09:50By:

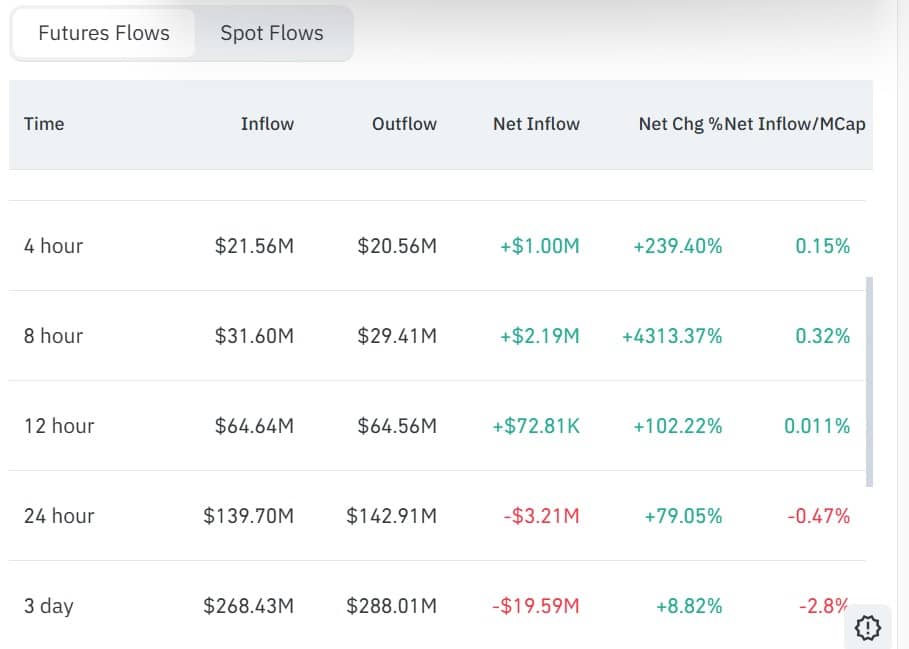

Summarize the content using AI ChatGPT Grok The price of Bitcoin (BTC) $90,357.50 saw a rapid increase following the unexpected inflation report, which indicated inflation numbers far below expectations. However, the rise was short-lived as negative sentiment towards cryptocurrencies quickly regained dominance. Experts speculate that this bearish sentiment could persist until tomorrow morning at 07:30. This period is anticipated due to impending economic announcements that might impact global crypto markets. Understanding the causes behind the fleeting rise and upcoming governmental decisions is crucial for navigating potential market shifts. Contents Reasons Behind Cryptocurrency Decline Future Market Movements and Predictions Reasons Behind Cryptocurrency Decline Japan is slated to release its interest rate decision at 07:30 AM (local time) tomorrow, with expectations of an increase. This decision is likely to perpetuate carry trade concerns, contributing to the ongoing pressure on cryptocurrencies. The week’s bearish pressure has intensified, prompting predictions that this week’s previous gains in the market might be misleading or deceptive traps for investors. In the short term, negative sentiment is expected to persist until the release of Japan’s interest rate decision. As a result, the rise driven by positive inflation data has been brief and quickly reversed. Bitcoin dropped below $86,000, reaching as low as $85,481. Future Market Movements and Predictions An examination of the above chart reveals a breakdown of the bear flag pattern, with attempts to reclaim the support level falling short. For four consecutive days, efforts to recover this key region have been unsuccessful, with each attempt turning into a liquidity grab. The victims are often eager investors pursuing daily trades. Many analysts are targeting $76,000 due to the breach in the bear flag, but a short-term recovery following the morning interest rate announcement might yield gains up to $96,000. However, future events, including a court decision on import tariffs in January and the MSCI delisting meeting, are likely to bring about deeper troughs. These developments may further disrupt cryptocurrency stability, leading investors to approach with caution in the coming weeks.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Polymarket Traders See Bitcoin Ending 2025 Near $80K

Cryptotale•2025/12/19 11:15

Falcon Finance Funds $2.1B $USDf on Base as Network Activity Hits New Highs

BlockchainReporter•2025/12/19 11:15

Can Pump.fun survive after PUMP falls 80% amid legal woes?

AMBCrypto•2025/12/19 11:08

Ripple CEO Drops XRP Price Truth Bomb

TimesTabloid•2025/12/19 11:07

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,292.55

+1.37%

Ethereum

ETH

$2,958.22

+3.80%

Tether USDt

USDT

$0.9996

+0.01%

BNB

BNB

$846.53

+0.96%

XRP

XRP

$1.87

-0.39%

USDC

USDC

$1

+0.01%

Solana

SOL

$124.99

+1.09%

TRON

TRX

$0.2791

+0.66%

Dogecoin

DOGE

$0.1282

+1.88%

Cardano

ADA

$0.3658

+0.64%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now