There’s more!

Tom Lee’s Bitmine staked 74,880 ETH worth $219 million. So, there is tons of confidence in Ethereum’s long-term growth.

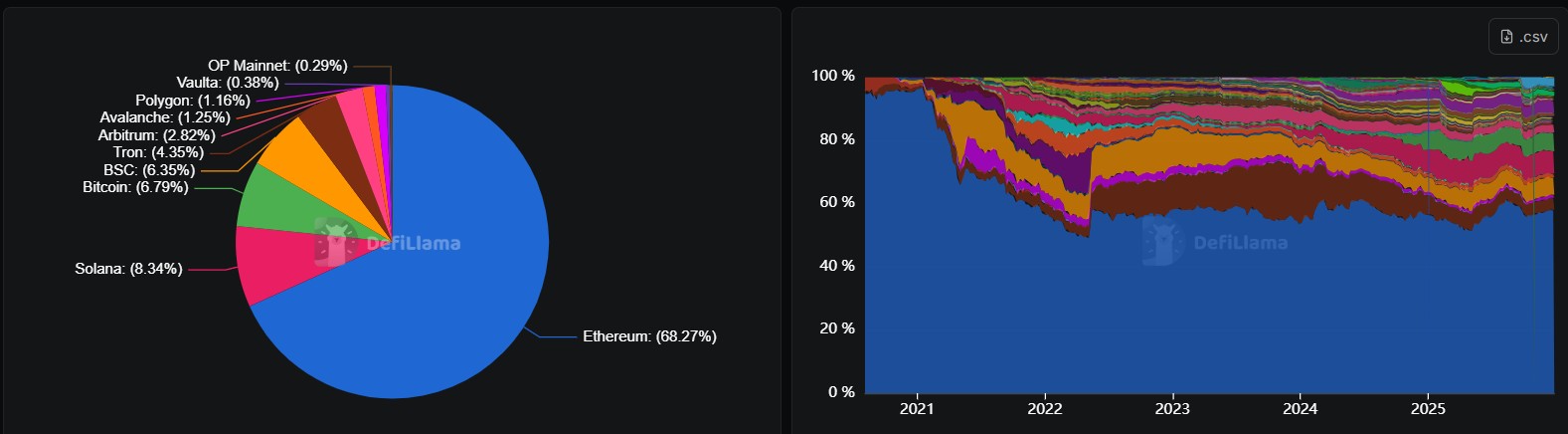

Meanwhile, SharpLink Gaming redeemed 35,627 ETH – A sign that institutional moves are becoming more active and tactical.

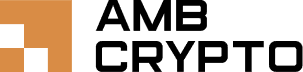

This fits the greater trend. Ethereum’s share of DeFi hasn’t weakened despite capital rotating. Instead, the big players are learning to work within the system.

What’s driving the price narrative?

While its fundamentals anchor Ethereum, price action is being influenced elsewhere… in derivatives.

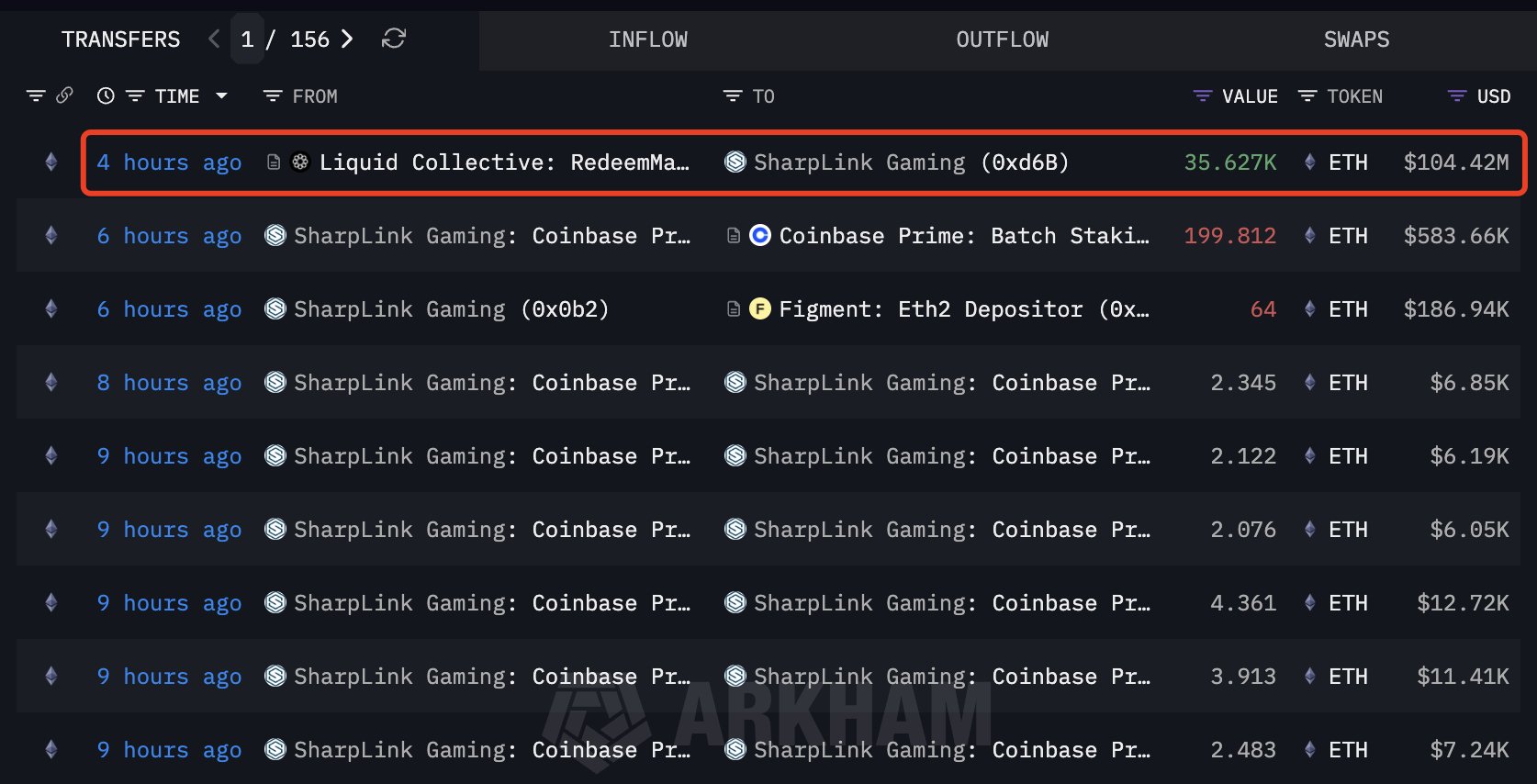

In 2025, ETH Futures activity went up to record levels. Binance alone saw over $6.7 trillion in ETH Futures volume, nearly double last year.

Other exchanges like OKX, Bybit, and Bitget followed the same pattern, confirming that speculation has been creating pace.

The imbalance is pretty striking. According to analyst Darkfost on X, for every $1 in spot ETH, nearly $5 flows into Futures.

This level of leverage explains why price moves feel chaotic and unstable, even as Ethereum’s fundamentals remain unshaken.

Final Thoughts

- Ethereum controls 68% of DeFi TVL and 70% with L2s.

- ETH’s price is being driven by record leverage, explaining volatility and market disconnect.