CryptoQuant says bear market has started, sees bitcoin downside risk to $70,000

A crypto bear market has already begun, according to onchain analytics firm CryptoQuant, which cited weakening bitcoin demand as a key signal.

"Bitcoin demand growth has decisively slowed, signaling a transition into a bear market," CryptoQuant said in a report published Friday. "After three major spot demand waves since 2023 — driven by the U.S. spot ETF launch, the U.S. presidential election outcome, and the Bitcoin treasury companies bubble — demand growth has fallen below trend since early October 2025."

The firm said this suggests that most of the incremental demand from the current cycle has already been absorbed, removing a key source of price support for bitcoin.

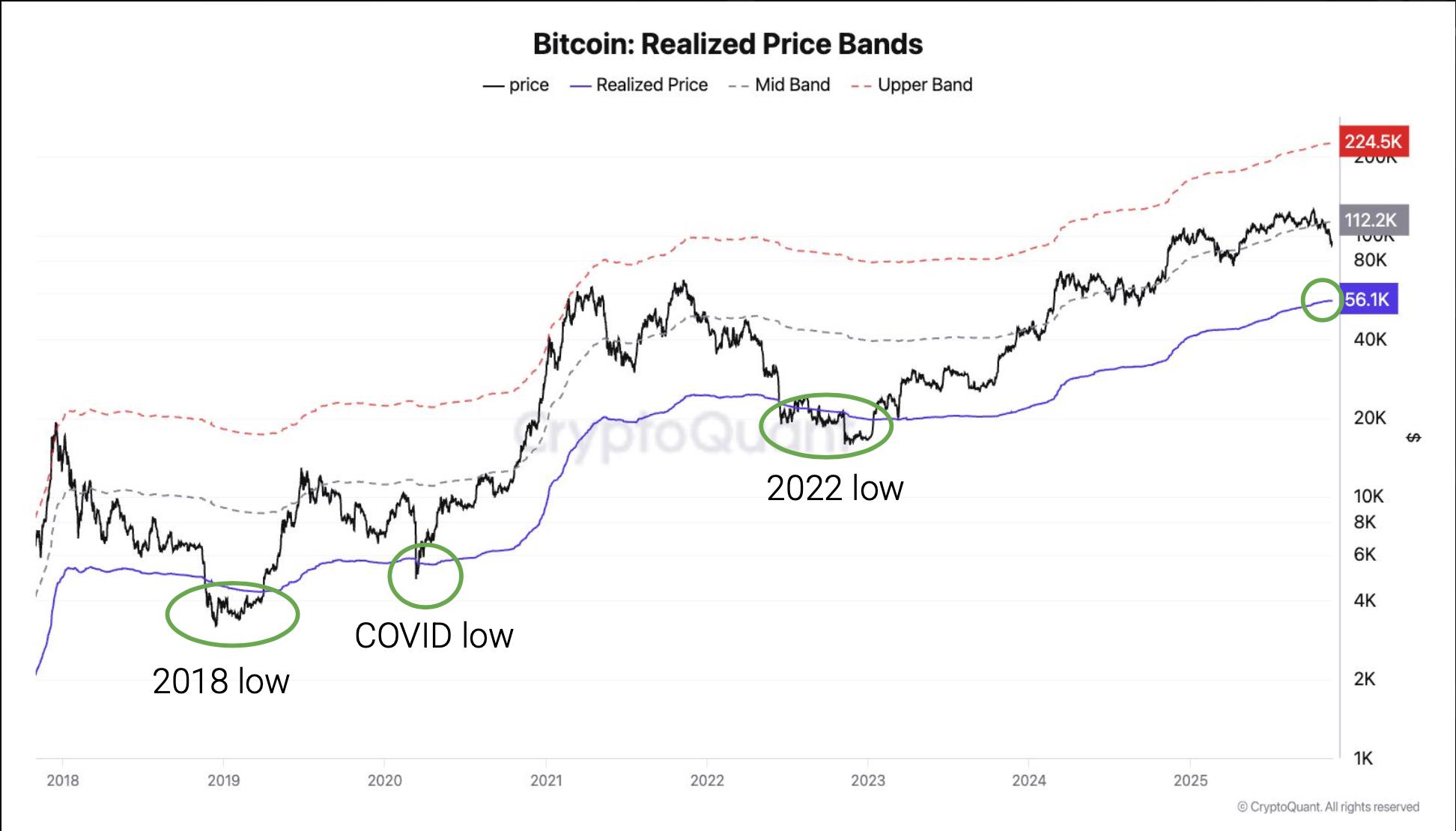

Based on these conditions, CryptoQuant sees bitcoin downside risk toward the $70,000 level, with a deeper decline toward $56,000 possible if bitcoin fails to regain momentum.

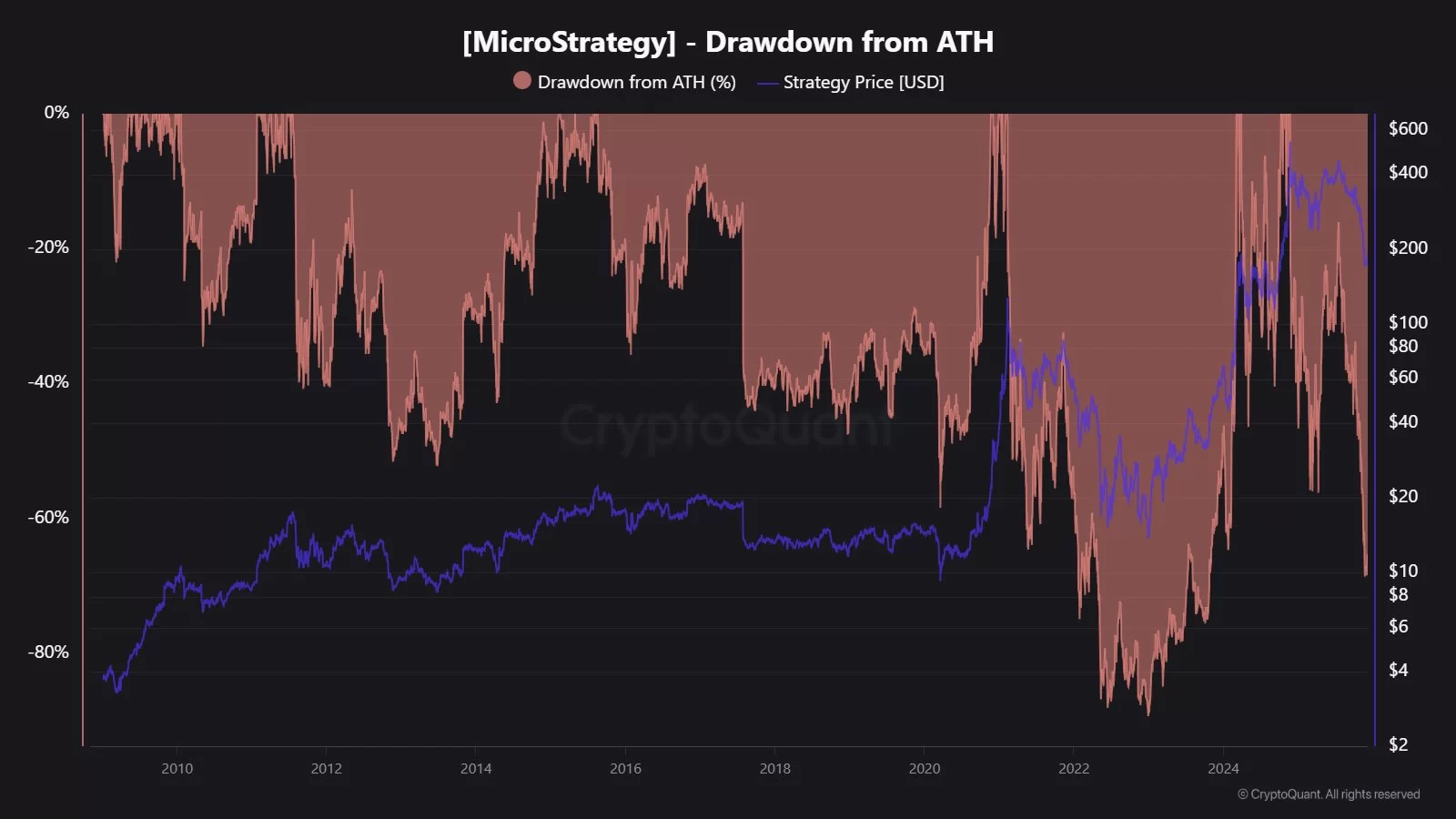

"Downside reference points suggest a relatively shallow bear market," the report said. "Historically, bitcoin bear market bottoms have aligned with the realized price, currently near $56,000, implying a potential 55% drawdown from the recent all-time high — the smallest drawdown on record. Intermediate support is expected around the $70,000 level."

When asked about timing, CryptoQuant head of research Julio Moreno told The Block the move to $70,000 could occur within months, while $56,000 would be a longer-term scenario. "$70,000 could be in three to six months," Moreno said. "$56,000 would be in the second half of 2026 if it comes to that."

Moreno added that the bear market effectively began around mid-November, following the largest liquidation event in crypto history on Oct. 10.

Since then, demand has continued to weaken. CryptoQuant said U.S. spot bitcoin ETFs turned into net sellers in the fourth quarter of 2025, with holdings declining by roughly 24,000 BTC. That marks a sharp reversal from the same period last year, when ETFs were strong net buyers.

Addresses holding between 100 and 1,000 BTC — a cohort that includes ETFs and bitcoin treasury companies — are also growing below trend, CryptoQuant said, mirroring demand deterioration seen toward the end of 2021 ahead of the 2022 bear market.

Derivatives data points to fading risk appetite as well. In perpetual futures markets, funding rates measured on a 365-day moving average have fallen to their lowest level since December 2023, CryptoQuant said. "Historically, falling funding rates reflect reduced willingness to maintain long exposure, a pattern consistently observed during bear market regimes rather than bull phases," it added.

Bitcoin has also slipped below its 365-day moving average, a long-term technical level that has historically marked the boundary between bull and bear market conditions, according to the firm.

"Demand cycles — not halvings — drive bitcoin’s four-year cycle," CryptoQuant said. "The current downturn reinforces that Bitcoin’s cyclical behavior is governed primarily by expansions and contractions in demand growth, not by the halving event itself or past price performance. When demand growth peaks and rolls over, bear markets tend to follow regardless of supply-side dynamics."

Bitcoin is currently trading at around $87,800, up about 3% in the past 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dave Portnoy Reveals What He Would Do If XRP Crashes to $1.75

OpenSea Adds Beeple’s Regular Animals Memory 186 to Flagship Collection, Expanding Its Digital Art Reserve

Bitcoin Poised to Rise to $1.4 Million by 2035, Analysts Say—Or Much Higher

Cryptocurrencies Face Turbulent Times as Market Shifts Intensify