Digital Asset Funds See Mixed Flows Amid Ongoing Market Caution

Quick Breakdown

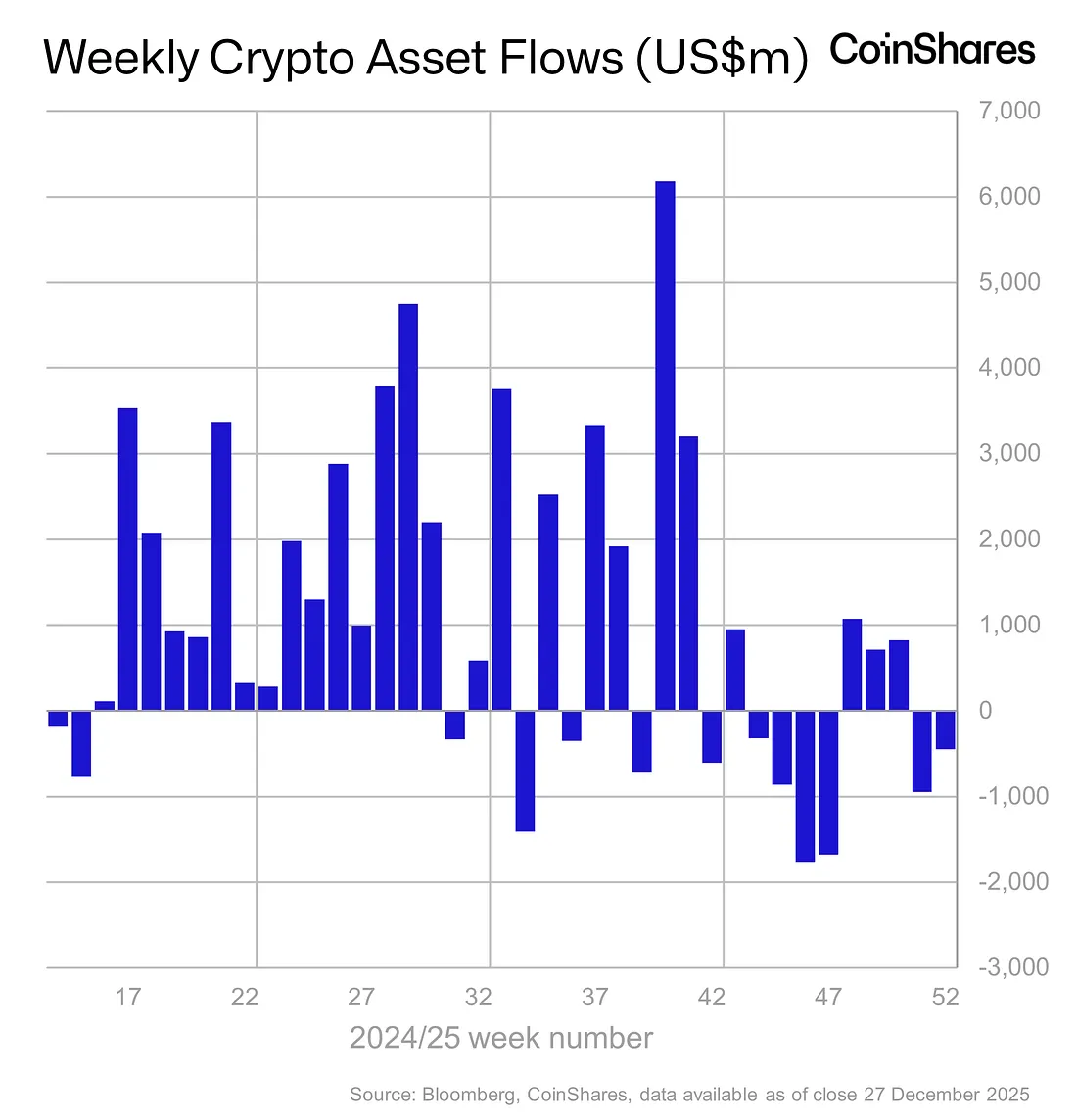

- Digital asset funds experience US$446 million outflows, totalling US$3.2B since October 10.

- Germany sees inflows while the US and Switzerland record outflows.

- XRP and Solana ETFs gain, Bitcoin and Ethereum continue to see withdrawals.

Digital asset investment products recorded US$446 million in outflows last week, pushing total withdrawals since the October 10 market drop to US$3.2 billion, according to CoinShares. Despite this, year-to-date inflows remain resilient at US$46.3 billion, only slightly below last year’s US$48.7 billion, highlighting ongoing investor engagement despite lingering caution. Total assets under management (AuM) have grown 10% YTD, reflecting modest gains for the average investor after accounting for recent outflows.

Source

:

CoinShares Research Blog

Source

:

CoinShares Research Blog

Regional flows highlight divergent investor sentiment

Outflows were concentrated in the United States, with US$460 million withdrawn, while Switzerland experienced minor outflows of US$14.2 million. Germany, however, stood out with inflows of US$35.7 million, bringing its monthly total to US$248 million. Analysts suggest German investors are selectively accumulating positions during the recent price weakness, indicating a differentiated regional appetite for digital assets.

Asset-specific trends show continued interest in XRP and solana

CoinShares data shows that XRP and Solana ETFs continue to attract inflows, totaling US$70.2 million and US$7.5 million last week, respectively. Since their US ETF launches in mid-October, XRP and Solana have drawn US$1.07 billion and US$1.34 billion in inflows, bucking the negative trend seen in other digital assets. By contrast, Bitcoin and Ethereum experienced outflows of US$443 million and US$59.5 million last week, with cumulative outflows since the ETF launches reaching US$2.8 billion and US$1.6 billion, respectively.

The mixed flow patterns reflect ongoing caution among investors, with sentiment showing fragility despite strong inflows earlier in the year. Market watchers note that inflows into alternative tokens such as XRP and Solana suggest selective confidence in certain digital assets, while broader market hesitancy persists for major cryptocurrencies.

Notably, CoinShares forecasts that tokenized real-world assets will anchor the next wave of crypto adoption in 2026. The firm expects RWAs, particularly tokenized US Treasuries, to attract trillions of dollars in institutional capital as investors seek higher yields, on-chain transparency, and settlement efficiency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cangoo Investment: Strategic $10.5M Boost from Major Shareholder Fortifies Bitcoin Mining Giant

Bitcoin Price Movements: The Revealing Truth Behind Recent ‘Heartbeat Trades’ and Tax Strategy

Bitcoin Investment Returns: Peter Schiff’s Shocking 3% Annual Yield Revelation for 5-Year Strategy

Hyperliquid Labs set for first HYPE token payout as 1.2 million tokens unstake