XRP funds up despite crypto ETPs posting $446 million in weekly outflows: CoinShares

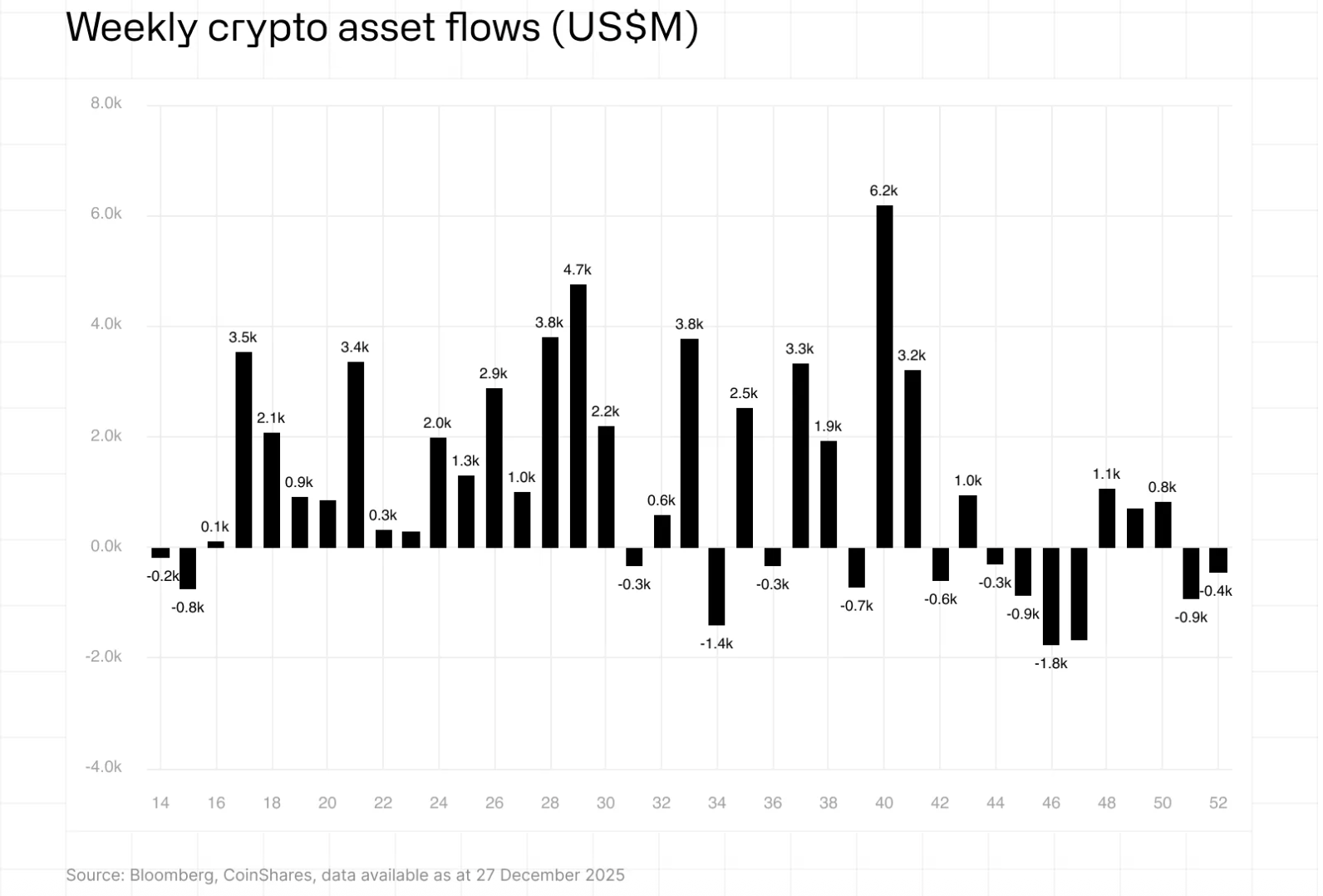

Short of XRP exchange-traded funds racking up $70 million in capital inflows, the crypto fund market took a bearish turn for the second week in a row, with overall crypto ETPs registering $446 million in outflows, according to CoinShares.

Principally led by investors selling out of Bitcoin and Ethereum-based products, total outflows from crypto ETPs rose to $3.2 billion since the market shock on Oct. 10, CoinShares said. Last week, after three consecutive weeks of inflows, the market reversed, posting $952 million in outflows.

"This suggests investor sentiment has yet to fully recover," CoinShares said. "Year-to-date (YTD) flows, however, remain broadly in line with last year, with inflows totaling $46.3. billion compared to $48.7 billion in 2024. Total assets under management (AUM) have risen by just 10% YTD, indicating that the average investor has not seen a positive outcome this year once flows are taken into account."

October's flash crash, thought to be the crypto market's largest liquidation event to date, was triggered, in part, by U.S. President Donald Trump threatening a 100% tariff on imports from China. The scale of the liquidations seemed to include the involvement of larger institutional players or market makers.

Last weeks outflows were led by Bitcoin ETPs shedding nearly $443 million and Ethereum products losing $59 million. The lone bright spots were XRP and Solana funds taking in a relatively meager $70 million and $7.5 million, respectively. Franklin Templeton's XRP ETF, launched in late November, brought in $28.6 million.

Weekly crypto asset flows. Image: CoinShares.

Germany on the upswing

With all of the biggest Bitcoin and Ethereum ETPs listed in the U.S., the American market once again led globally with outflows of $460 million. Switzerland ranked second in outflows with $14 million.

"Germany was the notable exception, attracting inflows of $35.7 million," CoinShares said, adding that the nation saw inflows of $248 million, which suggests "investors there are using recent price weakness as an opportunity to accumulate positions."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Social media follower counts have never mattered less, creator economy execs say

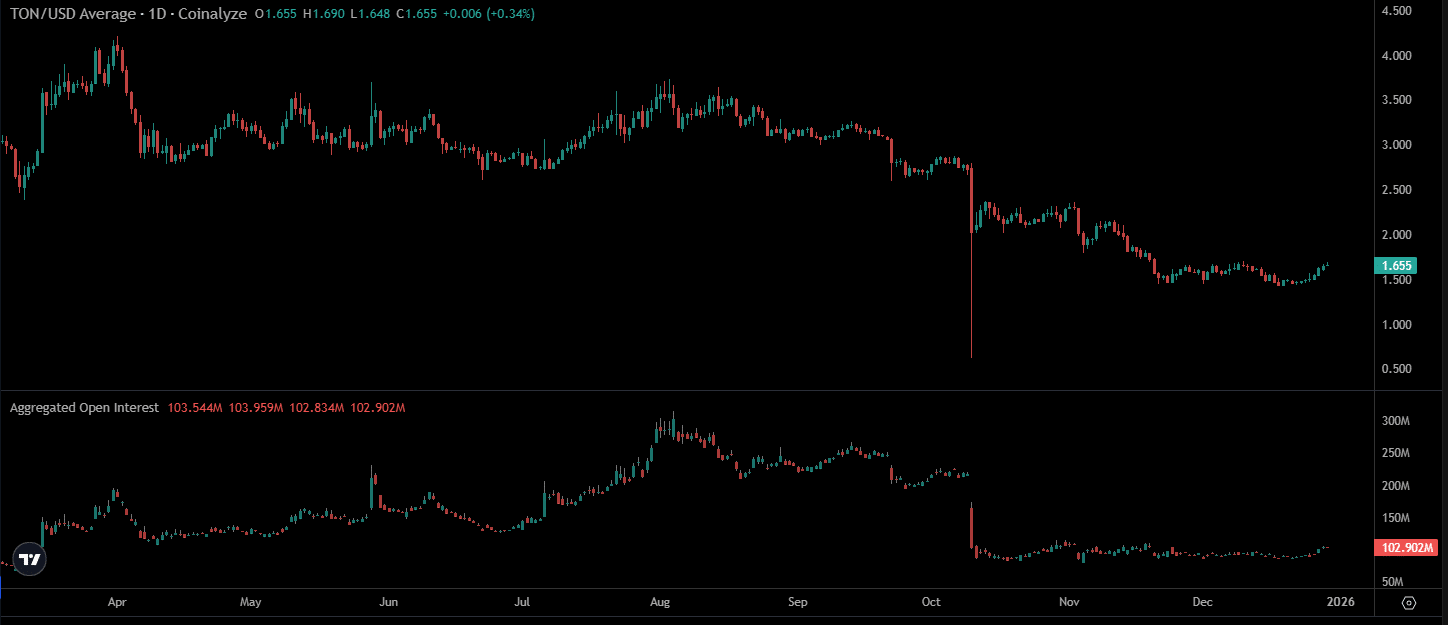

Can Toncoin break above $1.705 and extend its rally? Examining…

Despite All The Positive Developments, Why Has the Expected “Trump Rally” in Bitcoin Not Happened This Year?

Crypto Stabilization 2025: Cantor Fitzgerald Predicts Resilient Growth Amid Market Volatility