SoftBank eyes DigitalBridge in new AI data center land grab

SoftBank is in advanced talks to acquire DigitalBridge, sending DBRG shares sharply higher as the conglomerate doubles down on AI-driven digital infrastructure.

- SoftBank is reportedly in advanced but not final talks to buy DigitalBridge, with a formal announcement possible within days.

- DigitalBridge manages about $108b in digital infrastructure assets, including data centers and edge networks, and its stock spiked on the takeover report.

- A deal would mark SoftBank’s second major asset manager purchase after Fortress, reinforcing its strategy to dominate AI-era compute and infrastructure.

DigitalBridge Group shares surged in premarket trading on Monday, December 29, 2025, following reports that SoftBank Group Corp. is in advanced talks to acquire the digital infrastructure investment firm, according to Bloomberg.

SoftBank deal with DigitalBridge

The potential acquisition aligns with SoftBank’s strategy to expand its presence in data centers and digital infrastructure assets amid increased demand driven by artificial intelligence applications, the report stated.

SoftBank is in advanced discussions to acquire DigitalBridge, a private equity firm that invests in data centers, fiber networks, cell towers, and edge infrastructure, Bloomberg reported, citing sources familiar with the negotiations. The sources said talks are advanced but not final, and details including the timing of any announcement could still change. Transaction terms have not been disclosed.

DigitalBridge, led by CEO Marc Ganzi, manages approximately $108 billion of infrastructure assets on behalf of its limited partners and shareholders, according to company information. The firm’s portfolio includes operators such as DataBank, Switch, Vantage Data Centers, and Yondr Group.

Representatives for both SoftBank and DigitalBridge did not immediately respond to requests for comment, according to the report.

The potential transaction would mark SoftBank’s second major asset management acquisition, following its earlier purchase of Fortress Investment Group. DigitalBridge shares have experienced volatility throughout the year, with previous reports of takeover discussions triggering significant price movements.

Several analysts have maintained outperform ratings on DigitalBridge and revised price targets in recent weeks, according to market data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

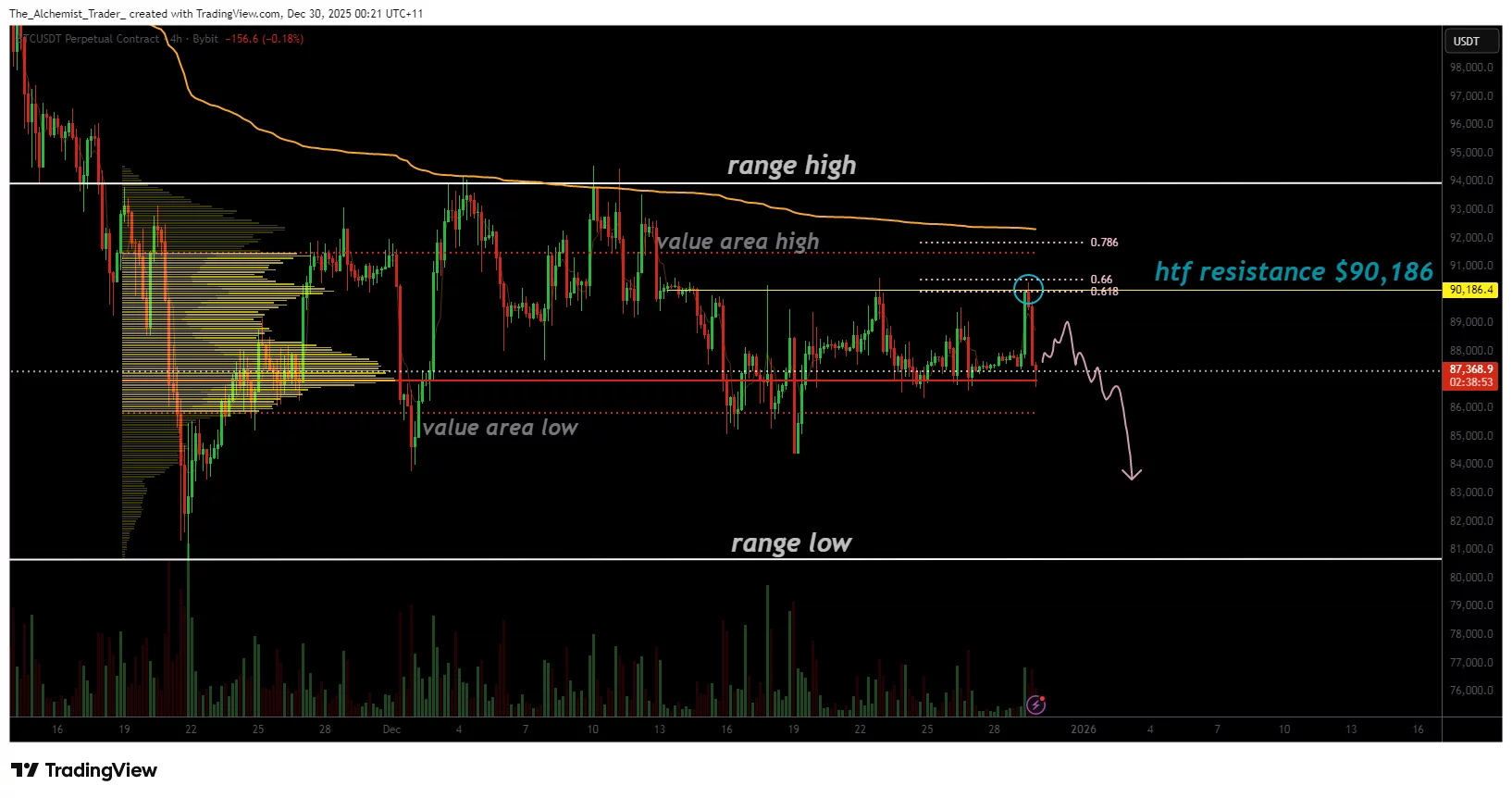

Bitcoin price hits $90k wall—and the floor may be $80k

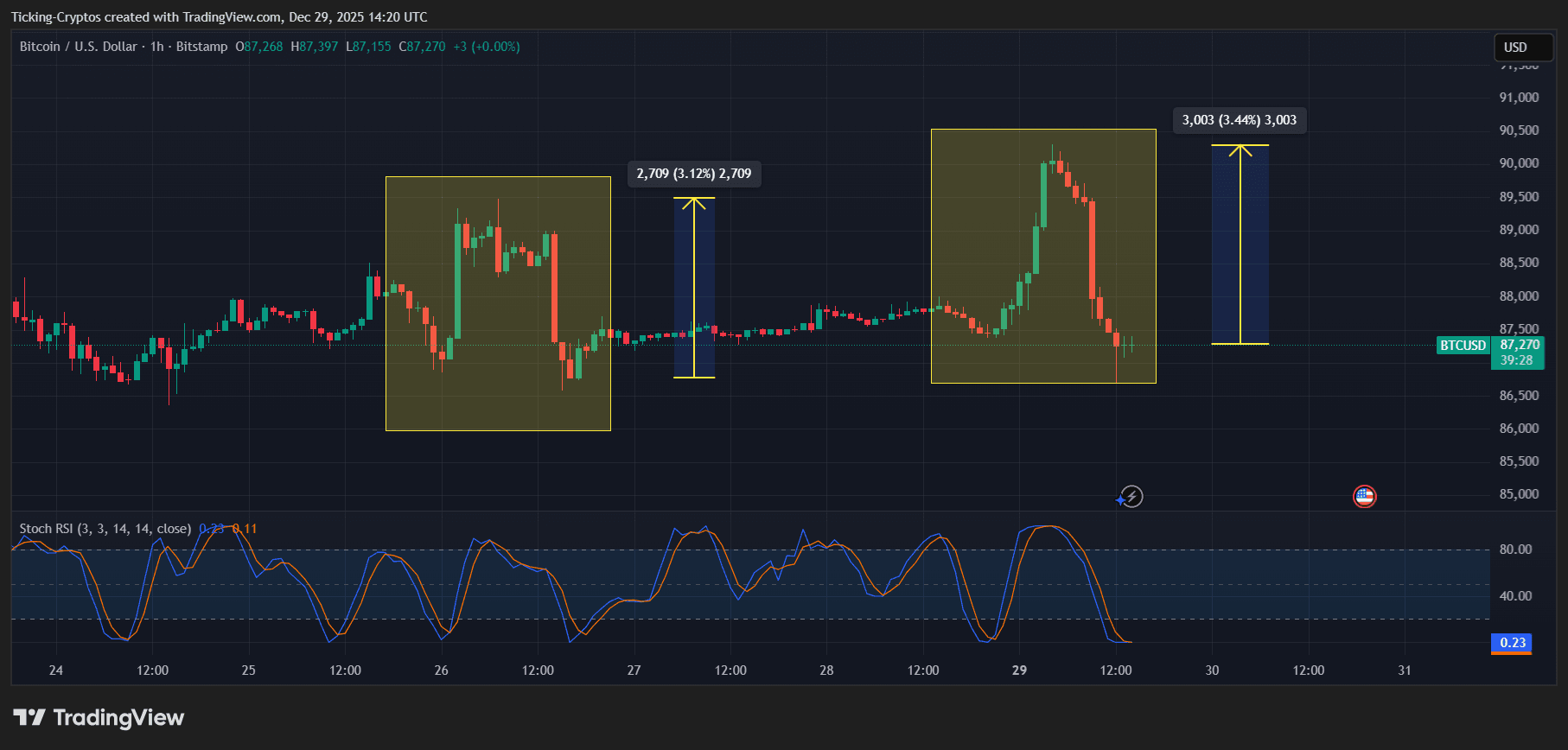

Bitcoin Price Swings: Market Manipulation or Just How Trading Works?

Analyst Turns Bearish on Ethereum, Bullish on XRP’s All-Time High Return