Lighter Crypto Farming Guide: How to Earn Points & Airdrops, Lighter Crypto TGE Date

Since launching its mainnet and new points farming campaign in October 2025, Lighter has exploded in growth and community interest, drawing comparisons to giants like Hyperliquid and Aster. In this article, you'll discover what Lighter is, how to participate in Lighter crypto farming, how the protocol works, what makes Lighter stand out, the current status of the platform, TGE (Token Generation Event) timelines, the project’s legitimacy, its risks, and the best strategies for maximizing your rewards.

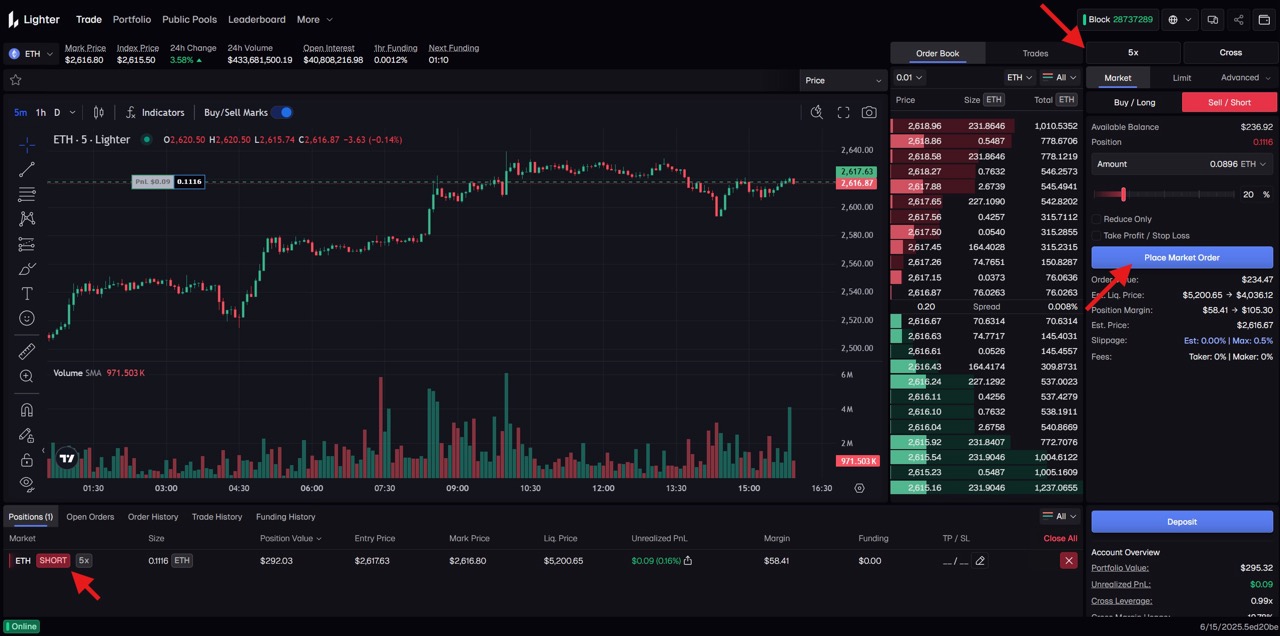

How to Farm Lighter Points

Getting Started

- Go to the official Lighter platform at: https://app.lighter.xyz/trade/

-

Connect your Ethereum wallet and log in.

-

Choose the “Public Pool” and select LLP as your liquidity token, then deposit funds.

-

Start trading perpetual futures—your trading volume and activity will generate points.

Points Farming Mechanics

-

Points are earned primarily through real trading activity (volume, order type, and participation).

-

The referral program is active: invite users and earn 25% of their points.

-

Every Tuesday, 250,000 points are distributed for season 2.

-

There are currently no official details on the public points formula, but an announcement is expected soon.

-

Sybil attacks, multi-account brushing, and similar manipulations are strictly filtered; suspected abusers will be disqualified from rewards.

Notes:

-

Normal short-term trading is not penalized, but repeated, meaningless “in-and-out” trading (instant open & close orders, i.e., “wash trading”) may flag your account as a Sybil and block future orders.

-

The points system is designed to encourage real user activity and avoid the “black box” ambiguity of private testing.

What is Lighter?

Lighter is an Ethereum-native Layer 2 DEX protocol for perpetual futures, blending CEX-grade speed and liquidity with DEX-level transparency and verifiability. Unlike rivals like Hyperliquid (which built its own L1), Lighter opted for Ethereum L2 to take advantage of open composability, and integrates closely with protocols like Aave.

The main features:

-

Self-developed ZK matching engine: Every trade and liquidation is cryptographically proven on-chain for fairness.

-

Impressive speed: Execution aims to match high-frequency trading standards, with much lower fees and latency compared to regular DEXs.

-

Retail-friendly fee policy: Most users pay nearly zero fees, while institutions and API HFTs pay for premium access.

How Does It Work?

ZK-Rollup Engine

Lighter’s matching and clearing occur in a single L2 sequencer (like a CEX for speed), but each action is submitted on L1 with a ZK proof—so users get the best of both worlds: speed and real transparency. Orders are matched by price-time priority, verifiably and without hidden manipulation. Unlike DYDX (which still has off-chain opacity), or Hyperliquid (which is closed to Ethereum), Lighter brings the entire order book experience to Ethereum with full composability.

Security Model

-

Layer 1 (Ethereum mainnet): All user assets remain custodied in audited smart contracts.

-

Layer 2 (Lighter network): Handles matching and trading. If L2 ever fails, users can claim assets via emergency withdrawal on L1.

LLP Public Liquidity Pool

Funds you deposit into LLP not only provide market liquidity and absorb liquidation loss (like an insurance fund), but future versions are expected to allow using LLP shares as margin—leveraging idle capital to earn in two ways (as seen with Aster/USDF). Risk control is critical for this feature and still under development.

Zero-Fee Structure

Lighter offers all retail traders zero maker/taker fees, reducing entry barriers and boosting organic participation, but charges for premium access, fast APIs, and advanced features.

What Makes Lighter Crypto Stand Out?

ZK-Proven Order Book Execution

Lighter’s biggest innovation is its cryptographically verifiable order book. Every trade and forced liquidation is proven with zero-knowledge proofs, submitted to mainnet for on-chain assurance. This removes the black-box manipulation risk found in centralized and even many decentralized competitors. All matching, clearing, and priority rules are mathematically enforceable and transparent, setting a new bar for trust in DeFi trading.

Ultra-Low Latency

Trading on Lighter feels as fast as leading centralized exchanges thanks to the platform’s optimized ZK rollup engine. Orders are matched and settled in close-to-real time, making the platform a serious choice for professional traders and market makers who require speed comparable to Binance or Coinbase.

No Fees for Regular Users

The Lighter crypto farming system is highly attractive because market and limit orders are generally fee-free unless you’re an institutional participant or opt for API access with prioritized execution. This dramatically boosts profitability for everyday traders and points farmers, lowering the barrier for onboarding and adding to organic liquidity.

Composability With Major DeFi

Lighter crypto is engineered for seamless DeFi composability. The LLP token can be swapped on L1 and will integrate with projects like Aave, offering opportunities for further lending or risk management. This focus on composability makes Lighter much more than just an exchange—it’s a building block for the Ethereum L2 future.

Rapid Growth and User Adoption

Growth indicators are remarkable: over 56,000 users registered in under a year, TVL soaring past $1.1 billion, and daily trading volumes peaking at $18.9 billion. Lighter has, at times, surpassed Hyperliquid’s volume, illustrating both its appeal and the eagerness of DeFi users to participate in Lighter crypto farming before the anticipated TGE. Analysts do warn, however, that much of the recent activity may reflect points-driven or “farming” incentives rather than purely organic adoption.

Is Lighter Crypto Legit?

When evaluating if Lighter crypto is legit, several important factors stand out.

First, from a technical and security perspective, Lighter crypto employs a robust dual-layer architecture: all user funds are custodied on Ethereum Layer 1 smart contracts, while order matching and settlement occur on Layer 2. This design guarantees that users always retain control over their assets—even in the event of a Layer 2 failure—via audited smart contracts and emergency withdrawal mechanisms. The matching engine, built on custom zero-knowledge (ZK) circuits, ensures every trade and liquidation is provably fair, transparent, and censorship-resistant, setting a new standard for trust in crypto derivatives.

Second, in terms of protocol audits and technology transparency, the Lighter team has stressed external audits of their ZK circuits and core contracts. During the mainnet launch, the community had open access to project documentation, and every order or settlement can be traced and validated on-chain. This strong commitment to third-party review and composability in the Ethereum ecosystem adds another layer of confidence for DeFi users.

Leadership and team composition are also worth noting. Lighter crypto was founded by Vladimir Novakovski, an entrepreneur with background in AI and fintech. While some online speculation has raised questions about the nature of institutional backers—debate remains about whether prominent VCs like a16z and Lightspeed invested in Lighter crypto itself or in Novakovski’s earlier company, Lunchclub—there is no public evidence of outright scams or misconduct by the team.

However, as with all high-growth DeFi protocols, Lighter crypto does carry substantial risks and should not be considered risk-free. Zero-fee trading, while attractive, may encourage manipulative wash trading (though the team actively polices such abuse). Recent surges in total value locked (TVL) and volume are also fueled by airdrop farming, which may not be sustainable post-TGE. Additionally, the upcoming feature of using LLP shares as margin adds complexity best suited to seasoned DeFi users able to evaluate systemic risk.

Market Performance, Valuation & Data

-

TVL: Over $1.1 billion (DeFiLlama, October 2025).

-

User growth: Over 56,000 registered.

-

Trading volume: Peaked at $18.9 billion in a single day.

-

Open Interest: Around $1.3 billion—much lower than Hyperliquid’s $13B (indicative of a high trading volume/OI ratio, and possible over-representation of short-term trading activity).

-

Points leaderboard: Dozens of regular wallets are now points leaders, giving hope of eventual airdrops.

Valuation analysis: If Lighter maintains half its current daily trading volume, with 20% of transactions at a 0.01% fee, annual revenue estimates could reach $30 million. Using a conservative 40x P/E (similar to Hyperliquid’s), Lighter’s Fully Diluted Valuation may settle near $1.2 billion, with markets (Polymarket) speculating >$2 billion at launch.

Create an account on Bitget and trade BTC today!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

- VOOI (VOOI): Simplifying Cross-Chain Leveraged Trading2025-12-18 | 5m

- Infrared (IR): Berachain's Proof of Liquidity Infrastructure2025-12-16 | 5m