Why will market sentiment collapse across the board in 2025? An analysis of Messari's 100,000-word annual report

Original Title: "Why Will Market Sentiment Completely Collapse in 2025? | Interpreting Messari's 100,000-Word Annual Report (Part 1)"

Original Source: Merkle3s Capital

This article is based on Messari's annual report, The Crypto Theses 2026, published in December 2025. The full report exceeds 100,000 words, with an official estimated reading time of 401 minutes.

Introduction | This Is the Worst Year for Sentiment, But Not the Most Fragile Year for the System

If we only look at sentiment indicators, the crypto market in 2025 could almost be sentenced to "death."

In November 2025, the Crypto Fear & Greed Index dropped to 10, entering the "Extreme Fear" zone.

Historically, there have been very few moments when sentiment fell to this level:

· March 2020, global liquidity crunch triggered by the pandemic

· May 2021, cascading leveraged liquidations

· May–June 2022, systemic collapse of Luna and 3AC

· 2018–2019, industry-wide bear market

These periods share a common trait: the industry itself was failing, and the future was highly uncertain.

But 2025 does not fit this pattern. There were no major exchanges misappropriating user assets, no Ponzi projects with tens of billions in market cap dominating the narrative, the total market cap did not fall below the previous cycle's high, stablecoin supply even hit record highs, and regulatory and institutionalization processes continued to advance.

On the "factual level," this is not a year of industry collapse. However, on the "emotional level," it may be the most painful year for many practitioners, investors, and long-time users.

Why Did Sentiment Collapse?

Messari presents a striking contrast at the beginning of the report:

If you are allocating crypto assets from a Wall Street office, 2025 may be the best year since you entered the industry. But if you are staying up late on Telegram or Discord, watching the charts and hunting for alpha, this is probably the year you miss the "old days" the most.

The same market, two almost completely opposite experiences. This is not a random mood swing, nor a simple bull-bear switch, but a deeper structural mismatch: the market is changing participants, but most people are still participating in the new system with their old identities.

This Is Not a Market Recap

This article does not intend to discuss short-term price trends, nor does it attempt to answer "Will prices rise next?"

It is more of a structural explanation:

· Why, as institutions, capital, and infrastructure are continuously strengthening,

· is market sentiment sliding to historic lows?

· Why do so many people feel they "chose the wrong track," yet the system itself has not failed?

In this 100,000-word report, Messari chooses to start again from a very fundamental question: If crypto assets are ultimately a form of "money," then who deserves to be treated as money?

Understanding this is the prerequisite for understanding the complete collapse of market sentiment in 2025.

Chapter One | Why Is Sentiment Abnormally Low?

If we only look at the outcome, the collapse of sentiment in 2025 is almost "incomprehensible."

Without exchange blowups, systemic credit collapse, or the failure of core narratives, the market still delivered sentiment feedback close to historic lows.

Messari's judgment is very direct: This is an extreme case of "sentiment being severely detached from reality."

1. Sentiment Indicators Have Entered the "Historically Abnormal Range"

The Crypto Fear & Greed Index dropping to 10 is not an ordinary pullback signal.

In the past decade, this value has only appeared at very rare moments, and each time was accompanied by real and profound industry-level crises:

· Breakdown of the funding system

· Collapse of the credit chain

· The market doubting whether the future exists

But none of these problems occurred in 2025.

No core infrastructure failed, no mainstream assets were liquidated to zero, and no systemic events occurred that could shake the industry's legitimacy. Statistically, this sentiment reading does not match any known historical template.

2. The Market Did Not Fail, It Was the "Personal Experience" That Failed

The collapse of sentiment did not come from the market itself, but from the subjective experience of participants. Messari repeatedly emphasizes a neglected fact in the report: 2025 is a year when institutional experiences are far better than those of retail investors.

For institutions, this is an extremely clear, even comfortable environment:

· ETFs provide low-friction, low-risk allocation channels

· DATs (Digital Asset Treasuries) become stable and predictable long-term buyers

· Regulatory frameworks are becoming clear, and compliance boundaries are gradually visible

But for many participants under the old structure, this year was exceptionally brutal:

· Alpha significantly decreased

· Narrative rotations failed

· Most assets underperformed BTC in the long run

· The relationship between "effort" and "results" was completely broken

The market did not reject people, it just changed the reward mechanism.

3. "Not Making Money" Is Misread as "The Industry Is Failing"

The real trigger for sentiment is not price declines, but cognitive dissonance. In past cycles, the implicit assumption of crypto was: as long as you are diligent enough, early enough, and aggressive enough, you can get excess returns.

But 2025 systematically broke this assumption for the first time.

· Most assets no longer get premiums just for "telling stories"

· L1 ecosystem growth no longer automatically translates into token returns

· High volatility no longer means high returns

As a result, many participants began to develop an illusion: if I didn't make money, there must be something wrong with the whole industry. Messari's conclusion is the opposite: The industry is becoming more like a mature financial system, not a machine that continuously generates speculative windfalls.

4. The Essence of Sentiment Collapse Is Identity Mismatch

Summing up all the phenomena, Messari gives only one implicit answer: The collapse of sentiment in 2025 is essentially an identity mismatch.

· The market is tilting toward "asset allocators," "long-term holders," and "institutional participants"

· But many participants still exist as "short-term alpha seekers"

When the system's reward logic changes but participation methods do not adjust accordingly, sentiment inevitably collapses first. This is not a problem of individual ability, but the friction cost of switching roles in an era.

Summary | Sentiment Did Not Tell You the Truth

Market sentiment in 2025 truly reflects the pain of participants, but does not accurately reflect the state of the system.

· Sentiment collapse ≠ industry failure

· Increased pain ≠ value disappearance

It only signals one thing: the old ways of participating are rapidly failing. Understanding this is the prerequisite for entering the next chapter.

Chapter Two | The Real Root of Sentiment Collapse: The Monetary System Is Failing

If we only stay at the market structure level, the collapse of sentiment in 2025 is still not fully explained. The real problem is not:

· Less alpha

· BTC is too strong

· Institutions have entered

These are all surface phenomena. Messari's deeper judgment in the report is: The collapse of market sentiment essentially stems from a long-ignored fact—the monetary system we are in is continuously putting pressure on savers.

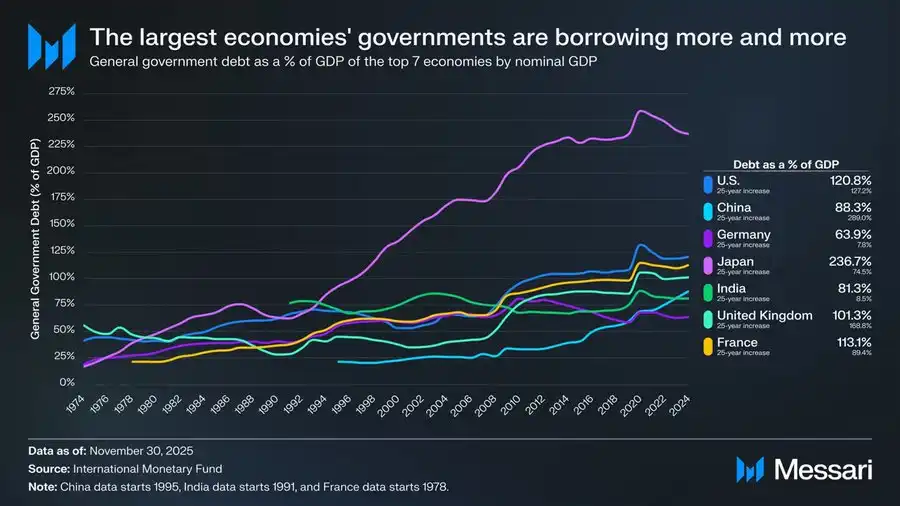

A Chart That Must Be Faced: Global Government Debt Out of Control

This chart is not just macro background decoration, but the logical starting point for the entire Cryptomoney argument.

Over the past 50 years, the ratio of government debt to GDP in major global economies has shown a highly consistent, almost irreversible upward trend:

· United States: 120.8%

· Japan: 236.7%

· France: 113.1%

· United Kingdom: 101.3%

· China: 88.3%

· India: 81.3%

· Germany: 63.9%

This is not the result of a single country's governance failure, but a common outcome across systems, political structures, and development stages. Whether in democracies, authoritarian states, developed economies, or emerging markets, government debt has long outpaced economic growth.

What This Chart Really Shows Is Not "High Debt," But "Systematic Sacrifice of Savers"

When government debt grows faster than economic output over the long term, the system can only remain stable in three ways:

1. Inflation

2. Prolonged low real interest rates

3. Financial repression (capital controls, withdrawal restrictions, regulatory intervention)

No matter which path is taken, the ultimate cost is borne by the same group: savers. Messari uses a very restrained but weighty phrase in the report: When debt grows faster than economic output, the costs fall most heavily on savers. In other words: When debt outpaces growth, savers are destined to be sacrificed.

Why Did Sentiment Collapse Concentrate in 2025?

Because 2025 is the year when more and more participants clearly realize this for the first time.

Before this:

· "Inflation is only temporary"

· "Cash is always safe"

· "Fiat is stable in the long run"

But reality is constantly refuting these assumptions.

When people discover:

· Hard work ≠ wealth preservation

· The act of saving itself is continuously shrinking

· Asset allocation has become significantly more difficult

The collapse of sentiment does not come from crypto, but from a loss of confidence in the entire financial system. Crypto is simply the place where this shock is first perceived.

The Meaning of Cryptomoney Is Not "Higher Returns"

This is also a point Messari repeatedly emphasizes, but is easily misunderstood. Cryptomoney does not exist to promise higher returns.

Its core value lies in:

· Predictable rules

· Monetary policy not arbitrarily changed by a single institution

· Assets can be self-custodied

· Value can be transferred across borders without permission

In other words, what it provides is not a "money-making tool," but: in a world of high debt and low certainty, it restores individuals' right to choose their money.

The Collapse of Sentiment Is Actually a Kind of "Awakening"

When you put this debt chart together with 2025's market sentiment, you find a counterintuitive conclusion: Extreme pessimism in sentiment does not mean industry failure, but that more and more people are beginning to realize that the problems of the old system are real.

The problem with crypto has never been that it is "useless." The real problem is: it no longer creates easy excess returns for everyone.

Summary | From Sentiment, to Structure, to Money Itself

This chapter addresses a fundamental question: Why, without a systemic crash, has market sentiment fallen to historic lows? The answer is not in the price charts, but in the monetary structure.

· Sentiment collapse is the appearance

· Paradigm break is the process

· Monetary system imbalance is the root cause

This is precisely why Messari chose to start the report from "money" rather than "applications."

Chapter Three | Why Is Only BTC Treated as "Real Money"?

If you've read this far, it's easy to raise a question: If the problem lies in the monetary system, why is the answer BTC and not something else?

Messari's judgment in the report is exceptionally clear: BTC is no longer competing on the same dimension as other crypto assets.

1. Money Is Not a Technical Problem, But a Consensus Problem

This is the first key to understanding BTC. Messari repeatedly emphasizes a fact that engineers often overlook: Money is a social consensus, not a technical optimization problem. In other words:

· Money is not about "who is faster"

· Not about "who is cheaper"

· Nor about "who has more features"

But about who is consistently and stably treated as a store of value. From this perspective, Bitcoin's victory is not mysterious.

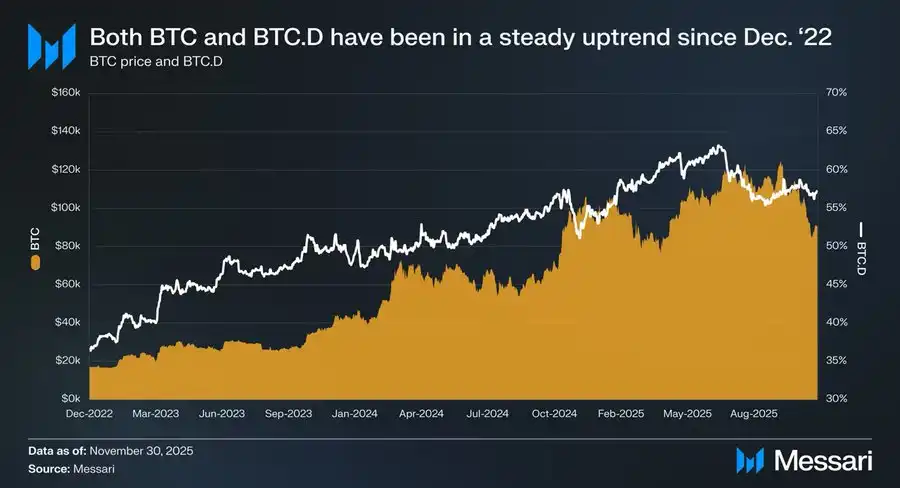

2. Three Years of Data Have Already Made the Answer Obvious

From December 1, 2022, to November 2025:

· BTC rose by 429%

· Market cap grew from $318 billion → $1.81 trillion

· Ranked among the top ten global assets

More importantly, relative performance: BTC.D rose from 36.6% → 57.3%. In a cycle where "alts should theoretically soar," funds instead kept flowing back to BTC. This is not a random result of a market cycle; it is the market reclassifying assets.

3. ETFs and DATs Are Essentially "Institutionalizing Consensus"

Messari's evaluation of ETFs is very restrained, but the conclusion is weighty. Bitcoin ETFs are not just "new buying power"; what they really change is: who is buying + why they are buying + how long they can hold

· ETFs make BTC a compliant asset

· DATs make BTC part of corporate balance sheets

· National reserves elevate BTC to the level of a "strategic asset"

When BTC is held by these entities, it is no longer: "a highly volatile risk asset that can be dumped at any time" but: a monetary asset that must be held long-term and cannot be easily mishandled. Once money is treated this way, it is hard to go back.

4. The More "Boring" BTC Is, the More It Resembles Money

This may be the most counterintuitive point of 2025:

· BTC has no applications

· No narrative rotations

· No ecosystem stories

· Not even "anything new"

But precisely because of this, it fits all the characteristics of "money":

· Does not rely on future promises

· Does not need growth narratives

· Does not require continuous team delivery

It only needs not to make mistakes.

And in a world of high debt and low certainty, "not making mistakes" itself is a scarce asset.

5. BTC's Strength Is Not a Market Failure

Many people's pain comes from an illusion: "BTC's strength means something is wrong with the market." Messari's judgment is the opposite: BTC's strength means the market is becoming more rational.

When the system starts rewarding:

· Stability

· Predictability

· Long-term credibility

Then all strategies that rely on "high volatility for high returns" will become increasingly painful. This is not BTC's problem; it is a problem of participation methods.

Summary | BTC Did Not Win, It Was Chosen

BTC did not "defeat" other assets. It was simply repeatedly validated by the market in an era of failing monetary systems as:

· The asset that needs the least explanation

· The asset that relies least on trust

· The asset that needs the least promise of the future

This is not the result of a single market cycle, but a kind of role confirmation.

Chapter Four | When the Market Only Needs One "Money," the L1 Story Starts to Fail

After confirming that BTC has been chosen by the market as the "main cryptomoney," one question is unavoidable: If money already has an answer, what is left for Layer 1? Messari does not give a direct conclusion, but after reading this section, one trend is very clear: L1 valuations are being forced from "future narratives" back to "real constraints."

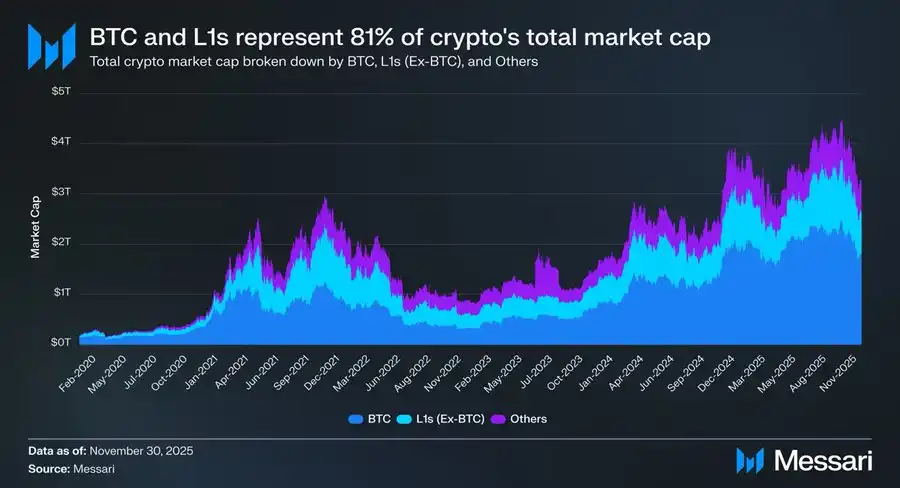

1. A Harsh but Real Fact: 81% of Market Cap Is in the "Money" Narrative

By the end of 2025, the total crypto market cap is about $3.26T:

· BTC: $1.80T

· Other L1s: about $0.83T

· Other assets: less than $0.63T

In total: about 81% of crypto asset market cap is priced by the market as "money" or "potential money." What does this mean? It means L1 valuations are no longer based on the "application platform" pricing logic, but on whether they qualify as money.

2. The Problem Is: Most L1s Don't Qualify

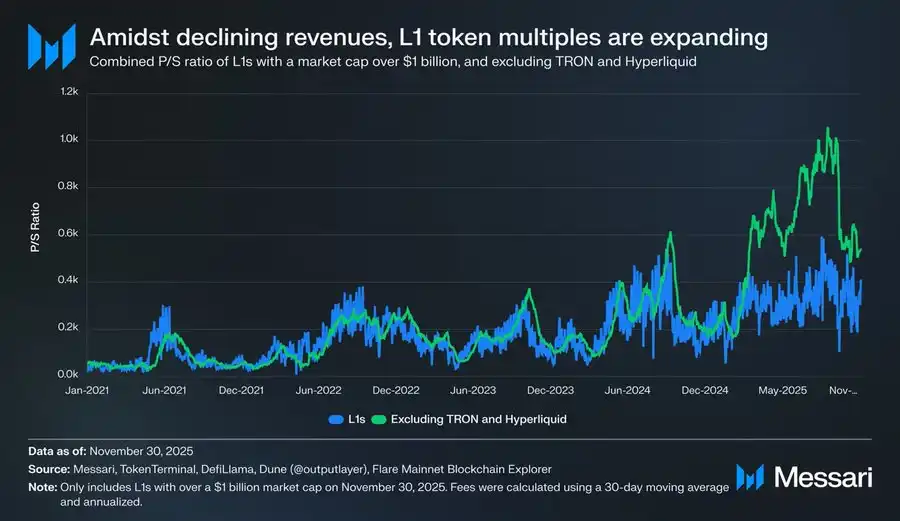

The data Messari provides is very direct and very cold.

After excluding outliers like TRON and Hyperliquid with abnormally high revenues:

· Overall L1 revenue continues to decline

· But valuation multiples are continuously rising

Adjusted P/S ratios:

· 2021: 40x

· 2022: 212x

· 2023: 137x

· 2024: 205x

· 2025: 536x

Meanwhile, total L1 revenue:

· 2021: $12.3B

· 2022: $4.9B

· 2023: $2.7B

· 2024: $3.6B

· 2025 (annualized): $1.7B

This is a scissors gap that cannot be reasonably explained by "future growth."

3. L1s Are Not "Undervalued," But "Reclassified"

Many people's pain comes from a misunderstanding: "Are L1s being wrongly killed by the market?" Messari's judgment is the opposite: The market is not wrongly killing L1s, but is reducing their 'monetary imagination space.'

If an asset:

· Cannot stably store value

· Cannot be held long-term

· Cannot provide certain cash flow

Then it is ultimately only priced as: a high-beta risk asset.

4. The Example of Solana Actually Says It All

SOL is one of the few L1s that outperformed BTC in 2025. But Messari points out a very telling fact:

· SOL ecosystem data grew by 20–30 times

· Price only outperformed BTC by 87%

In other words: to achieve "significant excess returns" over BTC, L1s need explosive ecosystem growth by orders of magnitude. It's not about "not trying hard enough," but the return function has already been rewritten.

5. When BTC Becomes "Money," the Burden on L1s Gets Heavier

This is a structural change many have not realized. Before BTC had a clear monetary status:

· L1s could tell the story of "becoming money in the future"

· The market was willing to pay in advance for this possibility

But now:

· BTC is already established

· The market is no longer willing to pay the same premium for a "second money"

So, L1s face a tougher question: If you're not money, then what are you?

Summary | The Problem with L1s Is Not Competition, But Positioning

L1s did not "lose to BTC." What they lost is:

· In the monetary dimension

· The market no longer needs more answers

And once they lose the protection of the "money narrative," all valuations must be re-anchored to reality.

This is the direct source of the emotional collapse for many participants in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

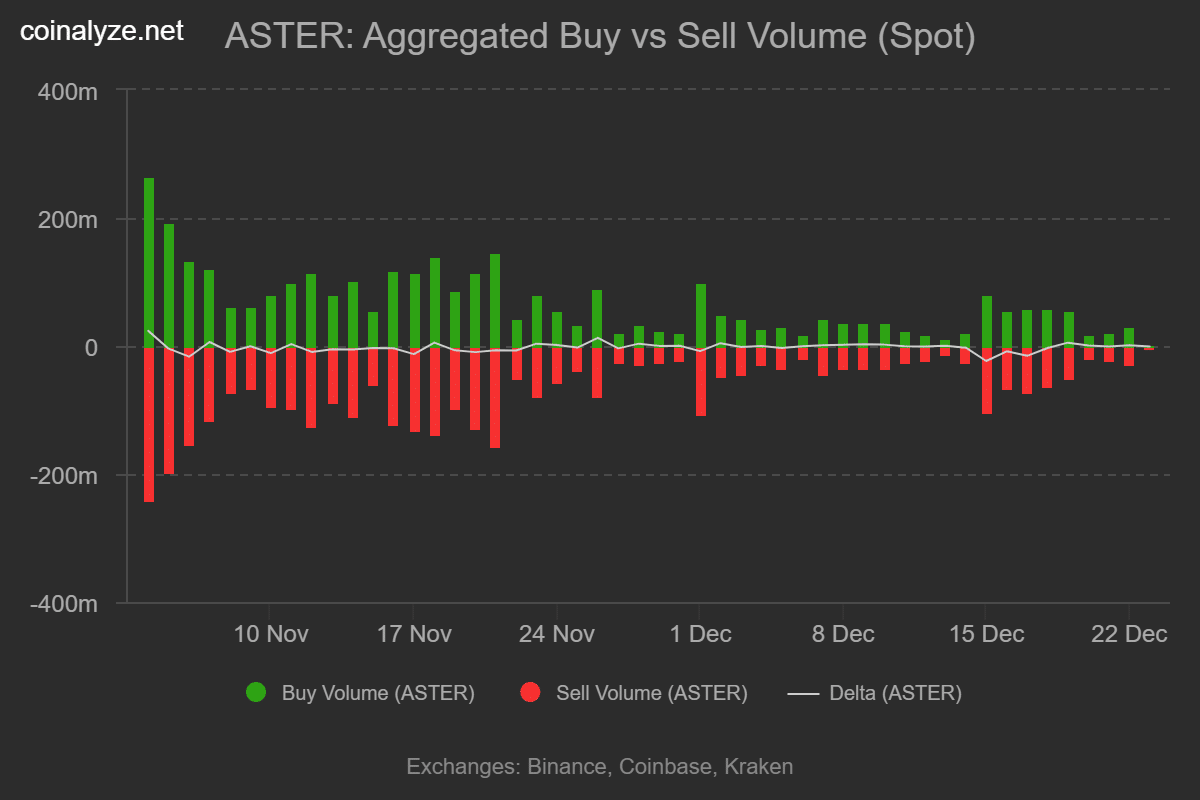

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share

Top Crypto Gainers December 23 – CRV Leads with 4.46% Surge as Gold Tokens Rise