Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history. While UNI has only posted modest gains so far, the combination of a major supply reduction and a constructive long-term chart suggests UNI may be approaching a pivotal inflection point — one that could define its direction well into 2026 if confirmed.

Source: Coinmarketcap

Source: Coinmarketcap

Uniswap Executes Major UNI Token Burn

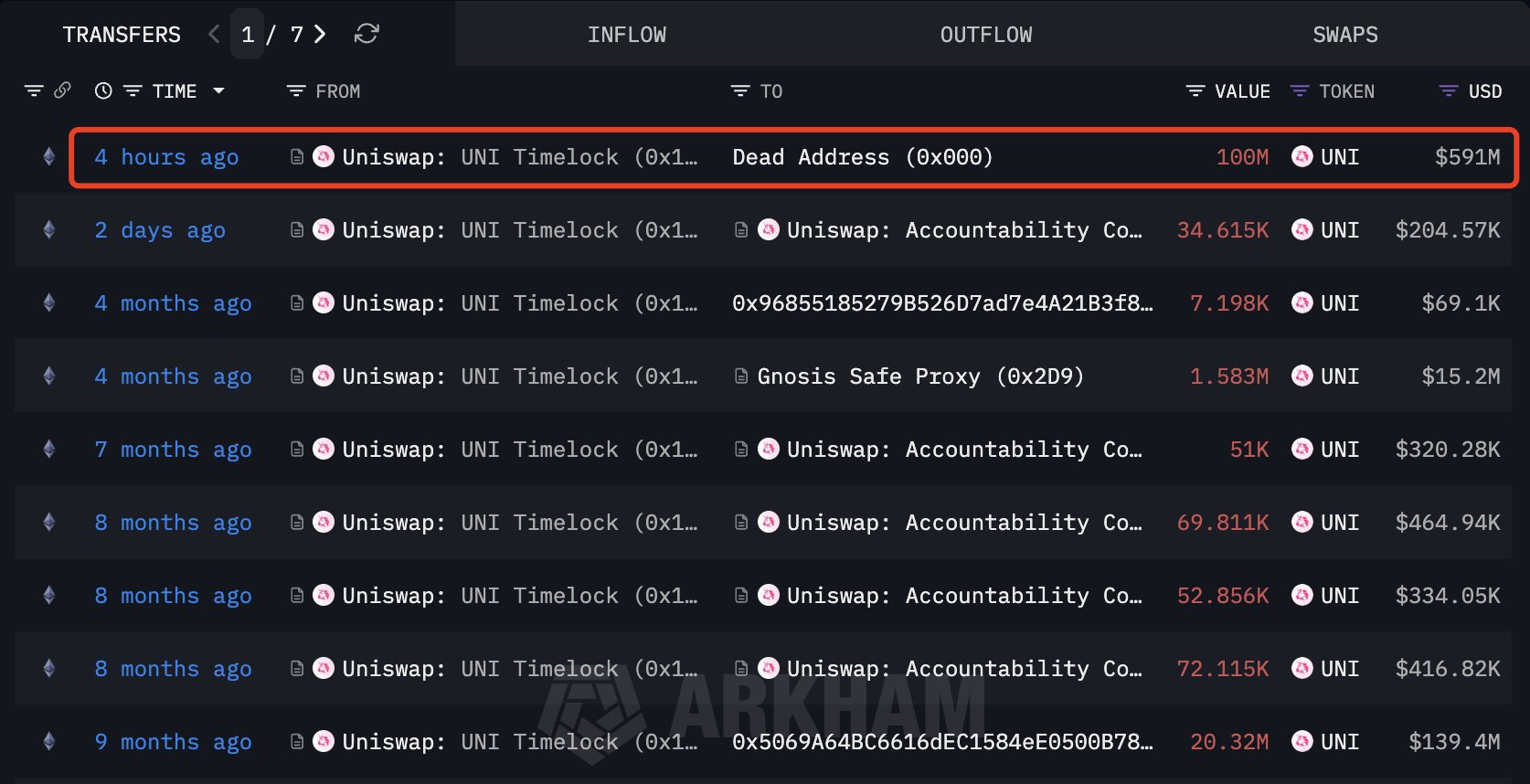

On December 28, 2025, Uniswap’s treasury carried out a massive on-chain burn of 100 million UNI tokens, valued at roughly $591–594 million at the time. This move followed the near-unanimous approval of the “UNIfication” governance proposal on December 25, which passed with 99.9% support.

$UNI Token Burn/Source: @lookonchain (X)

$UNI Token Burn/Source: @lookonchain (X)

As a result, circulating supply has been reduced meaningfully, from around 630 million UNI to roughly 530 million. Combined with the removal of Uniswap Labs’ interface fees and the consolidation of operations, this marks a clear shift toward long-term value accrual for UNI holders.

Could This Bullish Pattern Signal Further Gains?

From a technical perspective, UNI’s weekly chart is showing a classic double bottom formation — a bullish reversal pattern that often appears near the end of extended downtrends.

The first bottom formed in April when UNI dipped into the $4.70 region, followed by a recovery that carried price toward the neckline resistance near $12.28 in August. That level proved too strong at the time, triggering a pullback that eventually led to a second retest of the same $4.70 support zone.

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

Importantly, buyers stepped in once again. UNI defended this level convincingly and has since rebounded to around $6.19. The repeated rejection of lower prices suggests that selling pressure is drying up and that long-term accumulation may be underway.

What’s Next for UNI?

For the bullish scenario to gain traction, UNI must reclaim the 200-week moving average, currently sitting near $7.35. This level has acted as a key barrier during previous recovery attempts, and flipping it into support would signal a meaningful shift in momentum.

Beyond that, the $12.28 neckline remains the critical confirmation level. A decisive breakout above this resistance — ideally followed by a successful retest — would complete the double bottom pattern and significantly strengthen the bullish case.

If that confirmation occurs, the measured move from the pattern projects a long-term upside target near $19.87. Reaching this level would represent a substantial expansion from current prices and align with broader trend recovery expectations if market conditions remain supportive.

For now, UNI appears to be in a rebuilding phase. With supply dynamics turning deflationary and price holding a well-established support base, the coming weeks may prove crucial in determining whether this setup evolves into a full-scale trend reversal.