Date: Tue, Dec 23, 2025 | 05:30 AM GMT

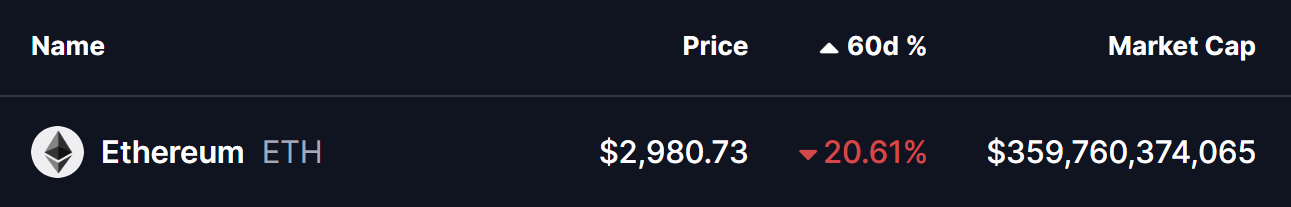

The broader crypto market has experienced choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum (ETH) down from sub-$4,700 levels to the $3,000 region, keeping traders cautious and overall risk appetite muted. Over the past 60 days alone, ETH has fallen by over 20%, reinforcing a short-term bearish narrative and shaking confidence across the market.

However, beneath the surface, the combination of growing whale activity and a shifting technical structure is beginning to hint that this extended downside phase may be laying the groundwork for a potential upside move rather than signaling further weakness.

Source: Coinmarketcap

Source: Coinmarketcap

Whale Accumulation Signals Quiet Confidence

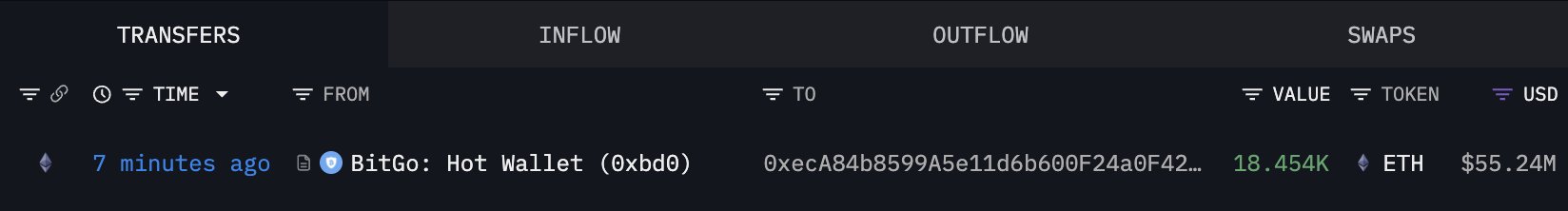

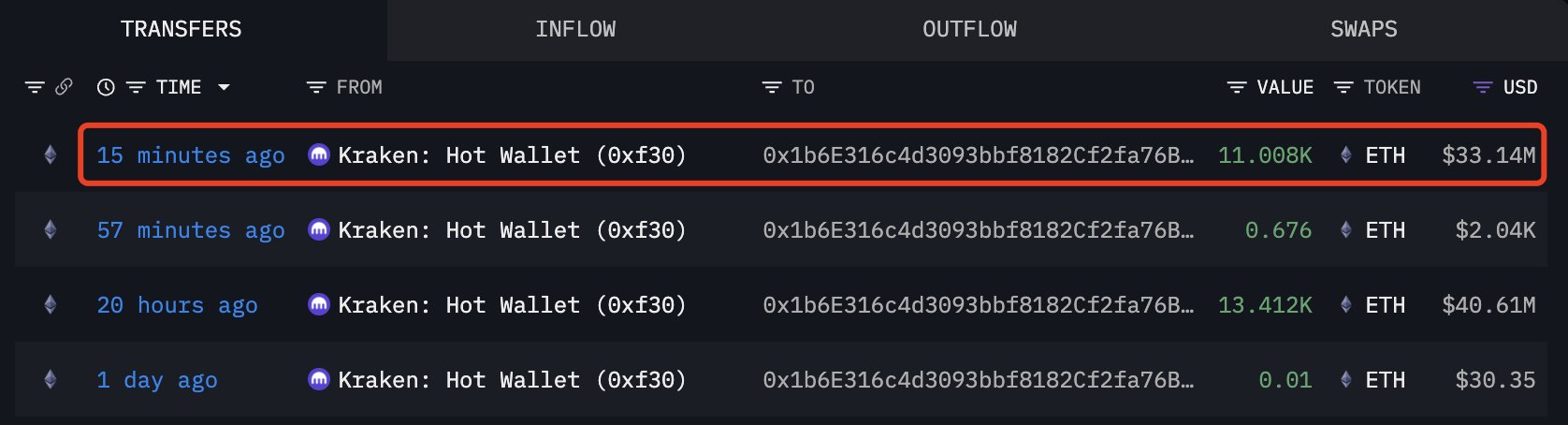

Despite Ethereum’s recent underperformance, large holders appear to be accumulating rather than exiting. According to data shared by Lookonchain, Tom Lee’s Fundstrat-linked entity Bitmine reportedly acquired another 29,462 ETH, worth approximately $88.1 million, through BitGo and Kraken.

$ETH Whale Accumulation/Source: @lookonchain (X)

$ETH Whale Accumulation/Source: @lookonchain (X)

$ETH Whale Accumulation/Source: @lookonchain (X)

$ETH Whale Accumulation/Source: @lookonchain (X)

Such sizable purchases during periods of consolidation often suggest strategic positioning rather than short-term speculation.

Descending Channel Breakout Retest Takes Shape

From a technical perspective, Ethereum spent much of the past two months trading inside a clearly defined descending channel. This structure formed after ETH topped out near $4,758 in early December, with price printing a series of lower highs and lower lows, reflecting strong bearish control. That pressure ultimately pushed ETH down toward the $2,559 region, marking a local exhaustion point for sellers.

The structure shifted on December 9, when ETH broke decisively above the upper boundary of the descending channel around the $3,070 area. That breakout triggered a sharp relief rally, sending price higher toward the $3,447 zone, which acted as near-term resistance and capped the initial upside attempt.

Ethereum (ETH) Daily Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) Daily Chart/Coinsprobe (Source: Tradingview)

Following this move, Ethereum entered a controlled pullback, returning to retest the former channel resistance near $2,774. Importantly, this level has so far acted as support rather than resistance as the price hovering above of it near $2,980, suggesting a classic breakout-and-retest behaviour.

What’s Next for ETH?

As long as Ethereum holds above the reclaimed descending channel boundary, the broader bullish structure remains intact. A sustained move back above the 50-day moving average near $3,103 would be a key confirmation signal, increasing the likelihood of another push toward the $3,447 resistance zone. Acceptance above that level would suggest momentum is shifting back in favor of buyers and that the recent pullback was corrective rather than the start of a new downtrend.

If bullish continuation unfolds, the measured move projection from the descending channel points toward a potential upside target around $4,220. Reaching that level would represent a recovery of roughly 41% from current prices and mark a meaningful medium-term trend reversal for Ethereum.

On the flip side, failure to hold above the $2,774 breakout support would weaken the bullish thesis. A sustained move back below the reclaimed channel could invalidate the breakout and reopen the door for renewed consolidation or a return to downside pressure. For now, however, the combination of whale accumulation and improving chart structure suggests Ethereum may be entering a critical decision zone that could shape its next major move.