MicroStrategy: The Life-or-Death Gamble of the World’s Largest Bitcoin Whale

Written by: Clow

670,000 bitcoins, accounting for about 3.2% of the global total supply.

This is the number of bitcoins held by MicroStrategy (now renamed Strategy Inc.) as of mid-December 2025. As the world's first publicly listed company to adopt bitcoin as its primary reserve asset, this former business intelligence software provider has completely transformed into an "operating enterprise engaged in structured financial design for bitcoin."

The renaming is not just a brand-level change, but an ultimate declaration that its corporate strategy has fully shifted to a "bitcoin standard."

However, entering the fourth quarter of 2025, as market volatility intensifies and with potential changes in index compilers' rules, this model—hailed by founder Michael Saylor as a "revolutionary financial innovation"—is facing its toughest test since its launch in 2020.

So, where does MicroStrategy's money actually come from? Can its business model be sustained? And where does the greatest risk lie?

From Software Company to "Bitcoin Bank"

In 2025, MicroStrategy officially changed its name to Strategy Inc., marking a complete transformation of its identity.

The core logic of this company is not complicated: it leverages the premium of its stock price over the net asset value of its bitcoin holdings, continuously raising funds to buy more bitcoin, thereby achieving a continuous increase in the per-share bitcoin holding.

In plain terms: as long as the market is willing to give MSTR stock a higher valuation than the bitcoin it holds, the company can issue new shares to buy more bitcoin, so that each existing shareholder's corresponding bitcoin holding does not decrease but actually increases.

Once this "flywheel effect" is set in motion, it creates positive feedback: stock price rises → shares issued to buy bitcoin → BTC holdings increase → stock price continues to rise.

But this flywheel also has a fatal premise: the stock price must remain above the net asset value of bitcoin. Once this premium disappears, the entire model comes to an abrupt halt.

Where Does the Money Come From? The "Three-Pronged Financing Approach"

The outside world is very curious about the source of funds for MicroStrategy's continuous bitcoin purchases. By analyzing the company's 8-K filings with the U.S. Securities and Exchange Commission (SEC), it is clear that its financing model has evolved from the early single convertible bond to a diversified capital matrix.

First Prong: ATM Program—A Money Printing Machine Capturing Premiums

MicroStrategy's core source of funding is its at-the-market (ATM) program for its Class A common stock (MSTR).

The operating logic is simple: when MSTR stock trades above the net asset value of its bitcoin holdings, the company sells new shares to the market and uses the proceeds to buy bitcoin.

In the week from December 8 to December 14, 2025, the company raised about $888.2 million in net proceeds by selling more than 4.7 million shares of MSTR stock.

The charm of this financing method is that as long as the stock price is above the net asset value of bitcoin, each new issuance is "accretive" rather than dilutive for existing shareholders.

Second Prong: Perpetual Preferred Stock Matrix

In 2025, MicroStrategy took an important step in capital instrument innovation by launching a series of perpetual preferred stocks to attract investors with different risk appetites.

In a single week in December, these preferred stocks raised $82.2 million from STRD.

These preferred stocks are usually structured as "capital return" dividends, which are attractive to investors from a tax perspective because they allow the deferral of tax obligations for at least ten years.

Third Prong: "42/42 Plan"—An $84 Billion Ambition

MicroStrategy is currently in the execution phase of its ambitious "42/42 Plan."

This plan aims to raise $42 billion through equity issuance and another $42 billion through fixed income securities over three years from 2025 to 2027, totaling $84 billion, all to be used for purchasing bitcoin.

This plan is an upgraded version of the previous "21/21 Plan" and reflects management's extreme confidence in the capital market's ability to absorb its securities. Such large-scale capital operations have effectively made MicroStrategy a closed-end fund with leveraged exposure to bitcoin, but its operating company shell gives it financing flexibility that traditional funds do not possess.

The Truth Behind "Bitcoin Selling" Rumors

Recently, rumors have circulated in the market that MicroStrategy might be selling bitcoin, but these do not hold up against financial data and on-chain evidence.

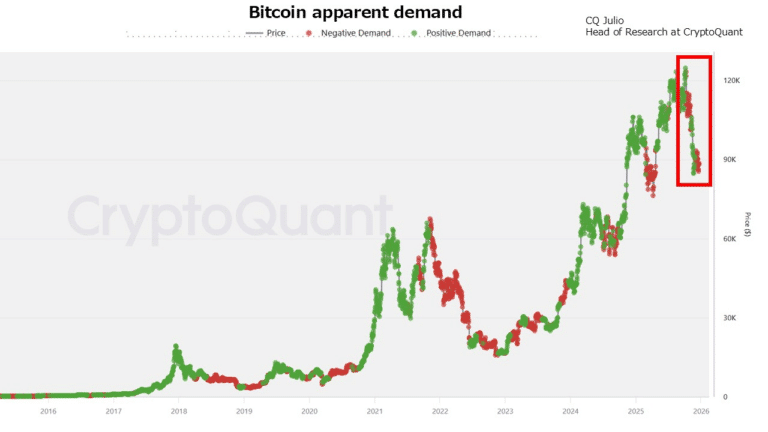

In mid-November and early December 2025, on-chain data monitoring tools (such as ArkhamIntelligence) observed large-scale asset transfers from wallets controlled by MicroStrategy. Data showed that about 43,415 bitcoins (worth about $4.26 billion) were transferred from known addresses to more than 100 new addresses. This triggered panic on social media, causing the price of bitcoin to briefly fall below $95,000.

However, subsequent professional audits and clarifications from management showed that this was not a selling action, but a normal "custodian and wallet rotation." To reduce the credit risk of a single custodian and improve security, MicroStrategy dispersed its assets from traditional platforms such as Coinbase Custody to more defensive addresses. Arkham's analysis pointed out that such operations usually involve security needs for address refreshes, rather than asset liquidation.

MicroStrategy Executive Chairman Michael Saylor has repeatedly refuted the rumors in public, and in December's Twitter and CNBC interviews, he made it clear: "We are buying, and buying at a considerable scale."

In fact, in the second week of December, the company increased its holdings by 10,645 bitcoins at an average price of $92,098 per coin, directly disproving the speculation of bitcoin selling.

In addition, the company's recently established $1.44 billion USD Reserve further proves that it does not need to liquidate bitcoin to pay dividends or debt interest; this reserve can cover at least 21 months of financial expenditures.

The Overlooked Software Business

Although bitcoin trading occupies the spotlight, MicroStrategy's software business remains an important foundation for maintaining its status as a listed company and for paying daily financial expenses.

In the third quarter of 2025, the total revenue from the software business was $128.7 million, a year-on-year increase of 10.9%, exceeding market expectations.

Although subscription revenue grew significantly, due to continued investment in AI R&D and cloud infrastructure, this business did not generate positive operating cash flow in the first six months of 2025. Q3 free cash flow was negative $45.61 million, meaning the company remains in an operating loss position, and its continued bitcoin accumulation is entirely dependent on external financing.

From January 1, 2025, MicroStrategy adopted ASU 2023-08, which requires bitcoin holdings to be revalued at fair value and changes to be included in current net profit. This change has made the company's book profits extremely volatile. In Q3 2025, due to the rise in bitcoin prices, the company recorded $3.89 billion in unrealized gains, bringing quarterly net profit to $2.8 billion.

The Three Damocles Swords Hanging Overhead

Although MicroStrategy has reduced the risk of short-term forced liquidation through complex financial design, it still faces several systemic risks that could shake its foundation in the future.

Risk One: MSCI Index Exclusion

The most immediate risk MicroStrategy faces comes from the review by index compiler MSCI.

MSCI has launched a formal consultation proposing to reclassify companies whose digital assets account for more than 50% of total assets as "investment tools" rather than "operating companies." Since bitcoin holdings account for the vast majority of MicroStrategy's assets, if this rule is passed, MicroStrategy will be excluded from the MSCI Global Investable Market Index (GIMI).

This exclusion could force passive funds to sell $2.8 billion to $8.8 billion worth of stock. Such large-scale forced selling would directly suppress its stock price, thereby compressing MSTR's NAV premium. If the NAV premium disappears or even turns into a discount, its "flywheel" of issuing shares to buy bitcoin will come to a complete halt.

Risk Two: NAV Premium Compression and Financing Stagnation

The entire logic of MicroStrategy's bitcoin accumulation is based on the market's willingness to pay a premium above its net asset value.

By the end of 2025, this premium showed great instability. In early December, due to concerns about index exclusion, MSTR once traded at an 11% discount to the value of its bitcoin holdings.

When the stock trades at a discount, any new equity financing will dilute the per-share bitcoin holding of existing shareholders, forcing the company to stop accumulating assets and even facing creditors' doubts about asset integrity. MicroStrategy suspended its ATM program for the first time in September 2025, reflecting management's high sensitivity to valuation multiples.

Risk Three: Debt Pressure and Theoretical Liquidation Price

As of the end of Q3 2025, MicroStrategy's total debt was about $8.24 billion, with annual interest payments of about $36.8 million, while preferred stock dividend payments were as high as $638.7 million per year.

Although its convertible bonds do not include bitcoin collateral clauses, reducing the risk of direct "liquidation" due to market declines, if bitcoin prices experience an extreme drop, the company's debt servicing ability will be tested.

Summary

MicroStrategy's situation at the end of 2025 vividly demonstrates the opportunities and challenges a company faces when trying to redefine the boundaries of corporate finance.

Its intention to continue accumulating has not changed, and by establishing a $1.44 billion USD reserve, the company has built a defensive wall against a potential liquidity winter.

However, MicroStrategy's greatest risk does not come from bitcoin price volatility itself, but from its connection to the traditional financial system—namely, its index status and NAV premium.

If institutions such as MSCI ultimately decide to exclude it from the traditional equity category, MicroStrategy must find a way to prove to investors that it still has growth vitality as a "bitcoin-backed structured financing platform" even without passive index inflows.

Whether the future "42/42 Plan" can proceed as scheduled will depend on whether it can continue to create attractive yield products for institutional investors in the process of bitcoin financialization, while maintaining at least basic financial dignity amid the growing pains of the software business's cloud transformation.

This is not just an experiment by one company, but a microcosm of the integration process between the entire crypto industry and the traditional financial system.

In this unprecedented high-stakes gamble, the only certainty is: no one knows how this story will end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gold Silver Rally but Bitcoin Fails to Catch Up: Weak Liquidity or Market Manipulation?

Chainlink Faces Uncertain Times in the Cryptocurrency Market

Justin Sun Locks $78 Million in WLFI Tokens, Strengthens World Liberty Financial Governance

57 million tokens burned, WBS enters a new valuation range