The Great BNB Meme Coin Crash: What Went Wrong?

In early October 2025, the BNB Chain found itself at the center of one of the most dramatic meme coin meltdowns in crypto history. Just weeks earlier, the ecosystem had been buzzing with excitement as thousands of new tokens flooded the market, each promising to be the next big thing. Coins like 币安人生 (Binance Life), BNB Meme Szn, and PALU exploded in value, drawing in tens of thousands of traders hoping to ride the latest wave of meme-fueled gains. For a moment, it felt like the BNB Chain had captured lightning in a bottle — a “Meme Season” that would rival Solana’s earlier rallies and inject fresh energy into the Binance ecosystem.

But the euphoria didn’t last. Practically overnight, the meme coin market on BNB collapsed, with most tokens plunging 60–95% in value. Millions in capital evaporated in hours, and once-viral projects became ghost towns. What went wrong? From whale-controlled liquidity pools to misplaced hype, a perfect storm of speculation, timing, and human psychology led to the Great BNB Meme Coin Crash of 2025.

The BNB Meme Coin Frenzy

Source: X

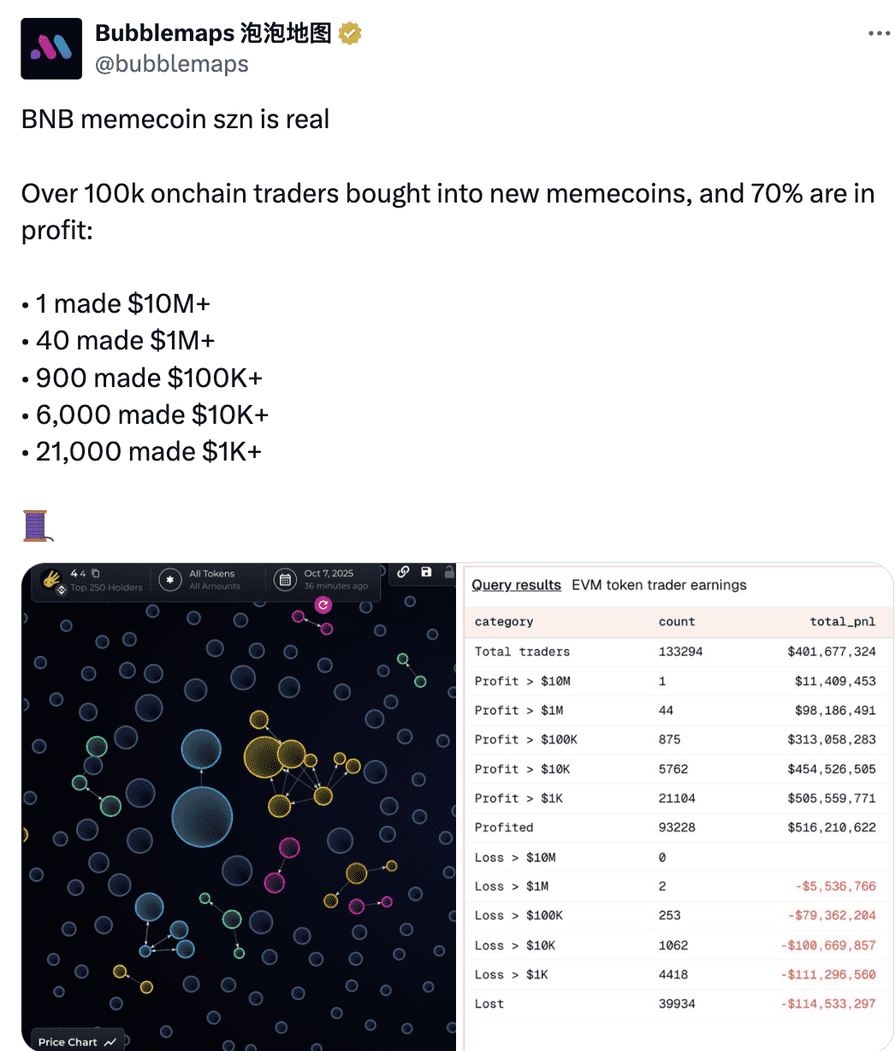

Before the crash came the mania. In late September and early October 2025, the BNB Chain became the hottest corner of the crypto world, as thousands of meme coins launched almost daily. Traders piled in, hoping to catch lightning in a bottle — chasing tokens that promised dizzying gains with names inspired by pop culture, internet jokes, and even inside references to Binance itself.

What fueled the frenzy was how easy it had become to create and trade these tokens. Platforms like Four.Meme, a no-code token launchpad, allowed anyone to deploy a coin in minutes, while PancakeSwap provided instant liquidity for speculative trading. The result was a gold rush of activity: trading volumes on the BNB Chain hit record highs — roughly $80 billion in swaps during September and another $30 billion in the first week of October. On-chain data showed that more than 100,000 traders joined the action, with nearly 70% in profit at the market’s peak.

Crypto influencers hyped it as “BNB Meme Szn” — meme season — a moment that seemed to capture the old spirit of retail-driven euphoria. Everywhere you looked, people were minting and flipping coins in hours, and social media was filled with stories of overnight millionaires. But while it all looked unstoppable, cracks were already forming beneath the surface — hidden in shallow liquidity pools and concentrated token holdings that would soon turn the excitement into chaos.

Too Many Sellers, Too Little Support

Source: X

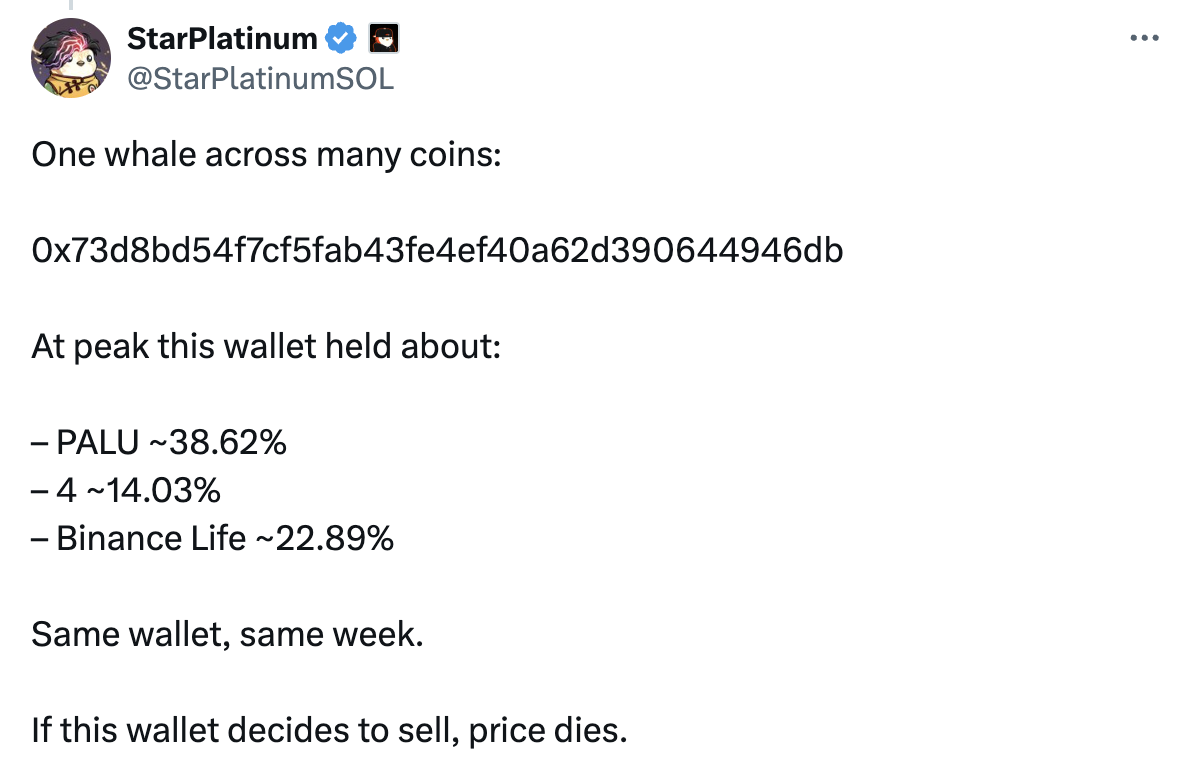

Behind the memes and moon emojis, the market’s foundation was far shakier than most traders realized. Many of the hottest BNB meme coins were built on fragile tokenomics — tiny liquidity pools, unverified contracts, and massive insider allocations. In simple terms, a handful of wallets controlled most of the supply, while the rest of the market traded on scraps.

On-chain data later revealed that in several top-performing tokens, one or two wallets held between 20% and 40% of the total supply. These were the so-called “whales” — early buyers or insiders who could move prices with a single transaction. When those large holders decided to take profits, their sales instantly drained the limited liquidity on decentralized exchanges like PancakeSwap. Some projects had less than 2.5% of their total token supply available in liquidity pools, meaning even modest selling pressure caused prices to collapse within minutes.

This setup created a dangerous feedback loop. Retail traders, encouraged by viral price charts, poured in without realizing how thin the markets really were. Then, as whales began unloading, prices spiraled downward, triggering panic sales from smaller investors. The result was a textbook liquidity crunch — too many sellers, not enough buyers, and no real support to hold prices up. Within hours, dozens of tokens lost 70% or more of their value, exposing just how top-heavy the entire meme market had become.

When the Next Big Thing Triggered a Crash

Just as the hype around BNB meme coins was reaching its peak, Binance introduced a new initiative called “Meme Rush.” The idea sounded like the next evolution of the trend — a curated launchpad where users could discover and invest in new meme projects built on the BNB Chain. It was marketed as a way to bring more transparency, fairness, and structure to a market that had grown wild with speculation.

But in practice, the announcement had an unexpected effect. Rather than stabilizing the ecosystem, Meme Rush triggered a wave of uncertainty. Traders began pulling liquidity from existing meme coins, anticipating that a fresh crop of tokens — potentially better supported and more legitimate — would soon dominate attention. As a result, capital that had been circulating within the existing meme ecosystem started to dry up almost overnight.

Some analysts described it as a “rotation of speculation.” Investors who had made quick profits in older tokens rushed to take them, while new buyers decided to wait for the Meme Rush listings instead. This sudden pause in buying activity hit the fragile market like a shockwave. With liquidity already thin and confidence beginning to slip, prices tumbled even faster. Ironically, an initiative meant to professionalize meme culture on BNB Chain may have accelerated the very crash it hoped to prevent.

CZ’s Tweets and the Market Turning Point

Few figures hold as much sway in the crypto world as Changpeng “CZ” Zhao, the founder of Binance. For better or worse, his words have a history of moving markets — and during the BNB meme coin boom, that influence was on full display. What started as lighthearted social media activity soon became a catalyst for both the rise and the fall of the entire trend.

In late September, CZ shared a few casual posts referencing the growing “BNB Meme Season.” Traders quickly interpreted his tweets as a sign of approval, and the hype exploded. Screenshots of his posts spread across X (formerly Twitter) and Telegram groups, fueling speculation that Binance might one day spotlight these tokens. Within hours of his comments, some meme coins doubled or tripled in value, as traders piled in simply because “CZ tweeted.”

But on October 8, everything flipped. CZ took to social media to clarify that his posts were not endorsements and that any overlap with meme projects was purely coincidental. It was a simple disclaimer — but it landed like a thunderclap. The same investors who had treated his earlier posts as bullish signals suddenly panicked. Liquidity evaporated, sell orders spiked, and meme coins that had been flying high began to nosedive.

For a market already stretched thin and heavily dependent on confidence, CZ’s clarification became the turning point. Traders realized there was no official backing, no insider hint — just speculation feeding on speculation. The moment the illusion broke, the stampede to the exits began. Within a day, dozens of BNB meme coins lost between 60% and 90% of their value.

Market Meltdown — The BNB Meme Collapse

By October 8–10, 2025, the BNB meme coin market had fully entered freefall. After weeks of frenzied buying and social-media-driven hype, the combination of thin liquidity, whale sell-offs, and CZ’s clarifying tweets triggered a massive panic. Within hours, prices across dozens of meme coins plummeted, with many losing 60–95% of their value almost overnight.

Tokens that had skyrocketed in days were now barely trading. Market capitalization for the memecoin sector on BNB Chain fell from roughly $2.1 billion to $1.3 billion, erasing billions in investor capital. Even BNB itself felt the tremors, dipping 3% in price as traders rushed to secure liquidity and exit positions. PancakeSwap recorded a surge in transactions during the crash — a flurry of frantic sell orders overwhelmed thin pools, highlighting just how fragile the ecosystem had become.

The fallout was widespread. Retail traders, many of whom had joined during the peak of the “BNB Meme Szn,” were left holding assets worth a fraction of their original investments. Projects that had once captured headlines vanished from the spotlight, their social-media communities shrinking as quickly as their token balances. Analysts later described the event as a classic speculative bubble bursting: the market’s growth had been fueled by hype, leveraged by whales, and sustained by thin liquidity. Once confidence broke, the momentum reversed violently.

In retrospect, the Great BNB Meme Coin Crash of October 2025 serves as a stark reminder: meme-driven markets can deliver explosive gains — but they can just as quickly evaporate when speculation outruns fundamentals. What had seemed like a boundless, viral rally ended as a cautionary tale of liquidity risk, concentrated power, and the fragility of hype-fueled markets.

Conclusion

The October 2025 BNB meme coin crash was a perfect storm of hype, liquidity fragility, and concentrated power. What began as a playful, social-media-fueled boom — the so-called “BNB Meme Szn” — quickly revealed the market’s vulnerabilities. Whales controlled outsized portions of token supply, liquidity pools were shockingly thin, and even minor shifts in sentiment triggered cascading sell-offs. The introduction of Binance’s Meme Rush launchpad and CZ’s clarifying tweets acted as accelerants, turning a speculative bubble into a full-blown market collapse.

For investors and observers, the event offered a stark lesson about the risks of meme-driven speculation. Explosive gains are possible, but so too is rapid loss — especially when markets are built on hype rather than fundamentals. The Great BNB Meme Coin Crash serves as a reminder that even in the most viral, seemingly unstoppable rallies, confidence is the currency that truly drives prices. When that confidence evaporates, the results can be swift and unforgiving.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.