Bitcoin's drop to $84.8K sparks bearish sentiment across social media platforms, impacting altcoin markets.

Bitcoin saw a sharp drop to $84.8k following a bearish sentiment surge on platforms like X and Reddit, leading to widespread market concerns.

The decline has implications for investor sentiment and market stability, highlighting potential volatility amid recent economic developments.

Bitcoin’s Drop and Market Reactions

Bitcoin’s drop to $84.8K heightened bearish sentiment across X, Reddit, and Telegram. Fear and pessimism increased after prices briefly rose to $90.2K, exemplifying the volatility usually associated with cryptocurrency markets.

Crypto trader Michaël van de Poppe attributed impacts to global economic news, particularly the Bank of Japan’s rate hike to 0.75%. This influence potentially shifts trends and underscores how global policies can affect Bitcoin’s value.

“It’s very likely that the trend keeps going down until the BoJ comes out with the news…. Wouldn’t be surprised if $BTC continues to cascade and gets itself into a form of capitulation in the next 24 hours as the trend clearly is down,” Michaël van de Poppe, Co-founder, MN Fund, commented on the market trends.

The cryptocurrency market reacted with notable declines, particularly among altcoins, some falling up to 20%. This drop reflects broader market vulnerability amid shifts in Bitcoin’s value following recent geopolitical developments.

Market cap fell by 33% to $2.93 trillion, the lowest since April. Such movements highlight the interconnectedness between Bitcoin and other cryptocurrencies, affecting market perception and investor behavior.

CryptoQuant observed a decrease in Bitcoin demand as previous trends reversed. Institutional interest remains active despite the downturn, suggesting potential recovery signals amidst ongoing selling pressures.

Historically, retail fear and bearish sentiment often signaled potential rebounds, yet current data suggests cautious market watchfulness. This scenario is reminiscent of the 2021 downturn, drawing comparisons with past cycles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Can’t Bitcoin Experience Massive Rallies Anymore? Anthony Pompliano Says the “Wild Era” Is Over and Explains Why

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

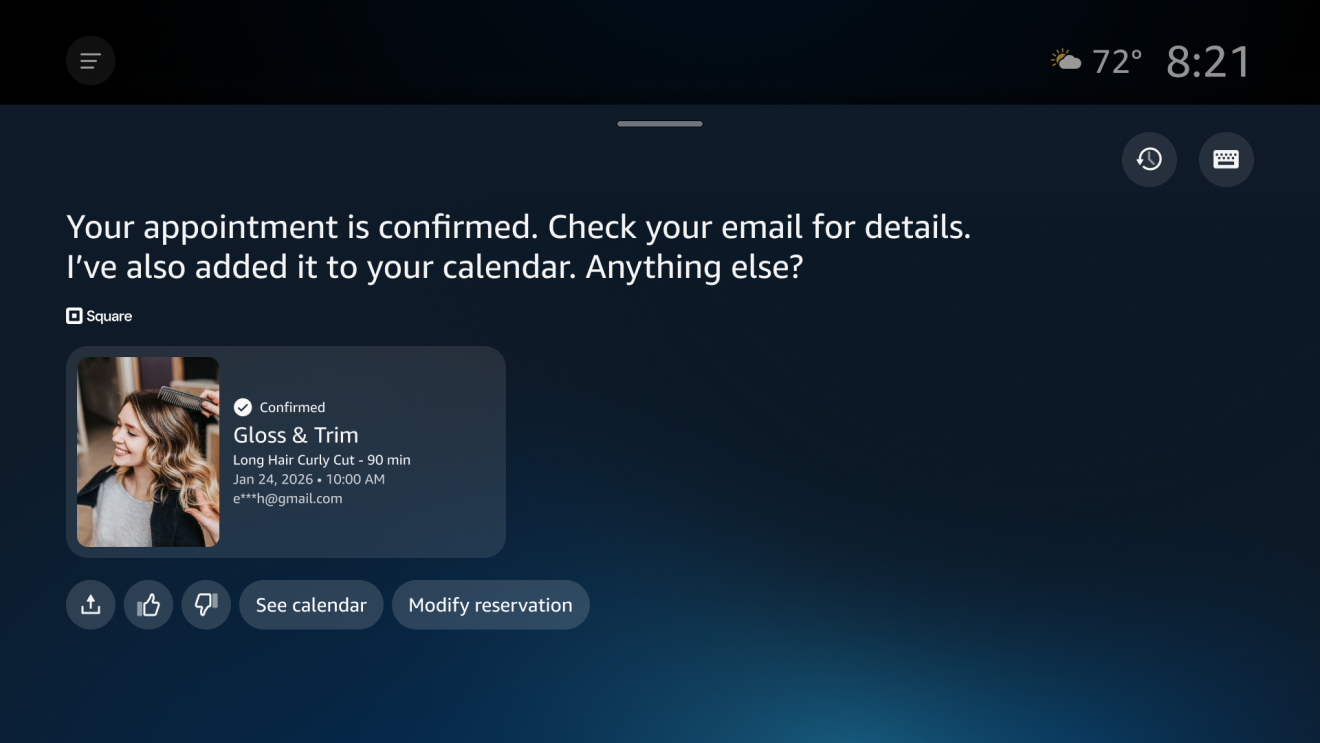

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

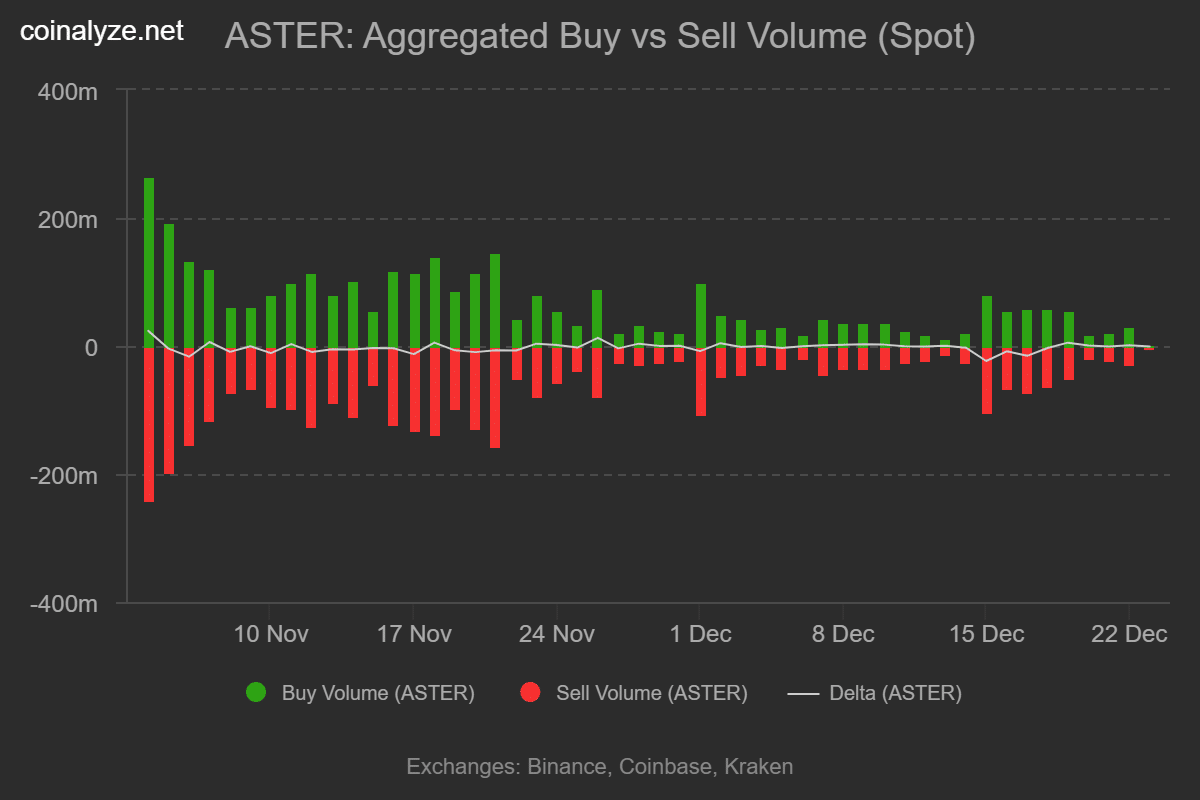

Aster DEX buys back $140M in tokens, yet prices stall – Why?