The US is integrating cryptocurrencies into the financial system with a new regulatory stance.

- SEC and CFTC redefine rules for cryptocurrencies in the US.

- Stablecoins gain legal clarity with the GENIUS Act.

- Bitcoin advances with institutional support and financial integration.

The United States will end 2025 with a clearer and more structured regulatory approach to cryptocurrencies, marking a significant shift in how the sector is treated by the federal government. Under the administration of current President Donald Trump, authorities have begun integrating digital assets into the traditional financial system, abandoning the predominantly punitive view that characterized previous years.

The strategy adopted does not seek to replace traditional finance, but to allow cryptocurrencies to operate within already known regulatory frameworks. This change became evident in the coordinated actions of bodies such as the SEC, the CFTC, and the OCC, which began to offer more objective guidelines for companies and investors.

At the SEC, Gary Gensler's departure opened the way for a new regulatory direction. During his tenure, the agency's actions were marked by lawsuits against companies like Ripple, Coinbase, and Binance, with little regulatory clarity. With the new leadership, the SEC launched Project Crypto, an initiative aimed at objectively defining which digital tokens can be classified as securities. The proposal represents a transition from litigation-based oversight to a more predictable regulatory model.

The CFTC also expanded its involvement in the sector by formally recognizing Bitcoin and Ethereum as commodities. Furthermore, the agency authorized the use of BTC, ETH, and USDC as collateral in derivatives markets, within the Digital Asset Collateral Pilot Program. The application of traditional risk control mechanisms brought cryptocurrencies closer to conventional financial practices.

Another significant change came from the Office of the Comptroller of the Currency. Until recently, companies in the sector faced barriers to operating nationally. This changed when the OCC conditionally approved national fiduciary banking licenses for companies like Circle and Ripple, allowing them to operate throughout the U.S. without the need for individual state licenses.

In the legislative field, the GENIUS Act brought greater clarity to the stablecoin market. The new legislation requires full reserves, prohibits rehypothesizing, and establishes federal oversight, consolidating these currencies as digital instruments pegged to the dollar within the legal framework.

This more defined regulatory environment contributed to the market's evolution in 2025. Bitcoin showed strong appreciation throughout the year, driven by institutional adoption and greater regulatory predictability. Even with periods of volatility linked to macroeconomic factors and trade policy decisions, the integration of cryptocurrencies into the US financial system has sustained the sector's growth and expanded its presence in traditional market structures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Price Prediction 2026 as Wintermute Warns of Increased Crypto Volatility, Investors Flock to DeepSnitch AI for 100x Returns

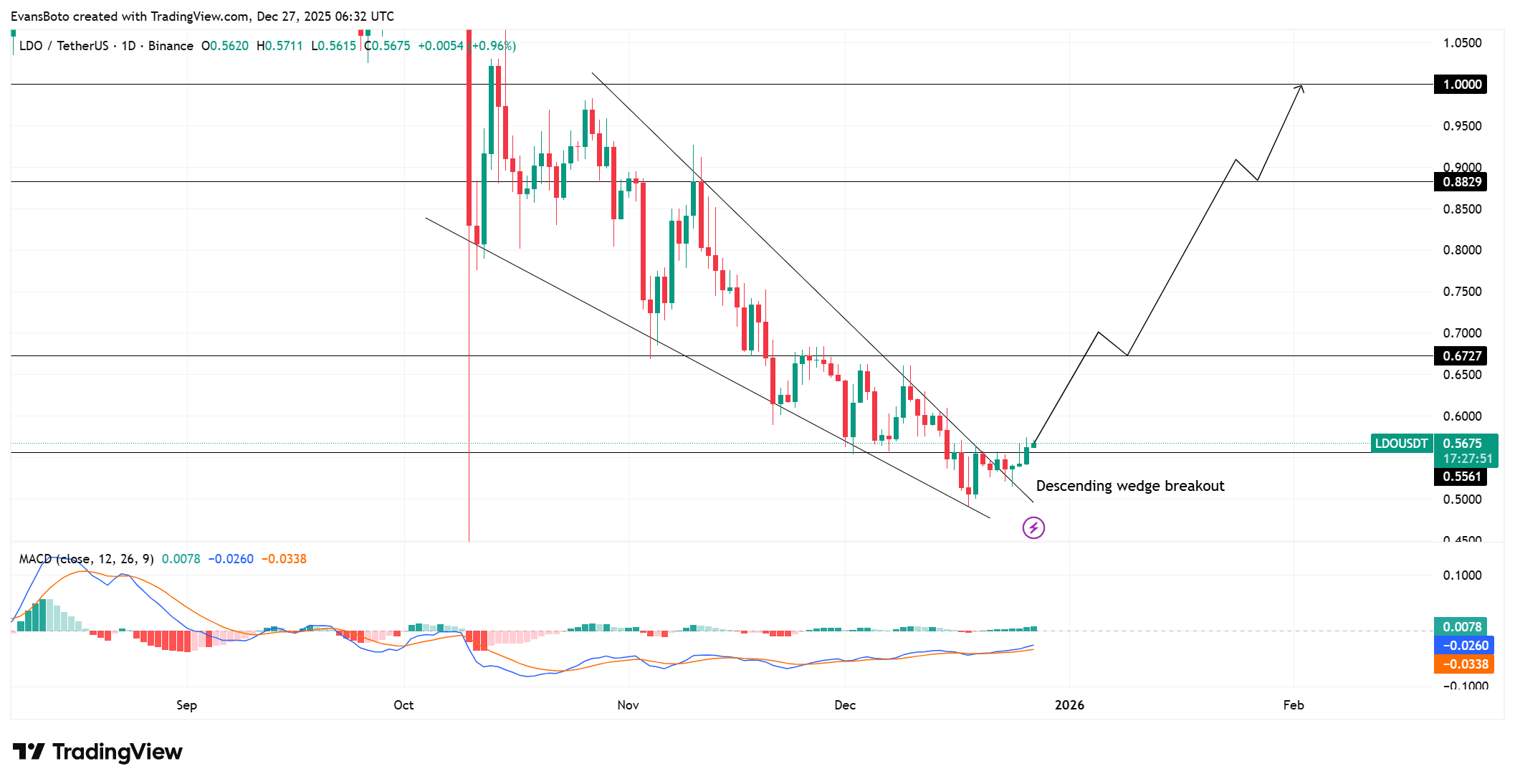

Arthur Hayes goes in on LDO, PENDLE – Is a DeFi rally taking shape?

XRP ETFs Pause Raises Questions About Market Dynamics

Fusionist’s ACE Holds Above Trendline After 6.4% Jump as Price Tests $0.2862 Resistance