Gemini Poll Finds Over 70% Of Investors Predict XRP Below $2 By Year's End

As the year draws to a close, XRP investors are increasingly adopting a bearish outlook, anticipating that the altcoin will remain below the critical $2 threshold.

XRP Forecasts Dipped

A recent poll conducted by cryptocurrency exchange Gemini, running from December 12 to 23, reveals that 73% of investors predict XRP will finish the year between $1.50 and $2.00, suggesting a muted conclusion for the altcoin’s performance in 2025.

Just weeks prior, market sentiment was more optimistic, with around 38% of traders expecting XRP to rally to a range of $2.00 to $2.50 by December 31. However, that figure has since dropped to 28%, reflecting a significant decline in confidence.

The possibility of the cryptocurrency exceeding $2.50 appears almost non-existent, as only about 4% of respondents foresee it reaching the $2.50 to $3.00 range, and a similar 4% predict it could surpass $3.00.

The consensus of 73% predicting an XRP finish between $1.50 and $2.00 marks an increase from the 63% recorded earlier in the poll. This growing alignment among poll participants indicates that they are consolidating around this range as the most likely scenario.

Furthermore, the sentiment towards higher price levels has significantly shifted. The percentage of voters anticipating a rally into the mid-$2 range has dwindled to a mere 4%, reflecting dwindling confidence after several failed attempts to break through resistance levels.

Even the outlook for the altcoin’s price to drop below $1.50 has risen slightly to 7%, up from 6%, although most believe a sharp sell-off is unlikely.

Rising Supply From Early Investors

This prevailing sentiment aligns with Futures data indicating a prevalence of aggressive sell orders, while the slow accumulation of XRP in exchange-traded funds (ETFs) at a pace of $30 to $50 million daily cannot keep up with profit-taking and risk reduction activities in the market.

On-chain data reveals that significant realized gains have been secured as XRP approached its recent highs. For instance, a long-term holder who initially acquired the altcoin around $0.40 sold over 350 million tokens at approximately $2.00, reaping an estimated profit of $721 million.

With many early investors reportedly cashing out at the $2 level, there has been minimal support for dip-buying to bolster the price, keeping it in the current range between $1.7 and $1.8 recorded in the week.

Experts suggest that when the supply increases from long-term holders, whose initial investments were made at $0.40 to $0.60, it creates a resistance ceiling that is challenging to break without substantial new demand entering the market.

The daily chart shows XRP’s price decline since October. Source:

XRPUSDT on TradingView.com

The daily chart shows XRP’s price decline since October. Source:

XRPUSDT on TradingView.com

At the time of writing, XRP was trading at $1.830. The altcoin has recorded major losses in all time frames, with a year-to-date decline of 15%, in line with the broader market’s performance.

Featured image from DALL-E, chart from TradingView.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Asia is quietly building a counterweight to the dollar stablecoin empire, and the West isn’t ready

Bitcoin 4-Year Cycle Is Dead: Famous Crypto Trader Explains What Happens Next

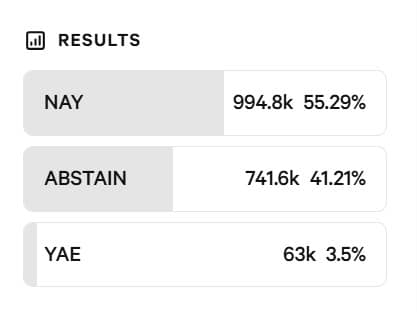

Aave DAO votes down brand control plan as altcoin falls by 14% – Explained

Are Stablecoins About to Overtake ACH Payments in 2026?