Institutional Investors Dump Bitcoin and Ethereum, Buy Solana and XRP, Trigger $952,000,000 of Weekly Outflows: CoinShares

Institutional investors just sold an overall total of $952 billion in Bitcoin and crypto assets in only one week, according to a new update from Coinshares.

This marks the first outflows in four weeks for digital asset investment products.

CoinShares notes the sell-off happened alongside delays in the US Clarity Act and concerns over whale investors selling adding pressure.

Ethereum led the outflows with $555 million withdrawn. Bitcoin followed with $460 million in outflows.

Solana saw inflows of $48.5 million, while XRP gained $62.9 million.

The US drove most of the negative flow. Outflows there reached $990 million. Canada offset some with $46.2 million in inflows. Germany added $15.6 million.

Assets under management now stand at $46.7 billion, below below last year’s $48.7 billion.

Year-to-date inflows for Bitcoin hit $27.2 billion. That’s down from $41.6 billion in 2024. Ethereum’s year-to-date inflows are $12.7 billion, up from $5.3 billion last year.

Featured Image: Shutterstock/thvideostudio/PurpleRender

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

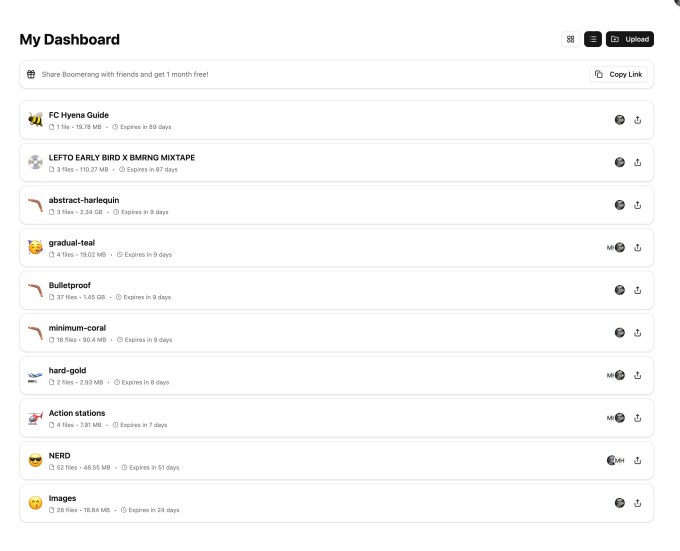

Why WeTransfer co-founder is building another file transfer service

Cardano Price Prediction: Russia and US Discuss Bitcoin Mining, DeepSnitch AI Crosses $900K Milestone Ahead of Rumored 100X Launch

Kazakhstan Permits Crypto Investments, Prohibits Domestic Payments

Missed Brett at $0.000125? This Next Crypto To Explode Offers 3000x Potential Gains