Date: Mon, Dec 29, 2025 | 06:36 AM GMT

The broader cryptocurrency market has kicked off the final week of 2025 with modest strength, as Bitcoin (BTC) reclaimed the $90,000 mark while Ethereum (ETH) trades over 3% higher. This improving backdrop has helped stabilize market sentiment, allowing notable Aptos (APT) — to begin forming constructive technical structures.

APT is trading with a modest intraday gain, but more importantly, its daily chart is now signaling a meaningful structural shift — one that could mark the early stages of a bullish continuation if confirmed.

Source: Coinmarketcap

Source: Coinmarketcap

Rounding Bottom in Play

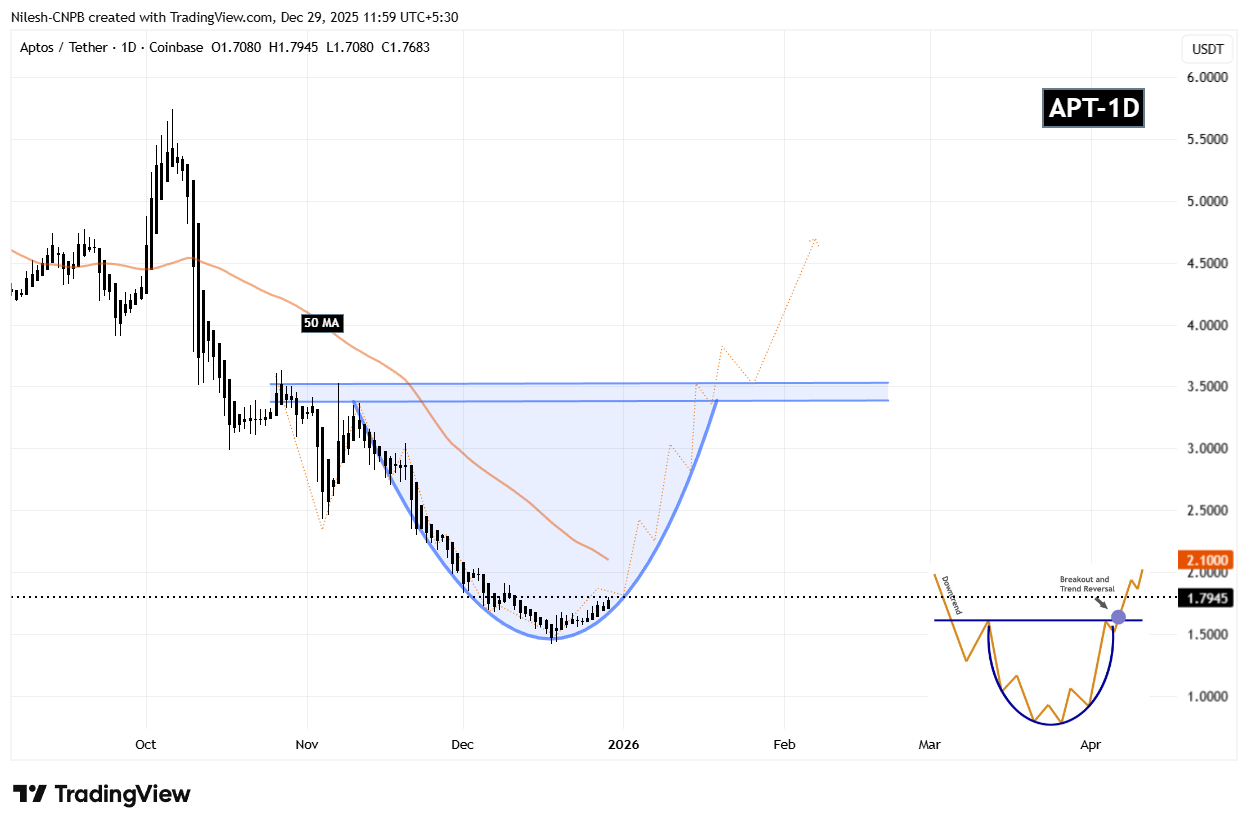

On the daily timeframe, Aptos appears to be shaping a textbook rounding bottom formation — a classic bullish reversal pattern that typically emerges after an extended period of downside pressure. This structure reflects a gradual transition from distribution to accumulation, where sellers lose control and buyers quietly begin to step in.

APT previously faced strong rejection near the $3.08 neckline zone before entering a sharp decline that eventually bottomed out near $1.42. This area acted as a critical demand zone, where price repeatedly found support, preventing any deeper breakdown and laying the groundwork for a potential trend reversal.

Aptos (APT) Daily Chart/Coinsprobe (Source: Tradingview)

Aptos (APT) Daily Chart/Coinsprobe (Source: Tradingview)

Since establishing that base, APT has begun curving higher in a rounded fashion, signaling that selling pressure is fading. The steady recovery back toward the $1.79 region suggests that accumulation is underway and that the market is slowly preparing for a larger move.

What’s Next for APT?

For the rounding bottom pattern to fully activate, APT must reclaim the 50-day moving average, currently positioned near $2.10. A decisive move above this level would mark a key momentum shift, confirming that buyers are regaining control after months of corrective price action.

Beyond that, the major technical hurdle remains the neckline resistance around $3.08. A clean breakout above this zone would validate the entire reversal structure and could open the door for a broader bullish expansion phase, with momentum traders likely re-entering the market.

Until those levels are reclaimed, the pattern remains in development. Short-term pullbacks or consolidation are still possible if APT struggles at the 50-day MA, but as long as price continues to hold higher lows above the $1.42 base, the broader bottoming structure remains intact.

Overall, Aptos is approaching a technically important inflection point. The rounding bottom formation, improving structure, and proximity to key resistance levels suggest the coming sessions could prove decisive for the token’s next directional move.