- XRP: Strong support near $1.90 signals resilience and potential move toward $3.00.

- ADA: Approaching key accumulation zone with Midnight L2 launch supporting a possible trend reversal.

- BNB: Consolidation above $825 hints at bullish breakout toward $1,000 and prior highs.

Some altcoins continue drawing attention despite uneven market conditions. Smart money often looks for resilience, strong support zones, and clear technical signals. Ripple, Cardano, and Binance Coin fit that profile. Each project shows signs of stability or recovery while others struggle. Long-term fundamentals support current price action. Quiet accumulation often happens during such phases. These three altcoins highlight where experienced traders currently focus attention.

Ripple (XRP)

Source: Trading View

Source: Trading View

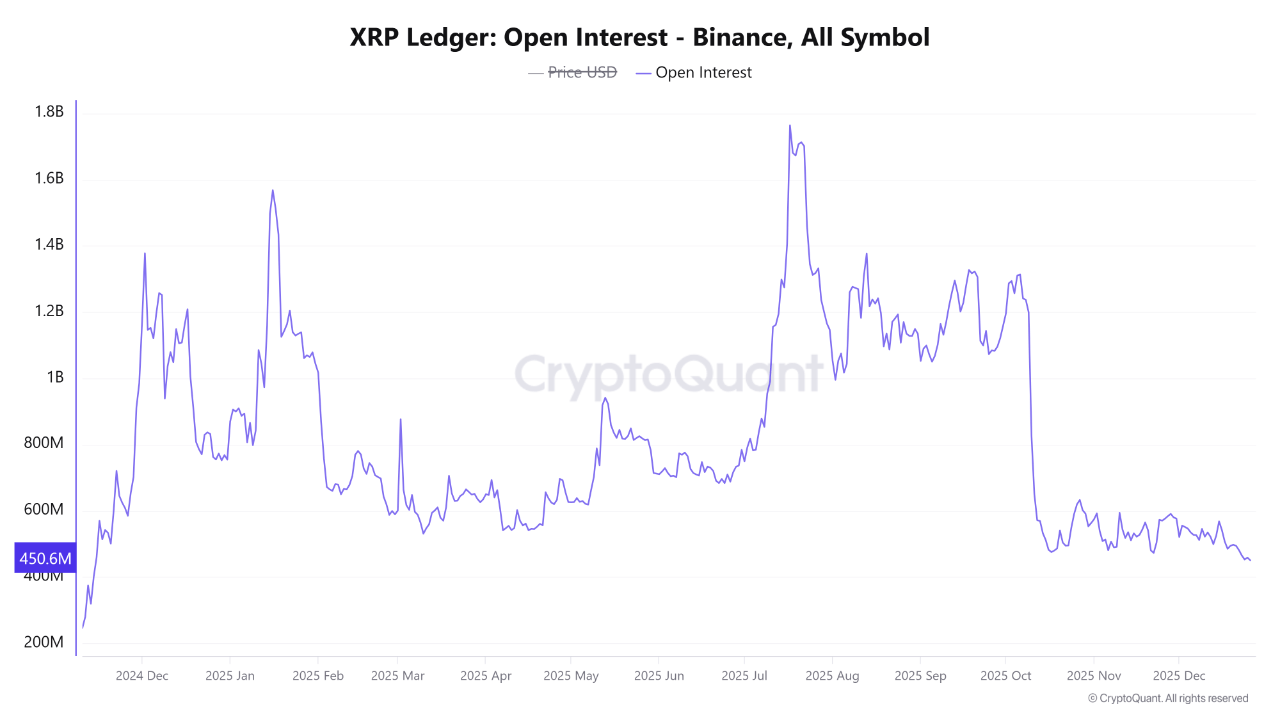

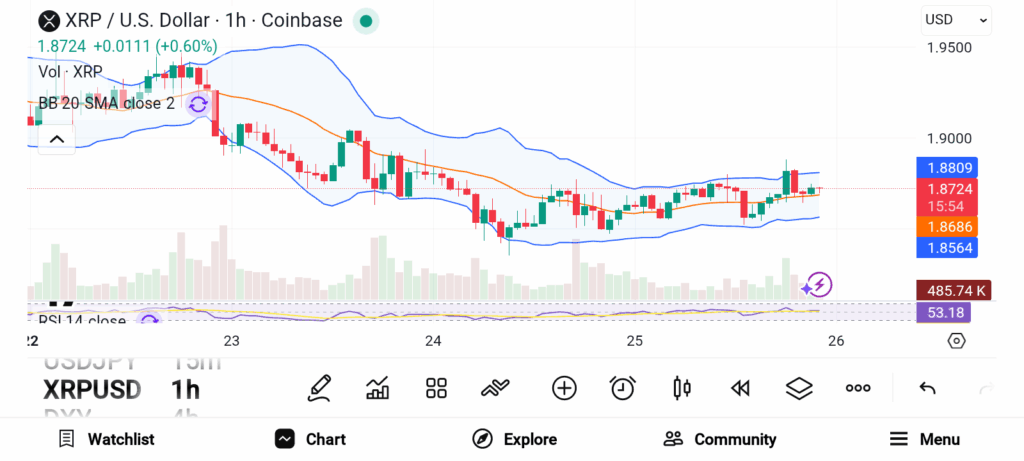

Ripple’s XRP showed notable strength during the recent market downturn. XRP declined only modestly across 2025 compared with many major altcoins. Several competitors lost over one third of total market value. That relative stability caught trader attention. Recent price action confirmed strong buyer interest near the $1.90 level. XRP bounced from a long-standing support trend line at that zone. Previous reactions from this area delivered strong rallies.

Buyers continue defending this demand zone with confidence. Current recovery attempts suggest renewed momentum. A break above $2.20 could open a path toward $3.00. Such a move would confirm bullish control. Strong fundamentals and clear technical levels continue attracting patient capital. XRP remains one of the most closely watched large-cap altcoins.

Cardano (ADA)

Source: Trading View

Source: Trading View

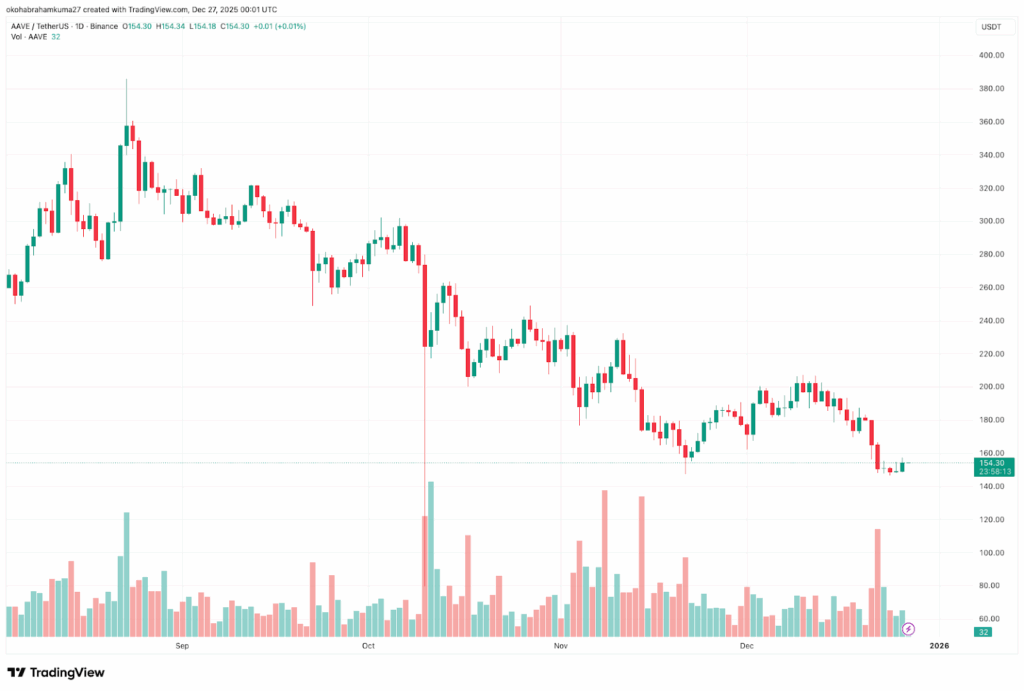

Cardano faced heavy selling pressure during recent months. Prices have declined steadily since early October. That move created a descending channel pattern on the chart. Such structures often precede major trend changes. ADA now approaches a historic accumulation zone. Large buyers previously accumulated heavily between $0.30 and $0.35. This range continues acting as a key support area. The launch of Midnight L2 adds another positive factor.

Midnight introduces privacy-focused Layer-2 functionality to the Cardano ecosystem. That development could shift long-term perception. A push above $0.40 would signal trend reversal confirmation. Such a breakout could target $0.60 during early recovery. That move offers attractive upside potential for short-term traders. Cardano fundamentals continue strengthening despite recent weakness.

Binance Coin (BNB)

Source: Trading View

Source: Trading View

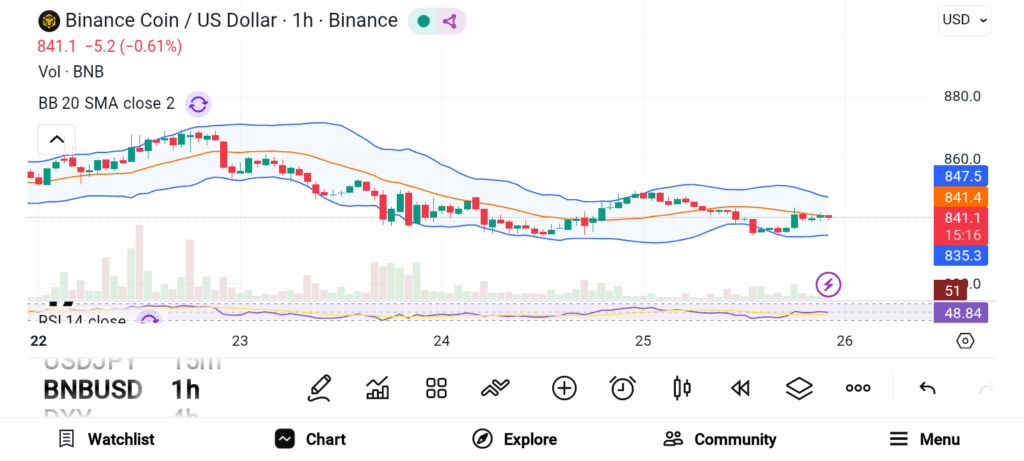

Binance Coin surprised many traders in 2025. Price reached a new all-time high near $1,360. That performance placed BNB ahead of other top-five cryptocurrencies. Year-to-date gains exceeded 21 percent despite market pressure. Technical structure now shows consolidation rather than weakness. BNB found strong demand around the $825 level.

Repeated bounces from this zone formed a descending triangle pattern. Such formations often resolve with strong directional moves. A breakout above $900 would confirm bullish continuation. That move could send the price toward $1,000 quickly. Sustained momentum could retest the $1,360 high. Strong exchange utility continues supporting long-term demand.

Smart money often accumulates during quiet market phases. XRP shows resilience near a proven demand zone. ADA approaches a key accumulation range with fresh network developments. BNB consolidates after strong yearly performance. These altcoins remain worth watching as market confidence slowly rebuilds.