Bitcoin isn’t moving the way it should. While global liquidity keeps expanding, BTC’s numbers look a bit different. Traders seem to be cautious, and the blind faith needed is still missing.

So where do we go from here?

Liquidity is booming, BTC is not following

Global money supply is at record highs. The US, China, Japan, and the Eurozone have all expanded M2 to new peaks, so there’s abundant liquidity across major economies.

So far, this setup has favored risk assets like Bitcoin. Yet, BTC remains nearly 30% below its all-time high.

Liquidity is rising, but it hasn’t yet reached the speculative markets yet. Instead, capital is waiting it out as uncertainty and tight financial conditions persist.

When liquidity eventually rotates into risk assets, Bitcoin [BTC] is sure to make a move up.

Is it too early?

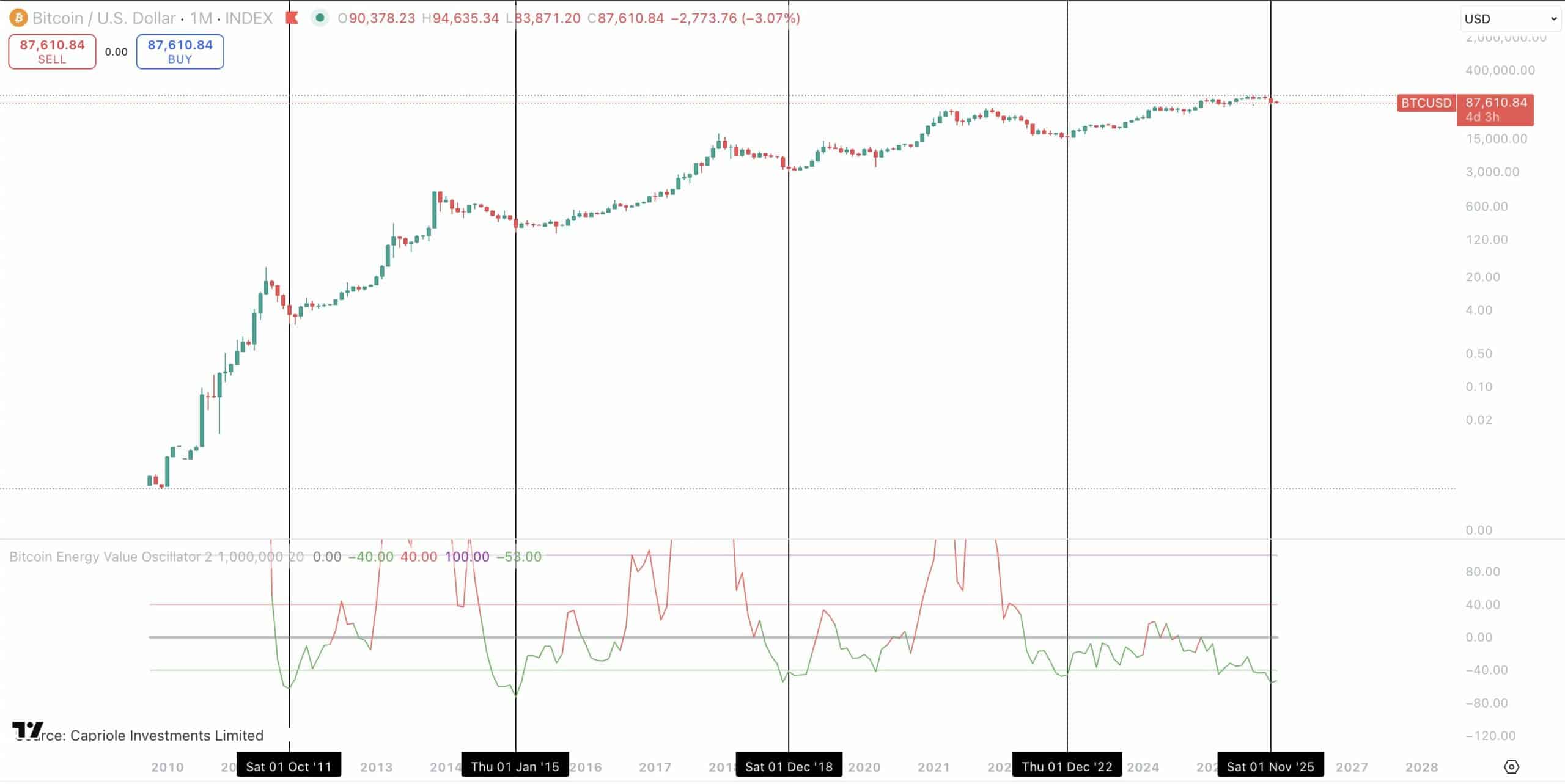

The Energy Value Oscillator shows BTC at levels last seen a decade ago, when the market was building its next major cycle. This metric tracks the energy poured into the network through mining and hash power.

Deep lows have usually meant long-term bottoms. Not tops.

This cycle has never entered the overheated “red zone,” seen during past bull market peaks.

That fits with what we’re seeing elsewhere; tighter liquidity, a slow moving business cycle, and risk assets that haven’t fully picked up. The pressure is building towards something, and the big picture remains to be seen.