Analyst: There have been historical deviations in the correlation between Bitcoin, US stocks, and gold; after the last occurrence, BTC price increased tenfold.

PANews reported on December 27 that crypto analyst Plan B posted on X, stating that bitcoin is currently deviating from its price correlation with US stocks and gold. This situation has occurred in history before, when bitcoin was below $1,000, but the price later increased tenfold. Although price correlation is not absolute and current market conditions may be different, time will tell everything.

In response, another analyst, Willy Woo, commented that the Mt.Gox hack at the end of 2013 put pressure on the bitcoin price, and the deadlock over block size in 2014 triggered whale sell-offs. The current question is whether investors will view quantum computing as an obstacle equivalent to the "block size debate."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst: Bitcoin Can Continue to Rise Without Waiting for Gold and Silver to Pull Back

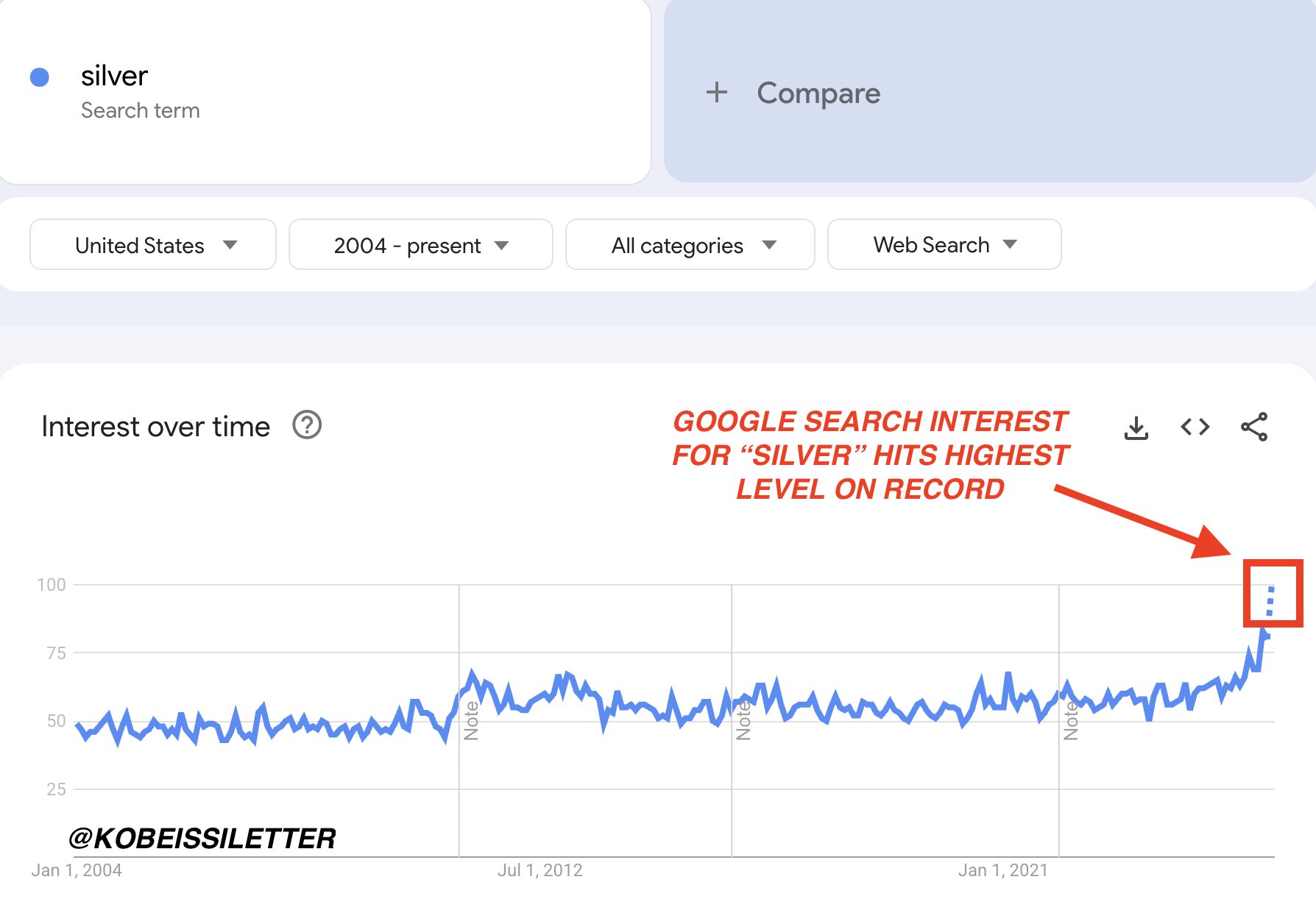

Google Trends shows search interest for "silver" hits an all-time high

Data: 45.98 BTC transferred from Hyperunit to Wintermute, valued at approximately $3.1894 million

Solana-based Meme Coin WhiteWhale Market Cap Surpasses $35 Million, 24-hour Growth 41.2%