Bitcoin On-Chain Sentiment Rebounds as Sell-Off Addresses Decline and Futures Market Turns Bullish

New on-chain data released this month points to a nascent shift in Bitcoin sentiment. Data analyst Murphy observed that wallets moving away from HODLing BTC to exiting the market surged between November 13 and 25, a window that coincided with the steepest BTC price decline in weeks. This spike in sell-off activity reflected market fear and pessimism, underscoring how price action can mirror crowded risk-off dynamics.

From December 1 to 18, as BTC repeatedly tested local bottoms, the tally of sell-off addresses diminished, aligning with a renewed bullish tilt in futures markets and a steadier price framework. Analysts note that the retreat in on-chain selling supports improving risk sentiment, suggesting a more balanced supply-demand dynamic rather than an imminent, sharp capitulation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

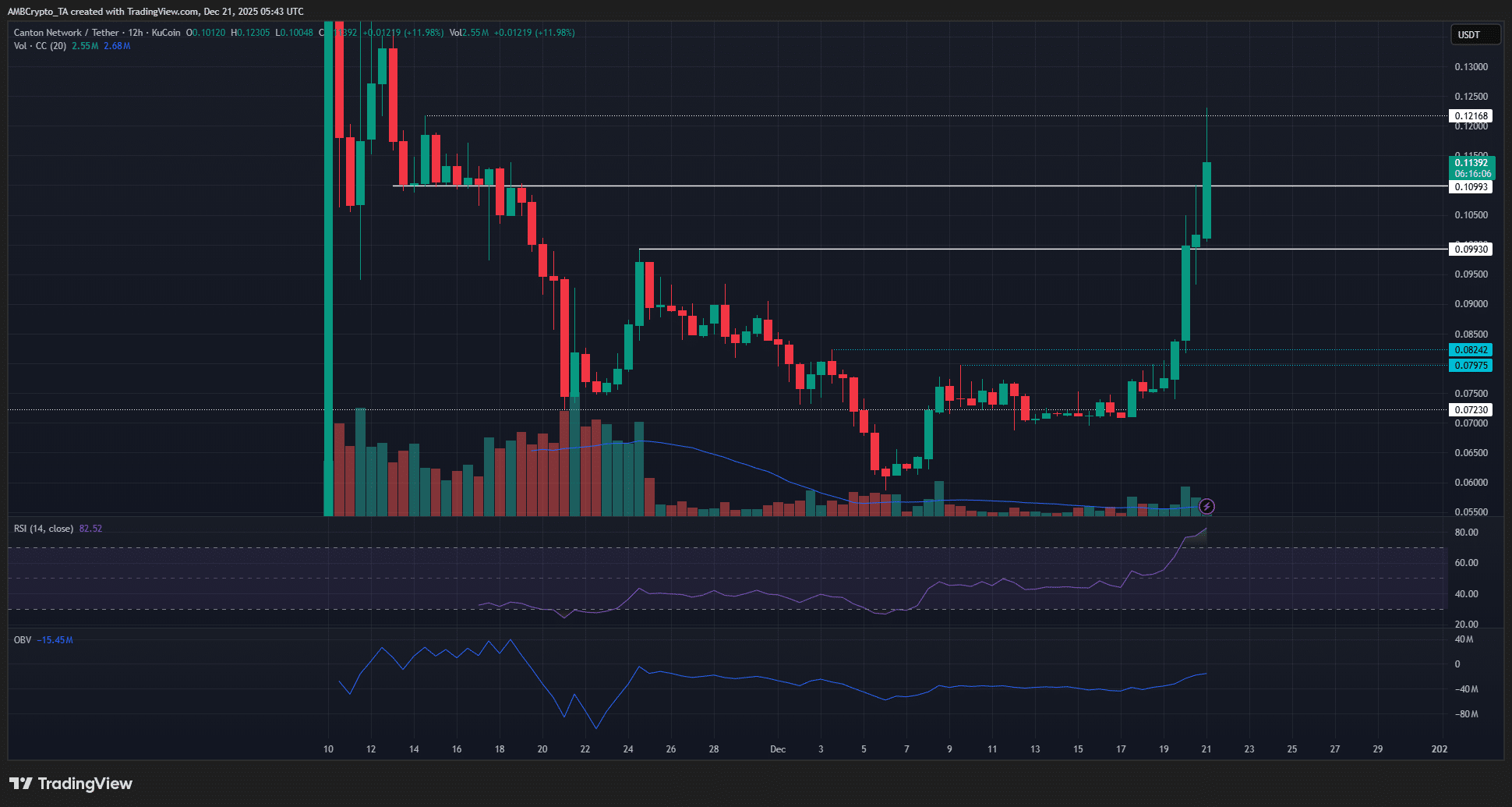

Canton Network explodes 36% after DTCC green light: Is a new trend born?

U.S. Lawmakers Make Special Amendments in Crypto Tax Rules

Altcoin Season Index at 17: Only 17 Top-100 Coins Have Outperformed Bitcoin, CoinMarketCap Data Show